– Things That Make You Go Hmmm… Like Gold Bullion, Gordon Brown, & A Growling Bundesbank (ZeroHedge, Jan 21, 2014):

2013 was an absolutely seismic year for gold, but, as Grant Williams details in his latest letter, the way in which the tectonic plates shifted has yet to be fully understood. Simply put, the gold in every central bank’s possession around the world is the property of the citizens of that country – not of the incumbent politicians or central bankers. Consequently, if the people want it audited, there shouldn’t be any reason to say no … unless… Williams firmly believes that in the years to come, when we look back at the great game being played in gold, we will pinpoint January 16, 2013, as the day when it all began to unravel – the day the Bundesbank blinked and demanded its gold…

“It was probably a mistake to allow gold to rise so high.”

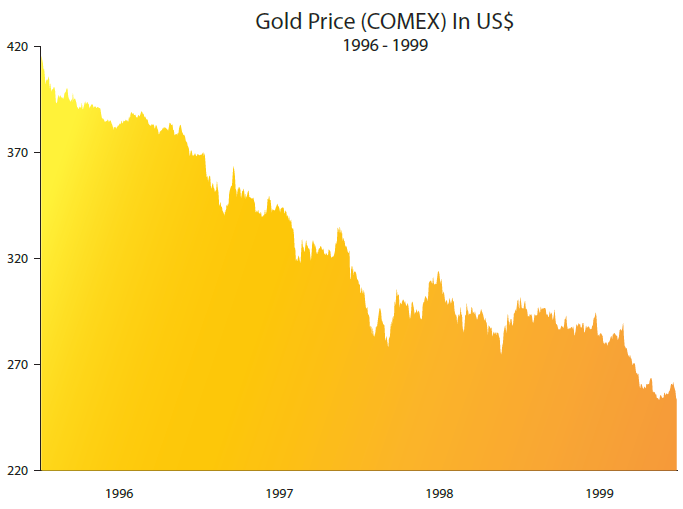

– Paul VolckerAfter a run-up to a spike-high of $415.50 on February 2, 1996, gold began to fall. It fell fairly quickly at first, losing 3% in six trading sessions; and then the decline steadied for a while but remained consistent — until, around the end of the calendar year, gold suddenly and inexplicably spiked straight down. By the end of 1996, it had lost 11% of its value.

As 1996 turned into 1997 the price continued to fall; and the new year saw several inexplicable downdrafts of considerable size and alarming speed which, by the time the dust had settled at midnight on December 31st, 1997, had cut the value of an ounce of gold by almost a quarter.

Gold market watchers were baffled at the continued weakness in their beloved metal. They bemoaned their bad fortune and pleaded with the gods above, but neither activity made any difference — the price continued to fall. (Sound familiar?)

“What a year this has been for gold,

“The price of the yellow metal fell almost 30% from its peak at the end of August a year earlier, to bombed-out lows amidst a wall of selling which included several very sharp and somewhat counterintuitive selloffs, including violent plunges in both the April-May time frame and again into year-end.

“Throughout the year, the spectre of manipulation was never far from the minds of all those involved in the gold market, whether they were crying ‘foul’ or asserting that, of course, there was no manipulation whatsoever and that those who suggested there might be were nothing more than conspiracy theorists, kooks, and whackos.

“The main suspects at the heart of the conspiracy theories were, naturally, the bullion banks and the central banks.

“The bullion banks, of course, have the eternal motive: profit; but what possible reason could central banks have for suppressing the price? None whatsoever, of course. The gold market is too small and too inconsequential for them to take an interest.

“And yet, rumours abounded that the bullion banks were in dire trouble and that a rising gold price could send one or more of them over the edge and into insolvency as a scramble for physical metal exposed massive short positions that had grown out of a fractional-reserve-based lending system backed (if not explicitly, then certainly complicitly) by central banks…”

Now THAT, you may well have thought, was the heart-racking, pulse-pounding introduction to my year-end look at the gold market. No preamble, no carefully constructed narrative to entice you into my latest little web, just BOOM! Straight into it.

And every word of the above makes sense based upon what we’ve seen happen in the past twelve months in the topsy-turvy world of element 79, which holds down the spot in the periodic table just after platinum and just before mercury.

But of course, nothing is what it seems when we are discussing gold.

That words above are the intro to the year-end review of gold that I would have written in 1999 … had I been doing such things back then.

2013 was, in many ways, a case of been there, done that; and to understand what is happening today, it is extremely instructive to go back to 1999 and reexamine some very strange goings on at the UK Treasury, AIG, Rothschild, Goldman Sachs, and Number 11 Downing Street.

(Cue dreamy harp music.)

The chart of the gold price between February 1996 and August 1999 (above) will look eerily familiar to anybody who follows the gold market closely; and for those who don’t, just stick around and I’ll show you what you’ve been missing.

…

2013 was an absolutely seismic year for gold, but the way in which the tectonic plates shifted has yet to be fully understood.

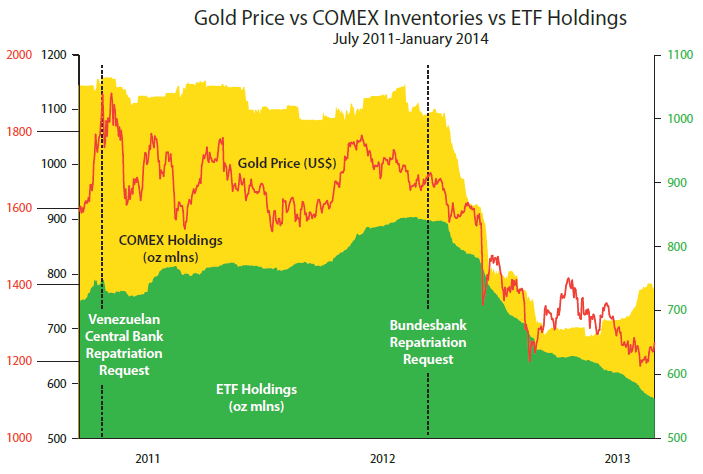

I firmly believe that in the years to come, when we look back at the great game being played in gold, we will pinpoint January 16, 2013, as the day when it all began to unravel.

That day, the day the Bundesbank blinked and demanded its bullion, will be shown to be the beginning of the end of the gold price suppression scheme by the world’s central banks; and then gold will go on to trade much, much higher.

The evidence of suppression is everywhere, though most refuse to believe their elected officials are capable of such subterfuge. However, the recent numerous scandals in the financial world are slowly forcing people to realize that anything and everything can be manipulated.

Libor, mortgage rates, FX — all were shown to be rigged markets, but NONE of them have the importance that gold has at the centre of the financial universe, yet all of them are far bigger markets than gold and therefore much harder to rig.

Gold is a manipulated market. Period.

2013 was the year that manipulation finally began to unravel.

2014? Well now, THIS could be the year that true price discovery begins in the gold market. If that turns out to be the case, it will be driven by a scramble to perfect ownership of physical gold; and to do that you will be forced to pay a lot more than $1247/oz.

Count on it…