PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

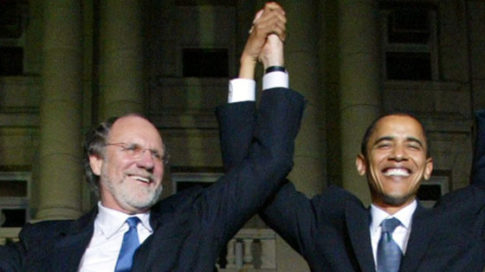

Jon Corzine

Jon Corzine Settles Over MF Global Collapse: Agrees To Lifetime Ban, $5 MILLION Fine

– Jon Corzine Settles Over MF Global Collapse: Agrees To Lifetime Ban, $5 Million Fine:

Three years ago, in February 2013, traders were outraged upon learning that the National Futures Association refused to ban former MF Global chief Jon Corzine from trading with other people’s money, rejecting a motion brought before that body’s board of directors to do so. The decision was a blow to a vocal group within the commodities trading world who – noting that Corzine has not been held accountable by the government for alleged crimes – wanted to see him publicly upbraided by his peers in the market.

All that changed today when Corzine agreed to pay a $5 million civil fine to settle a lawsuit by the U.S. Commodity Futures Trading Commission over the 2011 collapse of the former New Jersey governor’s brokerage, MF Global Holdings. More importantly, under the settlement disclosed on Thursday, Corzine also agreed to be barred for life and never again work for a futures commission merchant, or register with the CFTC in any capacity.

Read moreJon Corzine Settles Over MF Global Collapse: Agrees To Lifetime Ban, $5 MILLION Fine

MF Global 5 Years Later: PWC Set To Take The Fall As Corzine Still Untouched

– MF Global 5 Years Later: PWC Set To Take The Fall As Corzine Still Untouched:

Jon Corzine, former Governor of New Jersey and CEO of Goldman Sachs, took over the helm of MF Global in March 2010. When revenue at the bank failed to live up to expectations, Corzine developed a scheme to place a massive $6BN bet on the sovereign debt of the aptly named PIIGS (Portugal, Italy, Ireland, Greece, Spain) through a financial structure known as a “Repo to Maturity”. To summarize the strategy for all you aspiring CEO’s, when you find it difficult to generate organic revenue growth sometimes the better option is to just bet your entire firm on a single, massively-levered trade on the sovereign debt of countries on the verge of insolvency.

Read moreMF Global 5 Years Later: PWC Set To Take The Fall As Corzine Still Untouched

Vapor Capital Asset Mismanagement LP: Jon Corzine Planning Hedge Fund Launch

– Vapor Capital Asset Mismanagement LP: Jon Corzine Planning Hedge Fund Launch (ZeroHedge, April 19, 2015):

Shortly after Jon Corzine not only destroyed MF Global but “vaporized” $1.6 billion in supposedly segregated client funds which were illegally commingled with operating cash, Jon Corzine had a brief encounter with the legal system including several kangaroo court sessions in Congress, which ultimately led to absolutely nothing for two simple reasons.

Reason #1:

Read moreVapor Capital Asset Mismanagement LP: Jon Corzine Planning Hedge Fund Launch

A Close Encounter With Jon Corzine

– A Close Encounter With Jon Corzine (ZeroHedge, Feb 21, 2015)

You Can’t Make This Up: MF Global Sues PWC, Blames It For Its Collapse

– You Can’t Make This Up: MF Global Sues PWC, Blames It For Its Collapse (ZeroHedge, March 29, 2014):

File this one in the “you can’t make it up” category. Over two years after the MF Global collapse, in which the primary dealer headed by Jon “I don’t recall” Corzine all but admitted it had engaged in the cardinal sin of any financial intermediary, i.e., commingling money, to cover up a trade gone horribly bad and which resulted in the disappearance of some $1 billion in client funds until such time as the bankruptcy process managed to “liberate” funds from other part of the company, MF Global has suddenly figured who is at fault: not the CEO, not his brown-nosing lackey, not some janitor meant to be scapegoated precisely in a situation such as this, not even the infamous “glitch” – no, the party that is accountable for the firm’s theft of client funds, and horrible investing decisions that led to its bankruptcy, are the accountants.

No really: yesterday MF Global Holdings sued PricewaterhouseCoopers LLP for $1 billion, alleging accounting malpractice helped bring down the brokerage company.

Like we said, you can’t make this up. From Bloomberg:

Read moreYou Can’t Make This Up: MF Global Sues PWC, Blames It For Its Collapse

31 Year Old Son Of Jon Corzine Reported Dead

– 31 Year Old Son Of Jon Corzine Reported Dead (Zerohedge, March 13, 2014):

He may not have been a banker or trader, but the just reported passing of one Jeffrey Corzine, 31, son of the infamous Jon Corzine will likely raise more eyebrows than all previous recently reported banker deaths combined.

According to the NY Post, Jeffrey Corzine, who friends said worked as a drug counselor in California, was just 31, when he passed. Details of his death were not immediately known.

“Mr. Corzine is obviously devastated by this tragic loss,” said his spokesman, Steven Goldberg. “We ask that all respect his family’s privacy during this very difficult time.”

Feds Raid Marijuana Dispensaries In Washington State

– Feds Raid Marijuana Dispensaries in Washington State (Liberty Blitzkrieg, July 25, 2013):

Like an insecure bully trying to demonstrate how tough he or she is and feel better about itself, the Feds raided marijuana dispensaries in Washington state despite the fact that Proposition 502 made it legal. Recall, I warned about this last year in my piece: Colorado Legalizes Marijuana: Your Move Eric Holder.

Read moreFeds Raid Marijuana Dispensaries In Washington State

‘Financial Fascism’: Jon Corzine Will Not Face Criminal Charges Over MF Global

Flashback:

– Congressional Investigators: MF Global’s Jon Corzine Ordered Funds Moved To JP Morgan

More links are down below.

– Jon Corzine will not face criminal charges over MF Global: report (MarketWatch, July 8, 2013):

There will be no criminal charges for former New Jersey Governor Jon Corzine over the use of customer funds leading up to collapse of MF Global.

The criminal probe into whether there was wrongdoing on the part of Corzine by the Department of Justice will now be dropped due to lack of evidence, said a report in The New York Post, citing a person with knowledge of the matter.

Read more‘Financial Fascism’: Jon Corzine Will Not Face Criminal Charges Over MF Global

Apparently This MF Global ‘Clusterfuck’ Does Not Deserve Criminal Charges

– Apparently This MF Global “Clusterfuck” Does Not Deserve Criminal Charges (ZeroHedge, July 1, 2013):

We salute the CFTC for finally, if belatedly, doing the right thing and going after Jon “the bundler” Corzine. However, we wonder, just how is the following documented exchange between Edith O’Brien, MFG’s assistant treasurer, and some MF Global employee, not considered crime-worthy by Eric Holder? Or is the US Attorney General too busy to answer, having to come up with his own alibi to avoid going to jail for lying to Congress under oath?From the MF Global Civil, not Criminal, Complaint

Just prior to 6:30 p.m. ET, O’Brien told Employee #2 on a recorded telephone line that the Firm would not be in compliance with customer segregation rules because funds were not being returned to customer segregated accounts:

O’BRIEN: It is a total clusterfuck . . . . They have to move half a billion dollars out of BONY to pay me back . . . . Tell me how much money is coming in and I will make sure it gets posted. But if you don’t tell me, then tomorrow morning I am going to have a seg problem . . . . I need the money back from the broker-dealer I already gave them. I can’t afford a seg problem.

Read moreApparently This MF Global ‘Clusterfuck’ Does Not Deserve Criminal Charges

House Republicans Find Corzine Guilty Of MF Global Collapse, Missing Funds; Democrats Refuse To Endorse Findings

And again, it makes no difference whether elite puppet Republicans or elite puppet Democrats govern America.

The people get screwed all of the time:

– George Carlin: The Illusion Of Freedom – ‘This Country Finshed!’ (Video)

– George Carlin: The American Dream (Video)

An absolute MUST-SEE!!!, …

– Rep. Ron Paul’s Farewell To Congress (Video)

… especially for all real Americans out there.

– House Republicans Find Corzine Guilty Of MF Global Collapse, Missing Funds; Democrats Refuse To Endorse Findings (ZeroHedge, Nov 14, 2012)

Flashback:

– CNBC’s Rick Santelli Says It All In This Blockbuster Rant (Video)

– Missing $1.6 Billion MF Global Funds: Traced!

– Congressional Investigators: MF Global’s Jon Corzine Ordered Funds Moved To JP Morgan

– CFTC Pulls ‘JPMorgan Whistleblower’ Letter

If Nostradamus were alive today, he’d have a hard time keeping up with Gerald Celente.

– New York PostWhen CNN wants to know about the Top Trends, we ask Gerald Celente.

– CNN Headline NewsThere’s not a better trend forecaster than Gerald Celente. The man knows what he’s talking about.

– CNBCThose who take their predictions seriously … consider the Trends Research Institute.

– The Wall Street JournalA network of 25 experts whose range of specialties would rival many university faculties.

– The Economist

CNBC’s Rick Santelli Says It All In This Blockbuster Rant (Video)

– One Year Later – Santelli Rips Apart ‘Connected’ Corzine (ZeroHedge, Oct 31, 2012):

There remains more than $1.6 billion of customer funds unaccounted for and whether you believe PwC (as Forbes notes) were duped or not, one year on from MFGlobal, one thing is for sure – there is no more hated character in the pits of Chicago than Jon Corzine. CNBC’s Rick Santelli says it all in this blockbuster rant against the incredible reality that this ‘connected’ individual has got away with monetary murder. Must watch – but beware your blood pressure… as he concludes “we haven’t heard the end of this – Chicago will find the answers!”

Double or Nothing: How Wall Street is Destroying Itself

– Double or Nothing: How Wall Street is Destroying Itself (ZeroHedge, May 12, 2012)

There’s nothing controversial about the claim— reported on by Slate, Bloomberg and Harvard Magazine — that in the last 20 years Wall Street has moved away from an investment-led model, to a gambling-led model.

This was exemplified by the failure of LTCM which blew up unsuccessfully making huge interest rate bets for tiny profits, or “picking up nickels in front of a streamroller”, and by Jon Corzine’s MF Global doing practically the same thing with European debt (while at the same time stealing from clients).

As Nassim Taleb described in The Black Swan these kinds of trades — betting large amounts for small frequent profits — is extremely fragile because eventually (and probably sooner in the real world than in a model) losses will happen (and of course if you are betting big, losses will be big). If you are running your business on the basis of leverage, this is especially dangerous, because facing a margin call or a downgrade you may be left in a fire sale to raise collateral.

Read moreDouble or Nothing: How Wall Street is Destroying Itself

Missing $1.6 Billion MF Global Funds: Traced!

Before:

– Congressional Investigators: MF Global’s Jon Corzine Ordered Funds Moved To JP Morgan

– CFTC Pulls ‘JPMorgan Whistleblower’ Letter

– Missing $1.6 Billion MF Global Funds: Traced!(New York magazine, April 25, 2012):

The high-stakes game of lost-and-found for the missing $1.6 billion MF Global funds apparently reached a conclusion on Tuesday. According to CNN Money, investigators hunting the funds in the wake of the Jon Corzine–led brokerage firm’s collapse located the massive sums of customer money. “We can trace where the cash and securities in the firm went, and that we’ve done,” James Giddens, a trustee overseeing MF Global’s liquidation, told the Senate Banking Committee on Tuesday, adding that the investigation is “substantially concluded.”

Congressional Investigators: MF Global’s Jon Corzine Ordered Funds Moved To JP Morgan

DON’T MISS:

– CFTC Pulls ‘JPMorgan Whistleblower’ Letter:

However, with that said, we are manipulating the silver futures market and playing a smaller (but still massively manipulative) role in manipulating the gold futures market. We have a little over a 25% (give or take a percentage) position in the short market for silver futures and by your definition this denotes a larger position than for speculative purposes or for hedging and is beyond the line of manipulation.

On a side note, I do not work directly with accounts that would have been directly impacted by the MF Global fiasco but I have heard through other colleagues that we have involvement in the hiding of client assets from MF Global. This is another fraudulent effort on our part and constitutes theft. I urge you to forward that part of the investigation on to the respective authorities.

Flashback:

– Max Keiser And Gerald Celente On MF Global Bankruptcy Implications – The JP Morgan Connection – Goldman Sachs – CME (‘Chicago Mafia Exchange’) – Gold, Silver – Syria, Iran – Entire Financial System Collapsing, One Big Global Ponzi Scheme – False Flag, WW III – Bank Holiday, Economic Martial Law – ‘YOUR MONEY ISN’T SAFE’ (Video)

– MF’s Corzine Ordered Funds Moved to JP Morgan, Memo Says (Bloomberg, Mar 23, 2012):

Jon S. Corzine, MF Global Holding Ltd. (MFGLQ)’s chief executive officer, gave “direct instructions” to transfer $200 million from a customer fund account to meet an overdraft in a brokerage account with JPMorgan Chase & Co. (JPM), according to a memo written by congressional investigators.

Edith O’Brien, a treasurer for the firm, said in an e-mail quoted in the memo that the transfer was “Per JC’s direct instructions,” according to a copy of the memo obtained by Bloomberg News. The e-mail, dated Oct. 28, was sent three days before the company collapsed, the memo says. The memo does not indicate whether that phrase was the full text of the e-mail or an excerpt.

Read moreCongressional Investigators: MF Global’s Jon Corzine Ordered Funds Moved To JP Morgan

Jon Corzine’s Family Responds To Accusations Against The Patriarch

– Jon Corzine’s Family Responds To Accusations Against The Patriarch (ZeroHedge, Mar 6, 2012):

First appearing in Vanity Fair:, in response to Jon Corzine’s riskiest business.The sweeping negative narrative the authors use to describe our family in “Jon Corzine’s Riskiest Business” [by Bryan Burrough, William D. Cohan, and Bethany McLean, February] completely contradicts our firsthand experience of events and people.

Read moreJon Corzine’s Family Responds To Accusations Against The Patriarch

MF Global Customers Sue Jon Corzine Over Missing Millions

– Farmers Sue Jon Corzine Over Missing Millions (ABC News, ????Jan. 9, 2012):

Montana farmers have filed a class action suit against former New Jersey governor Jon Corzine, charging that the failed financial firm run by Corzine stole millions from their accounts to pay off its spiraling debts, and that Corzine’s “single-minded obsession” with making MF Global a big player on Wall Street led to the firm’s collapse.

MF Global’s clients included 38,000 wheat farmers, cattle ranchers and others who “hedged” their crop prices by placing millions in MF Global accounts. Those accounts were supposed to be “segregated and secure,” according to the federal suit, meaning MF Global could not draw on those funds.

The lawsuit, filed on behalf of all 38,000 customers, alleges that when MF Global made a series of bad investments — notably in European debt — it began “siphoning funds withdrawn from segregated client accounts” to cover its debts.

Read moreMF Global Customers Sue Jon Corzine Over Missing Millions

Max Keiser And Gerald Celente On MF Global Bankruptcy Implications – The JP Morgan Connection – Goldman Sachs – CME (‘Chicago Mafia Exchange’) – Gold, Silver – Syria, Iran – Entire Financial System Collapsing, One Big Global Ponzi Scheme – False Flag, WW III – Bank Holiday, Economic Martial Law – ‘YOUR MONEY ISN’T SAFE’

YouTube Added: 17.12.2011

Description:

In this edition of the show Max interviews Gerald Celente from Trendsjournal.com.

Gerald Celente is a trends forecaster who was recently defrauded by MF Global run by former New Jersey governor, Jon Corzine, who was also former head of Goldman Sachs.

When MF Global collapsed, client cash was taken and apparently transferred to creditors, like JP Morgan.

This commingling of funds has violated the very foundation of the futures market and we talk to Celente about whether he will ever invest money with a brokerage again?

Obama Administration Was Prepared To Call A Bank Holiday In 2009 (Video)

Flashback.

Things have gotten much worse since then.

Prepare for collapse.

Related info:

– Jon Corzine: ‘Don’t know’ Where MF Global Customers’ $1.2 Billion Went (Video)

Gerald Celente (not only) on MF Global:

The US government is preparing for collapse:

– Senator Carl Levin: Obama Required US Citizens To Be Included In Indefinite Detention!

– The New American: US Senate Traitors Pass ‘Indefinite Detention’ Bill S.1867, Create A Military Police State – Senator Rand Paul’s Adress To The American People (Video)

– Business Insider: The Media’s Blackout Of The National Defense Authorization Act Is Shameful – ‘IF THIS BILL PASSES IN ITS CURRENT FORM THE UNITED STATES WILL BE A MILITARY POLICE STATE’ (Video)

– Constitutional lawyer (Yale Law School graduate) & Founder Of Oath Keepers Stewart Rhodes: Senate Bill Declares War On Americans (Video)

– Wired: U.S. Senate Wants The Military To Lock You Up Without Trial

– Natural News: Occupied America: Senate Bill 1867 Would Allow US Military To Detain And Murder Anti-Government Protesters In American Cities

– Mother Jones: Is the US Getting Domestic Indefinite Military Detention (Also For US Citizens And Legal Permanent Residents) For Thanksgiving?

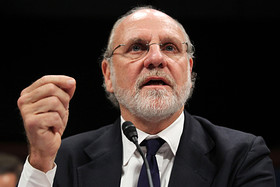

Jon Corzine: ‘Don’t know’ Where MF Global Customers’ $1.2 Billion Went (Video)

Gerald Celente (not only) on MF Global:

– Corzine: ‘Don’t know’ where MF Global customers’ $1.2B went (USA Today, Dec. 8, 2011):

Former MF Global chief executive Jon Corzine apologized “to all those affected” by the brokerage’s collapse Thursday as he told a congressional committee he doesn’t know what happened to $1.2 billion in missing customer funds.

Testifying under subpoena at a House Agriculture Committee hearing, Corzine, a former Democratic U.S. senator and ex-Goldman Sachs chief, portrayed himself as stunned about the massive shortfall that emerged as regulators and federal investigators began probing MF Global’s Oct. 31 bankruptcy.

“I simply do not know where the money is, or why the accounts have not been reconciled to date,” said Corzine, 64, in his first public comments since his resignation was announced four days after the bankruptcy filing.

Read moreJon Corzine: ‘Don’t know’ Where MF Global Customers’ $1.2 Billion Went (Video)

Bill Clinton Collected $50,000 Per Month From MF Global

MF Global ‘details’ (Must-listen!):

– Claim: Clinton Collected $50K Per Month From MF Global (Human Events, Dec. 5, 2011):

A former MF Global employee accused former president William J. Clinton of collecting $50,000 per month through his Teneo advisory firm in the months before the brokerage careened towards its Halloween filing for Chapter 11 bankruptcy.

Teneo was hired by MF Global’s former CEO Jon S. Corzine to improve his image and to enhance his connections with Clinton’s political family, said the employee, who asked that his name be withheld because he feared retribution.

“They were supposed to be helping Corzine improve his image as a CEO—I guess you can tell how that went,” he said. Corzine resigned as CEO and chairman November 4.

Read moreBill Clinton Collected $50,000 Per Month From MF Global

Gerald Celente: ‘IT’S FASCIST. CAN’T YOU SEE IT?’ – ‘It’s A TAKEOVER’ – ‘Hail Obama!’ – ‘The United States Has Become One Big Warsaw Ghetto’

A MUST-SEE!

And watch Joe Biden in the second video!

See also:

– The Federal Reserve And The $16 Trillion Bankster Bailout

If Nostradamus were alive today, he’d have a hard time keeping up with Gerald Celente.

– New York PostWhen CNN wants to know about the Top Trends, we ask Gerald Celente.

– CNN Headline NewsThere’s not a better trend forecaster than Gerald Celente. The man knows what he’s talking about.

– CNBCThose who take their predictions seriously … consider the Trends Research Institute.

– The Wall Street JournalA network of 25 experts whose range of specialties would rival many university faculties.

– The Economist

YouTube Added: 03.12.2011

YouTube Added: 03.12.2011

Don’t miss:

– The New American: US Senate Traitors Pass ‘Indefinite Detention’ Bill S.1867, Create A Military Police State – Senator Rand Paul’s Adress To The American People (Video)

– Business Insider: The Media’s Blackout Of The National Defense Authorization Act Is Shameful – ‘IF THIS BILL PASSES IN ITS CURRENT FORM THE UNITED STATES WILL BE A MILITARY POLICE STATE’ (Video)

– Constitutional lawyer (Yale Law School graduate) & Founder Of Oath Keepers Stewart Rhodes: Senate Bill Declares War On Americans (Video)

– Wired: U.S. Senate Wants The Military To Lock You Up Without Trial

– Natural News: Occupied America: Senate Bill 1867 Would Allow US Military To Detain And Murder Anti-Government Protesters In American Cities

– Mother Jones: Is the US Getting Domestic Indefinite Military Detention (Also For US Citizens And Legal Permanent Residents) For Thanksgiving?