You just can’t make this stuff up!

Blythe Masters invented credit default swaps, and is now heading JPM’s carbon trading efforts

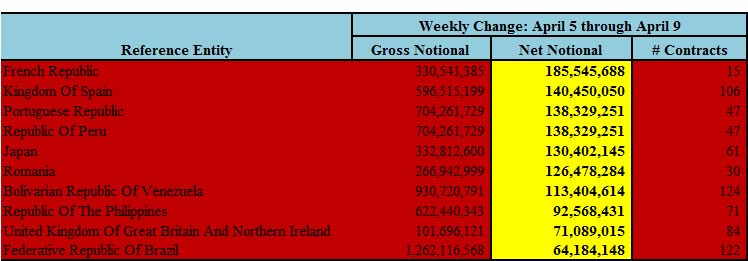

As I have previously shown, speculative derivatives (especially credit default swaps or “CDS”) are a primary cause of the economic crisis. They were largely responsible for bringing down Bear Stearns, AIG (and see this), WaMu and other mammoth corporations.

According to top experts, risky derivatives were not only largely responsible for bringing down the American (and world) economy, but they still pose a substantial systemic risk:

- Warren Buffett’s sidekick Charles T. Munger, has called the CDS prohibition the best solution, and said “it isn’t as though the economic world didn’t function quite well without it, and it isn’t as though what has happened has been so wonderfully desirable that we should logically want more of it”

- Former Federal Reserve Chairman Alan Greenspan – after being one of their biggest cheerleaders – now says CDS are dangerous

- Former SEC chairman Christopher Cox said “The virtually unregulated over-the-counter market in credit-default swaps has played a significant role in the credit crisis”

- Newsweek called CDS “The Monster that Ate Wall Street”

- President Obama said in a June 17 speech on his plans for finance industry regulatory reform that credit swaps and other derivatives “have threatened the entire financial system”

- George Soros says the market is still unsafe, and that credit- default swaps are “toxic” and “a very dangerous derivative” because it’s easier and potentially more profitable for investors to bet against companies using them than through so-called short sales.

- U.S. Congresswoman Maxine Waters introduced a bill in July that tried to ban credit-default swaps because she said they permitted speculation responsible for bringing the financial system to its knees.

- Nobel prize-winning economist Myron Scholes – who developed much of the pricing structure used in CDS – said that over-the-counter CDS are so dangerous that they should be “blown up or burned”, and we should start fresh

- A leading credit default swap expert (Satyajit Das) says that the new credit default swap regulations not only won’t help stabilize the economy, they might actually help to destabilize it.

- Senator Cantwell says that the new derivatives legislation is weaker than current regulation

Round Two: Carbon Derivatives

Now, Bloomberg notes that the carbon trading scheme will be largely centered around derivatives:

The banks are preparing to do with carbon what they’ve done before: design and market derivatives contracts that will help client companies hedge their price risk over the long term. They’re also ready to sell carbon-related financial products to outside investors.

[Blythe] Masters says banks must be allowed to lead the way if a mandatory carbon-trading system is going to help save the planet at the lowest possible cost. And derivatives related to carbon must be part of the mix, she says. Derivatives are securities whose value is derived from the value of an underlying commodity — in this case, CO2 and other greenhouse gases…

Who is Blythe Masters?

She is the JPMorgan employee who invented credit default swaps, and is now heading JPM’s carbon trading efforts. As Bloomberg notes (this and all remaining quotes are from the above-linked Bloomberg article):

Masters, 40, oversees the New York bank’s environmental businesses as the firm’s global head of commodities…

As a young London banker in the early 1990s, Masters was part of JPMorgan’s team developing ideas for transferring risk to third parties. She went on to manage credit risk for JPMorgan’s investment bank.

Among the credit derivatives that grew from the bank’s early efforts was the credit-default swap.

Some in congress are fighting against carbon derivatives:

“People are going to be cutting up carbon futures, and we’ll be in trouble,” says Maria Cantwell, a Democratic senator from Washington state. “You can’t stay ahead of the next tool they’re going to create.”

Cantwell, 51, proposed in November that U.S. state governments be given the right to ban unregulated financial products. “The derivatives market has done so much damage to our economy and is nothing more than a very-high-stakes casino — except that casinos have to abide by regulations,” she wrote in a press release…

However, Congress may cave in to industry pressure to let carbon derivatives trade over-the-counter:

The House cap-and-trade bill bans OTC derivatives, requiring that all carbon trading be done on exchanges…The bankers say such a ban would be a mistake…The banks and companies may get their way on carbon derivatives in separate legislation now being worked out in Congress…

Read moreJPMorgan Employee Who Invented Credit Default Swaps is One of the Key Architects of Carbon Derivatives, Which Would Be at the Very CENTER of Cap and Trade