Below is letter text, and attached is the letter that was faxed to every member of the Senate Banking Committee:

10/07/09

Chairman Chris Dodd

U.S. Senate Committee on Banking, Housing, and Urban Affairs

534 Dirksen Senate Office Building

Washington, DC 20551

Dear Chairman Dodd and members of the Banking Committee,

We are writing to ask you to postpone the confirmation of Ben Bernanke until the Federal Reserve releases documentation that will allow the public and the Senate to have a full understanding of the commitments that the Federal Reserve has made on our behalf. Without such an understanding, it is impossible to know whether Chairman Bernanke is fit to serve another term and fulfill the Federal Reserve’s dual mandate to ensure price stability and full employment. A list of said documentation is enumerated below.

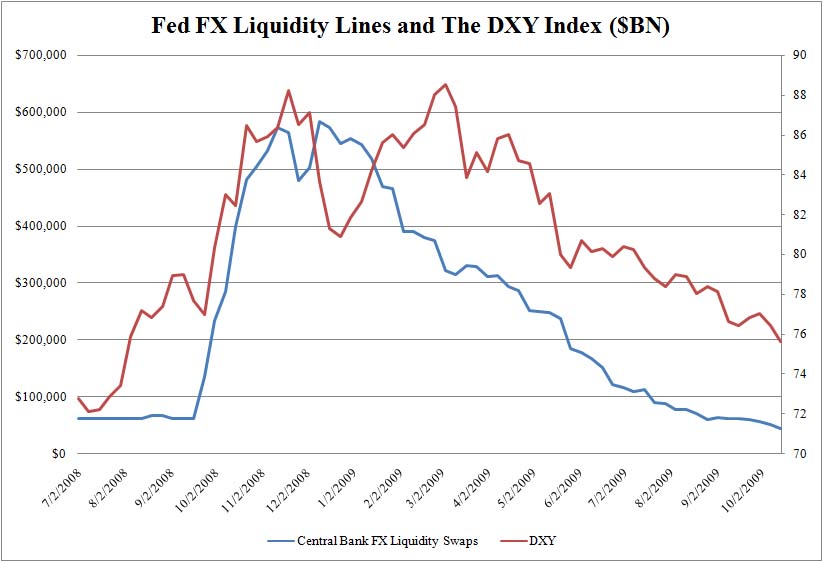

Since 2007, the Federal Reserve has expanded its balance sheet by $1.2 trillion and taken on substantial credit, interest-rate, and foreign exchange risk. It has lent immense sums to some financial institutions against overvalued collateral, while refusing to lend to others with no clear standards as to who was rescued and who was not. It has set up holding companies using no-bid contracts, and guaranteed substantial liabilities of Citigroup, all the while keeping information about its actions secret from the public and Congress. This is in stark contrast to the analogous period in the 1930s, when the Reconstruction Finance Corporation fully disclosed loans and collateral to Congress.

Today, big banks are being bailed out and have a substantially lower cost of capital through an implicit government backstop even as Americans themselves are seeing their pay cut. This lower cost of capital – at government expense – coupled with increased scarcity of credit is resulting in the banks recapitalizing by charging American consumers higher credit costs, including record overdraft fees and much higher credit card rates.

As you know, the Federal Reserve has a chartered mandate of both price stability and “full” employment. Since 2002, the year Bernanke joined the Federal Reserve board and aligned himself with Alan Greenspan’s activities, the incomes of Americans have actually declined in absolute terms, with incomes projected to decline a further 5% in 2009. One quarter of all mortgage holders owe more than they own, with that number projected to rise to nearly 50% by 2010. Consumer asset prices, most importantly housing, continue to fall, and unemployment continues to rise. This raises real questions about Bernanke’s tenure as Federal Reserve chairman, and about where those trillions of dollars have gone.

Federal Reserve secrecy must be understood in the context of an intellectual dogma which Alan Greenspan inculcated into the fabric of the Federal Reserve and the economics profession, and which has severely harmed ordinary Americans. Bernanke’s ‘Great Moderation’ speech in 2004 didn’t even consider the idea that the economy was becoming more unstable, even as risks were being built into the system by the policies he encouraged. He ignored evidence of a crisis, saying in 2007 that the turmoil was contained to subprime mortgages, ignoring the bankruptcy of over 100 mortgage originators, and the clear evidence the crisis would spread. Now, even as the crisis is said to be subsiding, we still do not have credit markets that are able to function without substantial government support, we have not addressed institutions that are ‘too big to fail’ which the Fed oversees, bank credit availability is again shrinking (posing risk of further increasing already high unemployment), and toxic assets in the system on the books of both private banks and the Federal Reserve have still not seen price discovery.

Federal Reserve secrecy must be understood in the context of an intellectual dogma which Alan Greenspan inculcated into the fabric of the Federal Reserve and the economics profession, and which has severely harmed ordinary Americans. Bernanke’s ‘Great Moderation’ speech in 2004 didn’t even consider the idea that the economy was becoming more unstable, even as risks were being built into the system by the policies he encouraged. He ignored evidence of a crisis, saying in 2007 that the turmoil was contained to subprime mortgages, ignoring the bankruptcy of over 100 mortgage originators, and the clear evidence the crisis would spread. Now, even as the crisis is said to be subsiding, we still do not have credit markets that are able to function without substantial government support, we have not addressed institutions that are ‘too big to fail’ which the Fed oversees, bank credit availability is again shrinking (posing risk of further increasing already high unemployment), and toxic assets in the system on the books of both private banks and the Federal Reserve have still not seen price discovery.

Chairman Bernanke’s policy-making errors might be chalked up to errors of judgment, and it’s possible to argue that he has been chastened by the last few years of turmoil. What is more disturbing is how the Federal Reserve has refused to disclose the details of its commitments to the bankers who came close to destroying our economy. The Bernanke Fed’s execution of its dual mandate cannot be judged without consideration of those commitments, which would require the Fed to disclose documents which it still contends the public has no right to see.

Specifically, I ask that you postpone the confirmation of the Chairman until after the Federal Reserve discloses:

(1) Information that Bloomberg reporter Mark Pittman has requested via a Freedom of Information Act Request on the Bear Stearns rescue and that the Federal Reserve is contesting in the courts, [i] and which Manhattan Chief U.S. District Judge Loretta Preska has ordered by turned over by the Federal Resrve.

(2) Information that Rep. Grayson requested in February at a hearing and by follow-up letter on which institutions received the $1.2 trillion added to the Federal Reserve’s balance sheet, how much reach institution received, and what was promised in return.

(3) All Federal Reserve documents that went to Attorney General Andrew Cuomo’s office relating to the Bank of America/Merrill Lynch merger in which potentially illegal and coercive activity might have occurred, as well all Federal Reserve documents relating to the lawsuit pursued by Merrill Lynch shareholders in the US District court for the Southern District of New York.

(4) Transcripts of all Open Market Meeting Minutes up to and including that of June, 2009, transcripts which are normally withheld from the public for five years.

(5) Full disclosure of all terms and conditions of all off-balance sheet Fed transactions in the past three years.

The Federal Reserve must become transparent and open with Congress and the public about its behavior during the financial crisis. Thank you for your consideration of this matter.

Best,

Alan Grayson

Ron Paul

Member of Congress Member of Congress

Cc: Richard C. Shelby

Tim Johnson

Robert F. Bennett

Jack Reed

Jim Bunning

Charles E. Schumer

Mike Crapo

Evan Bayh

Mel Martinez

Robert Menendez

Bob Corker

Daniel K. Akaka

Jim DeMint

Sherrod Brown

David Vitter

Jon Tester

Mike Johanns

Herb Kohl

Kay Bailey Hutchison

Mark Warner

Jeff Merkley

Michael Bennet

Wednesday, October 7, 2009

Source: Washington’s Blog

Federal Reserve secrecy must be understood in the context of an intellectual dogma which Alan Greenspan inculcated into the fabric of the Federal Reserve and the economics profession, and which has severely harmed ordinary Americans. Bernanke’s ‘Great Moderation’ speech in 2004 didn’t even consider the idea that the economy was becoming more unstable, even as risks were being built into the system by the policies he encouraged. He ignored evidence of a crisis, saying in 2007 that the turmoil was contained to subprime mortgages, ignoring the bankruptcy of over 100 mortgage originators, and the clear evidence the crisis would spread. Now, even as the crisis is said to be subsiding, we still do not have credit markets that are able to function without substantial government support, we have not addressed institutions that are ‘too big to fail’ which the Fed oversees, bank credit availability is again shrinking (posing risk of further increasing already high unemployment), and toxic assets in the system on the books of both private banks and the Federal Reserve have still not seen price discovery.

Federal Reserve secrecy must be understood in the context of an intellectual dogma which Alan Greenspan inculcated into the fabric of the Federal Reserve and the economics profession, and which has severely harmed ordinary Americans. Bernanke’s ‘Great Moderation’ speech in 2004 didn’t even consider the idea that the economy was becoming more unstable, even as risks were being built into the system by the policies he encouraged. He ignored evidence of a crisis, saying in 2007 that the turmoil was contained to subprime mortgages, ignoring the bankruptcy of over 100 mortgage originators, and the clear evidence the crisis would spread. Now, even as the crisis is said to be subsiding, we still do not have credit markets that are able to function without substantial government support, we have not addressed institutions that are ‘too big to fail’ which the Fed oversees, bank credit availability is again shrinking (posing risk of further increasing already high unemployment), and toxic assets in the system on the books of both private banks and the Federal Reserve have still not seen price discovery.