– Preparing To Asset-strip Local Government? The Fed’s Bizarre New Rules (Washington’s Blog, Sep 9, 2014):

By Ellen Brown

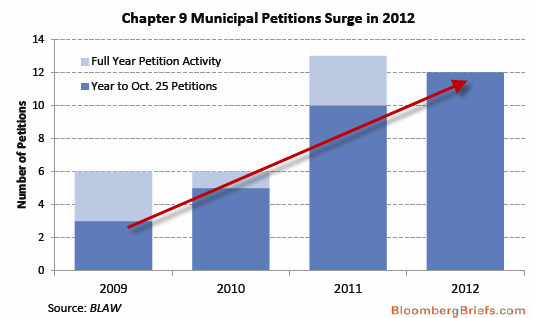

In an inscrutable move that has alarmed state treasurers, the Federal Reserve, along with the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency, just changed the liquidity requirements for the nation’s largest banks. Municipal bonds, long considered safe liquid investments, have been eliminated from the list of high-quality liquid collateral. assets (HQLA). That means banks that are the largest holders of munis are liable to start dumping them in favor of the Treasuries and corporate bonds that do satisfy the requirement.

Muni bonds fund the nation’s critical infrastructure, and they are subject to the whims of the market: as demand goes down, interest rates must be raised to attract buyers. State and local governments could find themselves in the position of cash-strapped Eurozone states, subject to crippling interest rates. The starkest example is Greece, where rates went as high as 30% when investors feared the government’s insolvency. Sky-high interest rates, in turn, are the fast track to insolvency. Greece wound up stripped of its assets, which were privatized at fire sale prices in a futile attempt to keep up with the bills.

Read morePreparing To Asset-strip Local Government? The Fed’s Bizarre New Rules