– Muni Ratings Slump As Bankruptcies Rise, Surpass 2011 Total (Zerohedge, Oct 26, 2012):

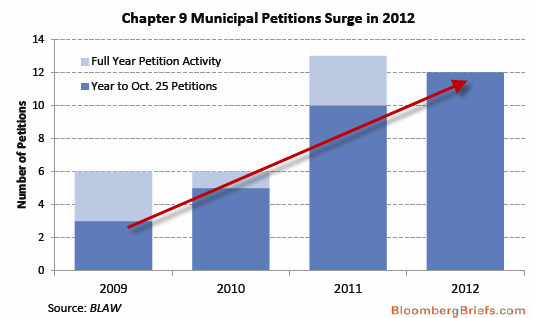

Credit-rating cuts were made on more than $200 billion of municipal securities in the first nine months of this year, exceeding the total for 2011, and there’s no end in sight. Bloomberg Briefs also notes that it is not just the weaker Californian cities (such as Fresno) but even Los Gatos (an affluent town about 50 miles south of San Francisco, where Apple’s Steve Wozniak lives) is facing possible rating downgrades. Moody’s is concerned that cities might skip debt payments in a cash crunch to preserve services and meet payroll. The decisions to seek bankruptcy “provide some indication that willingness to pay debt obligations may be eroding in the U.S. municipal market,” according to the Moody’s report, especially since California municipalities have limited ability to boost revenue. They can’t impose higher sales taxes without going to voters. Meanwhile Chapter 9 Muni petitions are now above 2011’s YTD equivalent as California’s Mendocino Coast HealthCare District became the 12th Chapter 9 petition filed year to date and the fourth from that state – up from just 5 Chapter 9s in 2010. Paging Ms. Whitney…

Chart: Bloomberg Briefs

Another domino to fall. All of us, over the past 80 years have lived in a world with a relatively stable economic system. We have had our ups and downs, but the world economies have been stable with sane rules and leadership. All of that is gone. The greedy guts have taken over, all the rules have been scrapped, and it is winner take all……regardless everyone will lose when the system implodes. It is just a matter of when, not if.

Thanks for a good article, I will pass it on.