Billionaire Kirk Kerkorian, whose Beverly Hills-based investment company confirmed Monday that it had dumped its remaining stock holdings in struggling Ford Motor Co., had had a long, if not always profitable, relationship with Detroit. Associated Press

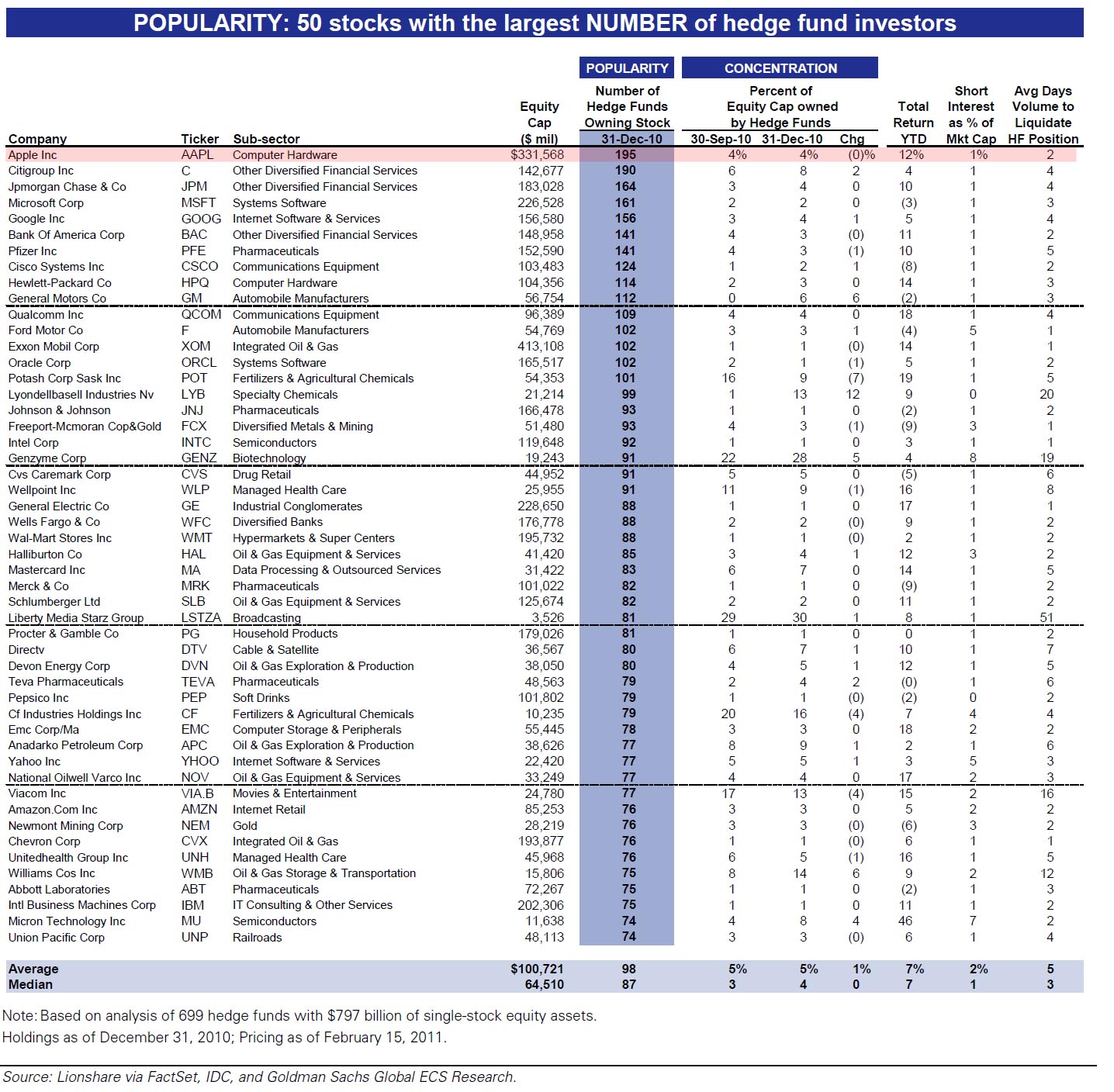

The investor spent about $1 billion acquiring a 6.5% stake in the struggling automaker this year, then saw the value of its stock plummet.

Kirk Kerkorian wasn’t kidding when he said he was putting the brakes on his latest foray into the auto industry.

A spokeswoman for Tracinda Corp., the billionaire’s Beverly Hills-based investment company, confirmed Monday that it had dumped its remaining stock holdings in struggling Ford Motor Co. She declined to provide details of the stock sales.

Kerkorian owned 107.1 million Ford shares, or 4.9% of the company, in late October, when Tracinda reported in a regulatory filing that it had unloaded 7.3 million shares and planned to sell the rest of its holdings by the end of the year.

Because it owned less than 5% of the company — the regulatory threshold for reporting changes in stock ownership — Tracinda was not required to file information with the Securities and Exchange Commission regarding the more recent sales, such as when the shares were sold or at what price.

But Kerkorian, who began buying Ford shares in April and spent about $1 billion acquiring a 6.5% stake in the automaker, clearly took a bath on the investment. Ford was trading at about $7.75 a share when Kerkorian began acquiring his stake. The average price since his last SEC filing in late October: $2.33 a share.

Read moreKirk Kerkorian sells remaining Ford shares