And by the way, Keynesianism (Deficit spending) is outdated and poison for the economy.

I am repeating myself here but people need to know that all of this is done by design, planned by the elite and executed by their puppets like Obama, Bernanke, Bush, Clinton, Greenspan, Geithner etc.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.” – Alan Greenspan

Those criminals are looting the taxpayer all of the time. No bailout and no stimulus package was ever benefiting the people in the US, but it is the taxpayer that has to pay for it all. The government and the Fed are intentionally destroying the dollar and the economy. The US is totally broke.

– Ron Paul: The Obama administration gives a tremendous amount of more power to the Federal Reserve, the very institution that created our problem (6/18/09)

– Gerald Celente: It is Obamageddon

– JIM ROGERS WAS RIGHT (05/06/09):

“There is a very good chance that America will default on its government debt sometimes during this administration.”

“And there is an extremely good chance that the currency will be very debased and weakened a lot during this presidency.”

Now this genius (Obama) comes along and says: ‘We are doing more of the same’!”

“It’s not going to work.”

The Government Accountability Office, in a report released Wednesday, finds that the $787 billion stimulus package is being used to “cushion” state budgets, prevent teacher layoffs, make more Medicaid payments and head off other fiscal problems.

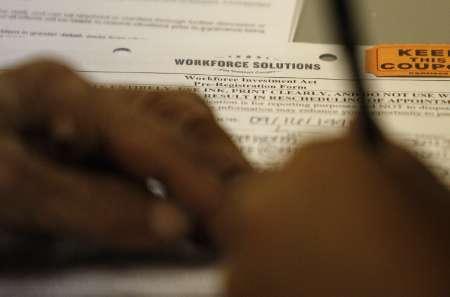

A person fills out an application for a summer job funded by stimulus money in Forth Worth, Texas, on June 10. (Reuters Photo)

Cash-strapped states have used federal stimulus dollars to close short-term budget gaps and avert major tax increases but generally have not directed the money toward long-term expansion, according to a new report.

The report released Wednesday by the Government Accountability Office, Congress’ investigative arm, found that the $787 billion stimulus package is being used to “cushion” state budgets, prevent teacher layoffs, make more Medicaid payments and head off other fiscal problems.

The Congressional Budget Office estimates that only 10 percent of the Recovery Act funds have been released so far, with about half of the money expected to be spent by October 2010. That dispersed money is being used to prioritize short-term projects and needs over more ambitious goals, the GAO report states.

For example, the GAO said about half the money set aside for road and bridge repairs is being used to repave highways, rather than build new infrastructure. And state officials aren’t steering the money toward counties that need jobs the most, auditors found.

Taxpayers have also recently complained that the federal government has wasted money by advertising stimulus-funded construction projects with road signs which costs between $500 and $1,200 to produce.

Read moreThe Obama Stimulus Failed: States Use Stimulus Money for Short-Term Needs, Audit Shows