– Caterpillar Dealer Sales Soar Most In 6 Years

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

– About Caterpillar’s “Tremendous Earnings Growth”, There Is Just One Thing…:

With CAT and MCD accounting for over 100 of the 250+ Dow points today, one would think that, as CNBC has repeatedly stated today, these two companies are posting “tremendous earnings growth.”

And, in a way they are… a non-GAAP way. Because while CAT reported adjusted EPS of $1.28, up exactly 100% from a year ago – almost as if it was goalseeked – something far less appetizing emerges when looking at CAT’s actual, GAAP EPS, which happen to be exactly one quarter of the non-GAAP number, or $0.32, a 30% drop from a year ago.

…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– The Streak Is Over: Caterpillar Posts First Positive Retail Sales After 51 Months Of Declines:

After 51 consecutive months, the dead CAT spell is finally over.

…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

https://youtu.be/yQQ3-2YqBeA

Mar 2, 2017

Silver and gold was slammed today. Initial jobless claims is at its lowest point in 44 years. BCBG filed bankruptcy. The art bubble is popping. CalPers threatens to slash pension benefits. Trump sent a message to every American that the economy is collapsing. Rickards, Stockman say Trump will not be able to avoid the debt bomb that is ready to go off. The Fed has set the stage to bring down the economy. BofA has analyzed the market and makes a prediction that the economy will collapse in the second half of this year.

H/t reader squodgy.

*****

‘The Great Economic Collapse’ coming to a country near you, …

… as planned by …

And it will happen exactly, when these bastards press this button …

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Nobody seems to even care anymore about such news …

– Caterpillar Records 50 Consecutive Months Of Declining Global Sales

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Caterpillar Posts Record 49 Consecutive Months Of Declining Retail Sales

As Caterpillar’s stock continues to soar, its operations continue to decline.…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Caterpillar Retail Sales Decline For Record 47 Consecutive Months:

While Caterpillar’s CEO may have resigned recently, admitting that he misjudged the business strategy, the stock does not appear to be bothered, soaring by 15% since the Trump victory on hopes an infrastructure push would make excavators great again. For now, however, the woes at the heavy industrial manufacturer continue, with yet another month of declining global sales, the company’s 47th in a row.

To be sure, there was a glimmer of hope for CAT coming out of Asia, where retail sales continued the rebound after posting positive gains in the August and September, rising 12% in October, the biggest annual gain since September 2012. This however was offset by continuing declines in North America, the EAME and Latin Ameica regions, which declined by 16%, 14% and 24% respectively.

Following the latest, October, double-digit decline in worldwide sales, which dopped by 12% following the September 18% slide, CAT has not recorded a positive growth month for nearly 4 straight years, or 47 consecutive months.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

While Caterpillar’s CEO may have resigned recently, the woes at the heavy industrial manufacturer continue, with yet another month of declining global sales, the company’s 46th in a row.

According to the latest monthly release of global retail sales which traditionally presages the company’s earnings release due out tomorrow, the company reported that North American sales dipped by 23%, the steepest monthly decline since February 2010, confirming recent speculation that demand for original equipment is simply not there. The rest of the world did not fare much better, with EAME down 17%, Latin America sliding 23% and only Asia posting a rare rebound in sales, up 3%, the best print in the series since October 2012.

– Caterpillar slashes revenue forecast, cutting up to 10,000 jobs:

Caterpillar Inc (CAT.N) slashed its 2015 revenue forecast on Thursday and said it will cut as many as 10,000 jobs through 2018, joining a list of big U.S. industrial companies grappling with the mining and energy downturn.

Shares of Caterpillar tumbled as much as 8 percent to a five-year low, pulling down the sector and knocking as much as 37 points off the Dow Jones industrial average .DJI.

Read moreCaterpillar slashes revenue forecast, cutting up to 10,000 jobs

– Caterpillar Retail Orders Suffer Second Biggest Plunge Since Financial Crisis:

While the relentless decline in Caterpillar retail sales has been duly noted here every month for nearly 4 years, now posting 44 consecutive declines, the latest, July data was downright depressionary.

According to the company, in the latest month – just when China was supposed to be rebounding and the US recovery getting “stronger” – demand took another sharp leg lower, as follows:

– Caterpillar Retail Sales Decline For 43 Consecutive Months:

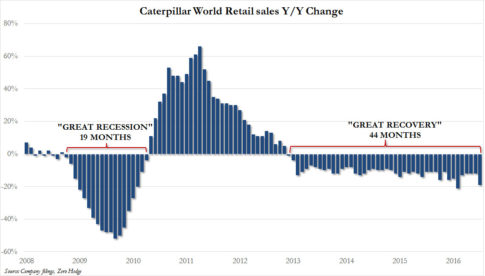

There was a time when Caterpillar was considered a key bellwether for trends in global heavy industries, and thus a proxy for the manufacturing sector. However, over the past 3 years that has not been the case for one simple reason: if one looks only at trends revealed by CAT’s retail sales the global economy has been mired not in a recession but an unprecedented depression, one which has now lasted some 43 months. That’s how long CAT has gone without a single positive month in global retail sales, well over double the duration of the acute collapse in demand following the financial crisis.

Since there is little we can add to this story that we haven’t sasid for the past 42 months in our monthly monitoring of demand for CAT products, we will just lay out the breakdown:

Read moreCaterpillar Retail Sales Decline For 43 Consecutive Months

– Caterpillar Retail Sales Fall For Record 41 Consecutive Months:

For Caterpillar, the great recession was bad, for about 19 months. In May 2010, after declining sharply for just under two years, CAT posted it first positive global retail sales comps and never looked back… until December 2012 when comp sales once again turned negative and have been negative ever since. For the past 41 months!

…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– World’s Leading Heavy Equipment Manufacturer Suffers Longest Losing Streak Ever:

Caterpillar is the world’s premier heavy equipment manufacturer, from tractors to locomotives to engines of every shape and size. As such, Caterpillar is used as a litmus test for the global economy. More sales by Caterpillar means more people around the world using heavy equipment to produce and build. Less sales means falling production and crashing demand globally. Currently, Caterpillar is suffering from one of the longest losing streaks in the company’s history – over 37 straight months of significant year over year retail losses. That is three years of solid decline. The mainstream has attempted to pin the lack of demand for Caterpillar machinery on the dramatic fall in oil prices (approximately 50% decline in the past six months), however, oil prices do not explain the three year span of negative year over year profits. The ONLY thing that explains Caterpillar’s troubles is a crisis level collapse in global demand. Period. Caterpillar is a signal, like the Baltic Dry Index, and like oil to some extent. As the current bear market rally in equities tops out and fizzles over the next two weeks, keep in mind the fundamentals. A system that requires exponential growth to survive cannot last long under the weight of collapsing demand. There is nothing that anyone, including central banks, can do to avoid this reality…

Read moreWorld’s Leading Heavy Equipment Manufacturer Suffers Longest Losing Streak Ever

– Manufacturing Depression Enters Uncharted Territory: Caterpillar Retail Sales Have Never Been Worse:

Moments ago Caterpillar reported its latest monthly retail sales statistics and the numbers have never been worse.

Not only is the fourth, feeble and final dead CAT bounce in US sales officially over, with December US retail sales tumbling -10% Y/Y, after “only” a -5% decline in November and hugging the flatline for the past few months, but sales elsewhere around the globe were a complete debacle: Asia/Pacific (mostly China) was down -21%, EAME dropping -12%, and Latin America (i.e. Brazil) continuing its free fall dropping by -36%, but global retail sales just posted a massive -16% drop in the past month, tied for the worst annual decline since the financial crisis.

For CAT the global manufacturing depression just turned 3 years old as the company has now suffered through 36 consecutive months of declining annual retail sales – something unprecedented in company history, and set to surpass the “only” 19 months of declining during the great financial crisis by a factor of two!

…

– For Caterpillar The Depression Has Never Been Worse… But It Has A Cunning Plan How To Deal With It:

CAT has now suffered a record 35 months, or nearly 3 years, of consecutive declining annual retail sales – something unprecedented in company history! But fear not, the company has a cunning plan how to stem the bleeding…

…

Was: $2.9m | Now: $15,000: Caterpillar 992C wheel loader

– What An Industrial Depression Looks Like: Photos From An Australian Heavy-Machinery Auction:

Two weeks ago, when looking at the latest Caterpillar retail sales data…

… we said that “If Caterpillar’s Data Is Right, This Is A Global Industrial Depression.”

Today we get visual evidence of this, courtesy of an Australian heavy industrial equipment auction where machines such as a Caterpillar 992C wheel loader, which normally costs $2.9 million, can now be bought for just $15,000, a 99% discount!

As Australia’s ABC reports, now that the commodity bubble has burst for good, auctioneers are hard at work selling tens of millions of dollars of suddenly useless coal mining machinery for just a fraction of its original market value.

Read moreWhat An Industrial Depression Looks Like: Photos From An Australian Heavy-Machinery Auction

H/t reader squodgy:

“Like I said before, Cat’s products form the first stage of any large project.

If they have no orders, nobody has any orders & we grind to a halt.

When that happens, we all stand there looking at each other.

Then all hell breaks loose.”

And again, this is the Greatest Depression.

– If Caterpillar’s Data Is Right, This Is A Global Industrial Depression:

Most cats bounce at least once when they die, but not this one: after CAT posted its first annual drop in retail sales in December of 2012, it has failed to see a rise in retail sales even once.

In fact, since then Caterpillar has seen 34 consecutive months of declining global sales, and 11 consecutive months of double digit declines!

Why is this important? Because a month ago we asked: “What On Earth Is Going On With Caterpillar Sales?”

Read moreIf Caterpillar’s Data Is Right, This Is A Global Industrial Depression

– What On Earth Is Going On With Caterpillar Sales?:

We have been covering the ongoing collapse in global manufacturing as tracked by Caterpillar retail sales for so long that there is nothing much to add.

Below we show the latest monthly data from CAT which is once again in negative territory across the board, but more importantly, the global headline retail drop (down another 11% in August) has been contracting for 33 consecutive months! This is not a recession; in fact the nearly 3 year constant contraction – the longest negative stretch in company history – is beyond what most economists would deem a depression.