Kyle Bass:

…what does this all mean? It means war.

And your governments prepare for that …

– Business Insider: The Media’s Blackout Of The National Defense Authorization Act Is Shameful – ‘IF THIS BILL PASSES IN ITS CURRENT FORM THE UNITED STATES WILL BE A MILITARY POLICE STATE’ (Video)

– Constitutional lawyer (Yale Law School graduate) & Founder Of Oath Keepers Stewart Rhodes: Senate Bill Declares War On Americans (Video)

– Wired: U.S. Senate Wants The Military To Lock You Up Without Trial

– Natural News: Occupied America: Senate Bill 1867 Would Allow US Military To Detain And Murder Anti-Government Protesters In American Cities

– FOX News: Freedom Watch – Judge Napolitano Interviews Rand Paul On Unconstitutional INDEFINITE DETENTION Bill S. 1867 (Video)

– InfoWars: Senate Bill Would Allow US Military To Indefinitely Detain Americans Without Charge Or Trial Anywhere In The World

– Mother Jones: Is the US Getting Domestic Indefinite Military Detention (Also For US Citizens And Legal Permanent Residents) For Thanksgiving?

… and so do the people …

– ABC News: Black Friday Best-Seller: Guns!

– Kyle Bass Explains The New World Order – Panel Presentation (ZeroHedge, Dec. 2, 2011):

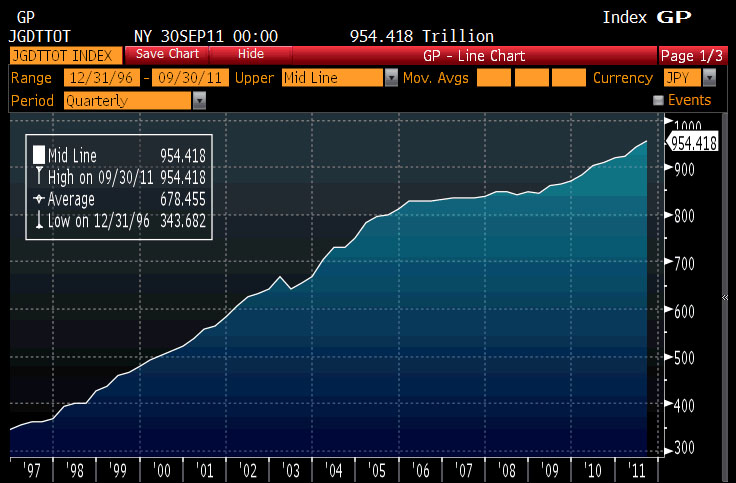

Unlike the broad consensus of prognosticators who feel the road for the US is a decade or more, Bass sees a three-to-five year window for a credible solution to the debt saturation or else kicking the can will cease to have any impact. The reason for the proximity is the acceleration of what happens in Europe and Japan with that respective chronology his central view – which he sees a s critical in understanding for every money manager.

In this extended interview at AmeriCatalyst, he points to the optimistic self-deception biases that leave people unable to comprehend the scenarios as they either lead to a really bad outcome or a nominally bad outcome. Using the Lehman moment as an example, Bass explains how we have been conditioned to believe there is always a backstop or savior…now those backstops at a corporate and sovereign level (central banks and the IMF for example) are being called into question in their roles (being seen for what they are – as just promises) and it is the chasm between what we want to believe and what does happen that is enormous and leaves the extreme volatility, risk-on/risk-off market the way it is.

Reiterating how critical the psychology of today’s situation, Bass goes on to debunk the optimism of globalization (at least for the Western world), destroy the myth of a 50% greek writedown solution, Japanese xenophobia and savings losses, structural versus cyclical implications for US equity deterioration, US deficits and housing‘s bottom, global debt saturation and how this tearing at the social fabric of the world will lead to – war.

Click image for video (no embed available)

This extended interview includes some of the following views (among many others):

On Greece:

For those who think a 50% write-down on debt will fix Greece, you have lost your mind. It is only a full wipe-out of the non-TROIKA-owned debt that is the only mathematical way for Greece to have any chance.

On the IMF and its role as global savior

He discusses in some detail Keynes and the IMF formation and the new world order he foresees as our era of the largest peacetime accumulation of global debt has no precedent (as it has historically ended in conflict or been created by conflict).

And how this debt saturation will inebitably play out:

Fundamentally, its about the social fabric of the world…what does this all mean? It means war.

And summarizing for every long-only talking head pitch-man:

This is not a cyclical rebound from a crisis we had two years and you should NOT be buying stocks because a P/E ratio is low relative to historical S&P behavior because the E is wrong. We are going to see declines and people don’t know how to position themselves for declines. We are at peak earnings now! Earnings only look good because if you take all the bad assets and put them on the public balance sheet.

We need to delever globally. We haven’t delevered. Just now we are seeing marginal delevering in Europe and all hell is breaking loose. An summing up:

Consensus is US low/slow GDP growth – no recession, US better than Europe, Europe mild recession, muddle through, go all in to Emerging markets as that’s where the convexity is.

The consensus is never going to be right.

I don’t get paid to be an optimist or a pessimist. I get paid to be a realist and the realist negative currently.

Don’t believe these governments when they tell you everything is going to fine. The day before Mexico devalued by 60% they denied that they would ever devalue. They can and will never tell you the truth. Find your own numbers.

More from Kyle Bass:

– Of Imminent Defaults And Self Deception: Hedge Fund Manager Kyle Bass Prepares For The Worst

– University of Texas Takes Delivery Of $1 Billion In Gold Bars After Cue From Hedge Fund Manager Kyle Bass, Storing It In New York Vault

“By failing to prepare, you are preparing to fail.”

– Benjamin Franklin