– Kyle Bass Was Right: Texas To Create Own Bullion Depository, Repatriate $1 Billion Of Gold (ZeroHedge, June 1, 2015):

Most investors have heard Kyle Bass’ rather eloquent phrase, “buying gold is just buying a put against the idiocy of the political cycle. It’s that simple.” However, what few may remember was his warnings in 2011, suggesting the University of Texas Investment Management Co. take delivery of its gold – as opposed to trusting it in the ‘safe’ hands of COMEX massively levered paper warehouse. Now, as The Star Telegram reports, Texas is going one step further with State Rep. Giovanni Capriglione asking the Legislature to create a Texas Bullion Depository, where Texas could store its gold. The goal is to create a secure facility that would allow the state to bring home more than $1 billion in gold bars that are owned by UTIMCO and are now housed at HSBC in New York.

From 2011:

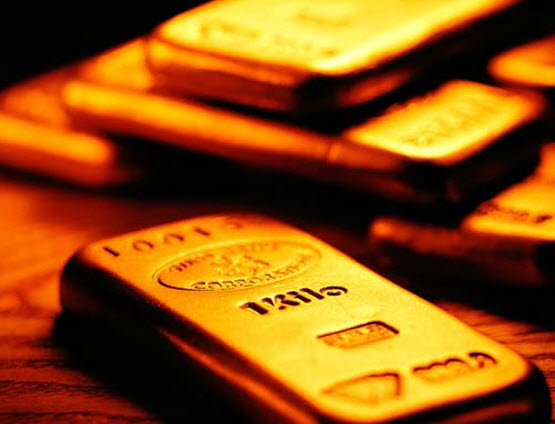

“The University of Texas Investment Management Co., the second-largest U.S. academic endowment, took delivery of almost $1 billion in gold bullion and is storing the bars in a New York vault, according to the fund’s board.”

The decision to turn the fund’s investment into gold bars was influenced by Kyle Bass, a Dallas hedge fund manager and member of the endowment’s board, Zimmerman said at its annual meeting on April 14. Bass made $500 million on the U.S. subprime-mortgage collapse.

“Central banks are printing more money than they ever have, so what’s the value of money in terms of purchases of goods and services,” Bass said yesterday in a telephone interview. “I look at gold as just another currency that they can’t print any more of.”

And now, as The Star Telegram reports, UTMICO would prefer a Texas depository than a New York one…

“We are not talking Fort Knox,” Capriglione said. “But when I first announced this, I got so many emails and phone calls from people literally all over the world who said they want to store their gold … in a Texas depository.

“People have this image of Texas as big and powerful … so for a lot of people, this is exactly where they would want to go with their gold.” And other precious metals.

House Bill 483 would let the Texas comptroller’s office establish the state’s first bullion depository at a location yet to be determined.

Capriglione’s changes to the bill must be approved by Monday, the last day of the 84th legislative session.

The goal is to create a secure facility that would allow the state to bring home more than $1 billion in gold bars that are owned by the University of Texas Investment Management Co. and are now housed at the Hong Kong and Shanghai Bank in New York.

“The depository would be an agency of the state located in the Office of the Comptroller, directed by an administrator appointed by the Comptroller with the advice and consent of the Governor, Lieutenant Governor and Senate,” according to a fiscal analysis of the bill.

The depository could also hold deposits of gold and other precious metals from financial institutions, cities, school districts, businesses, individuals and countries.

“This will allow for bullion to be deposited here, as well as any other investments that … any state agencies, businesses or individuals have,” Capriglione said.

Storage fees will be charged, perhaps generating revenue for the state. For instance, Texas pays about $1 million a year to store its gold in New York, Capriglione said.

A fiscal note attached to the bill states that the depository will have “an indeterminate fiscal impact” on the state, depending on the number of transactions and fees, but says it’s too early to determine the extent.

“It’s unusual,” said Cal Jillson, a political science professor at Southern Methodist University. “So far as I know, there are no states with bullion depositories.”

* * *

Perhasps the fact that Texas doesn’t trust New York suggests the unitedness of the states is starting to quake and surely “the idiocy of the political cycle” has only got worse…

“buying gold is just buying a put against the idiocy of the political cycle. It’s that simple.”

This is Capriglione’s second attempt to create the depository.

Two years ago, then-Gov. Rick Perry was on board, saying work was moving forward on “bringing gold that belongs to the state of Texas back into the state.”

“If we own it,” Perry has said, “I will suggest to you that that’s not someone else’s determination whether we can take possession of it back or not.”

In 2013, the Legislature ended before Capriglione could win approval of the bill.

Jillson said the bill’s sentiment is consistent with the anti-federal approach that conservative lawmakers have taken this year. “It’s in line with the idea that Texas is exceptional and needs to keep a distance from the federal government that respects individual states’ depositories,” he said.

Sounds like Texas – just like Austria, Germany, Russia, and China to name just four – no longer trusts the status quo.

I wish CA would follow TX’s lead…..in this case, they are spot on. I agree with them 100%.

Bring home your gold, TX. I wish our state would do the same.

If their gold has NOT been rehypothicated to nothing. Tell them they want to see the Texas gold. The FED really likes when you ask. It shows you care. It will more likely get you killed for asking.

Long gone, boys….