– Kyle Bass Warns “All Hell Is About To Break Loose” In China:

China’s credit system expanded “too recklessly and too quickly,” and “it’s beginning to unravel,” warns Hayman Capital’s Kyle Bass.

Crucially, Bass notes that ballooning assets in Chinese wealth management products are another sign of a looming credit crisis in the nation.

“Some of the longer-term assets aren’t doing very well,” Bass said on Bloomberg TV from the annual Milken Institute Global Conference in Beverly Hills, California. “As soon as liabilities have problems – meaning the depositors decide to not roll their holdings – all hell breaks loose.”

The wealth management products, or WMPs, have swelled to $4 trillion in assets in the last few years, he said., on a $34 trillion banking system…

“think about this – in the US, our asset-liability mismatch at the peak of our subprime greatness was around 2%! … China’s mismatch is more than 10% of the system.”

Must Watch simplification of the next stage of the credit cycle in China…

Timing the drop is hard, Bass notes, reminding Bloomberg’s Erik Schatzker that “in the US, the first bumps in the road hit in early 2007, and we didn’t start to really accelerate until mid 2008… even a large unraveling takes a while.“

Bass has been sounding the alarm for some time that debt-burdened Chinese banks need to be restructured…

“What you see when the liquidity dries up is people start going down… and this is the beginning of the Chinese credit crisis.”

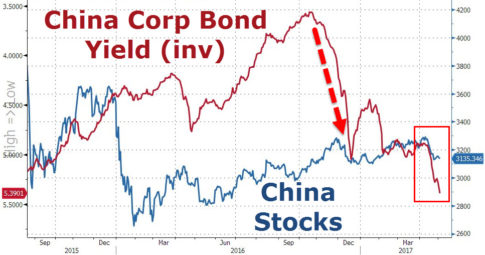

And judging by the collapse in both Chinese stocks and bonds, the deleveraging is accelerating…

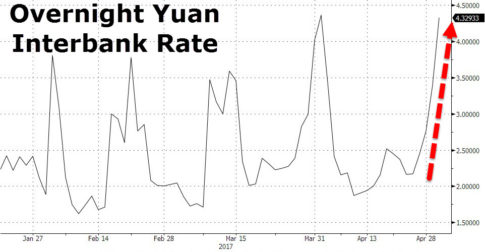

And liquidity is getting desperate again…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP