“We had a hard landing in the stock market already. We had a hard landing in commodities. [So yes], we could have a hard landing in the economy. China has a colossal credit bubble and no one knows how it’s going to unwind.”

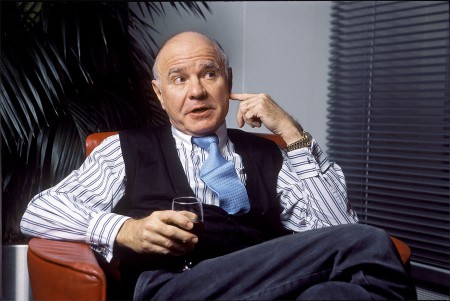

– China Has A “Colossal Credit Bubble” And No One Knows How It Will Unwind, Marc Faber Warns:

A little over a week ago, Marc Faber dialed in from Thailand to chat with Bloomberg TV about the outlook for US equities, the American economy, and USTs in the new year.

The US is “already in a recession,” the incorrigible doomsayer said.

Stocks will head lower in 2016, Faber continued, taking the opportunity to mock the sellside penguin brigade for adopting a universally bullish take on markets going forward. “Well, I don’t think that the U.S. will continue to increase interest rates,” he concluded, before predicting what we’ve been saying for years, namely that in the end, the Fed may be forced to do an embarrassing about-face and return to ZIRP and eventually to QE. “In fact, given the weakness in the global economy and the deceleration of growth in the U.S., I would imagine that by next year the Fed will cut rates once again and launch QE4.”

On Wednesday, Faber was back on Skype with Bloomberg to chat more about his outlook for 2016.

Asked why he believes the US is already in a recession, Faber says all one need do is “look at exports, look at industrial production and the slowdown in credit growth.”

As for what’s likely to work as an investment now that central banks have created bubbles everywhere you look, Faber says the following:

“With the exception of those that held Bitcoins, the performance of all asset classes has been poor. The Fed has created an atmosphere where the future return on assets whether it’s stocks or bonds or art will be poorer.”

Next, he bemoans the lack of market breadth, and warns that although the “indices are holding up well, the majority of market is already down 20% or more.” The S&P, he says, peaked in May and will fall 20-40%.

“Janet Yellen will go down in the history books as the biggest joke, the biggest failure,” he continues, noting that in hindsight, the Fed will be shown to have hiked right on the eve of a recession.

As for China, Faber thinks it’s better to be “overly cautious than overly optimsitic” given the fact that the country “has a colossal credit bubble” and no one knows how it’s going to unwind.

Quizzed on whether the Chinese economy will ultimately experience a “hard landing”, Faber says simply this: “We had a hard landing in the stock market already. We had a hard landing in commodities. [So yes], we could have a hard landing in the economy.”

…