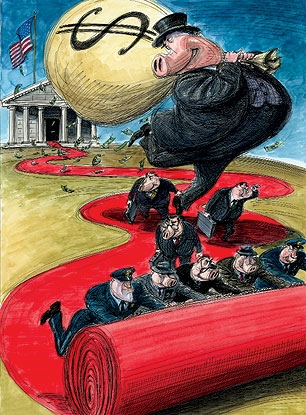

Financial crooks brought down the world’s economy — but the feds are doing more to protect them than to prosecute them

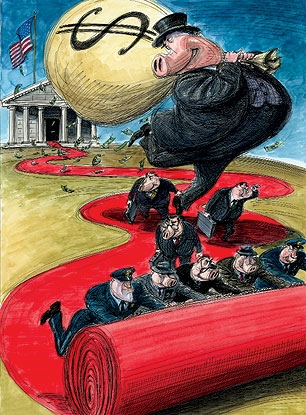

Illustration by Victor Juhasz

Over drinks at a bar on a dreary, snowy night in Washington this past month, a former Senate investigator laughed as he polished off his beer.

“Everything’s fucked up, and nobody goes to jail,” he said. “That’s your whole story right there. Hell, you don’t even have to write the rest of it. Just write that.”

I put down my notebook. “Just that?”

“That’s right,” he said, signaling to the waitress for the check. “Everything’s fucked up, and nobody goes to jail. You can end the piece right there.”

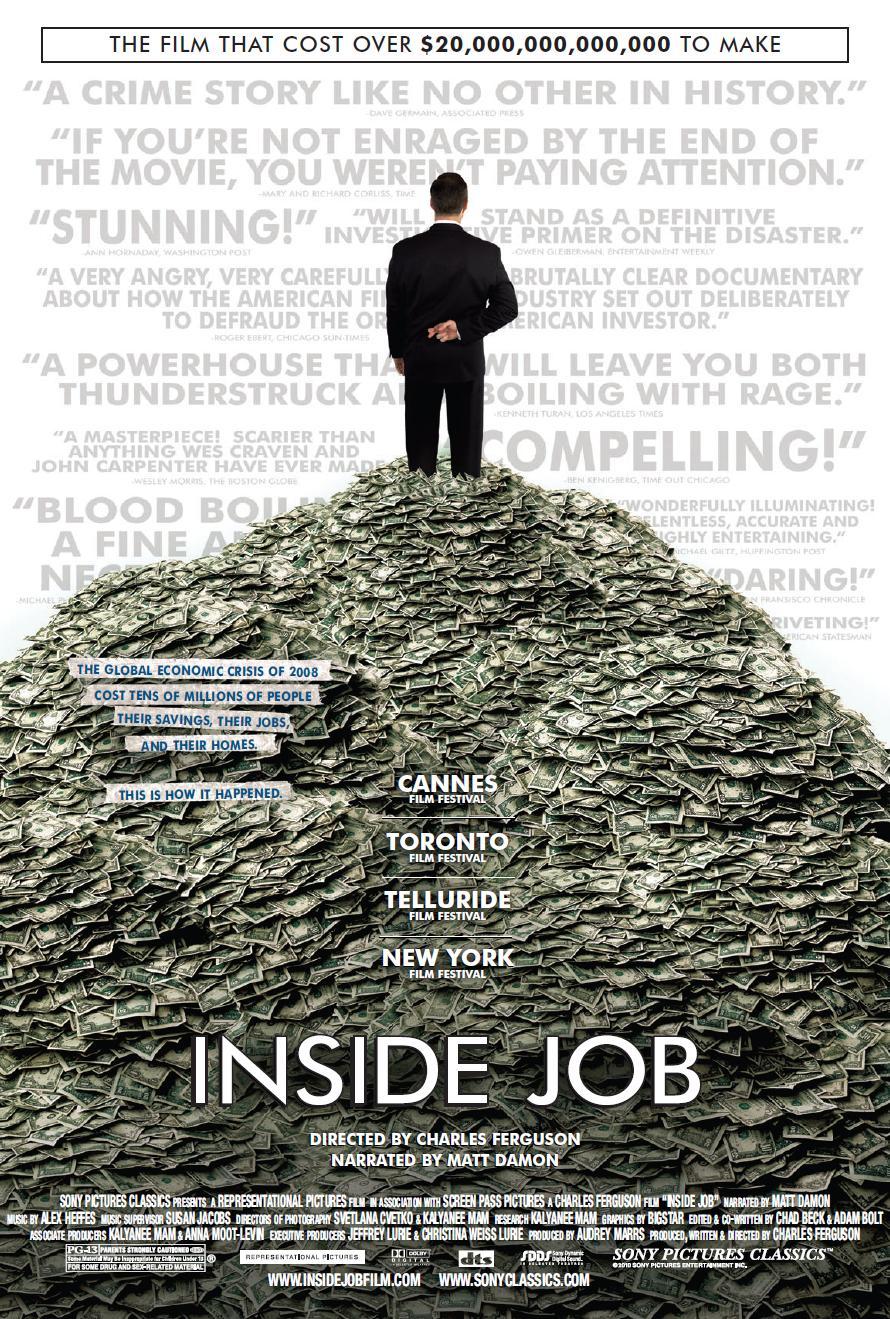

Nobody goes to jail. This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world’s wealth — and nobody went to jail. Nobody, that is, except Bernie Madoff, a flamboyant and pathological celebrity con artist, whose victims happened to be other rich and famous people.

This article appears in the March 3, 2011 issue of Rolling Stone. The issue is available now on newsstands and will appear in the online archive February 18.

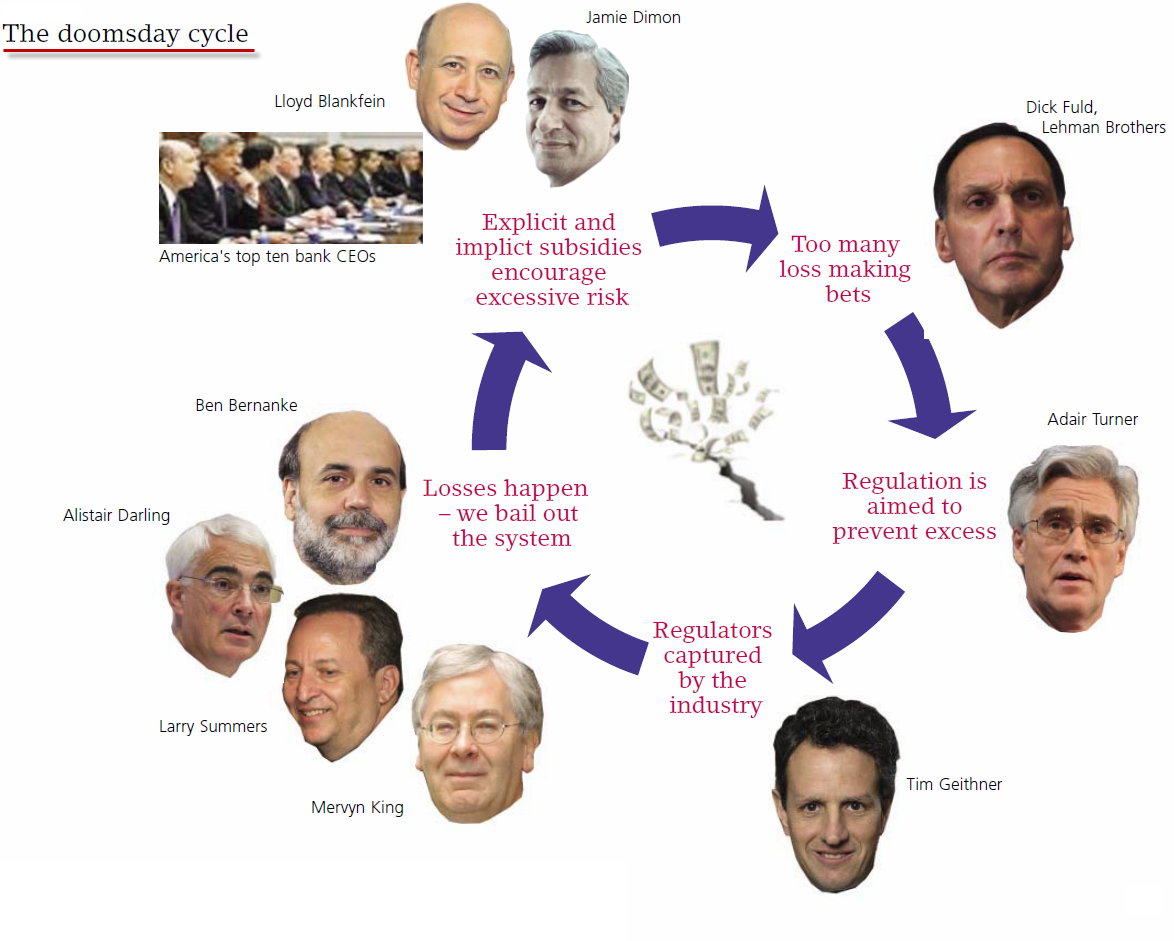

The rest of them, all of them, got off. Not a single executive who ran the companies that cooked up and cashed in on the phony financial boom — an industrywide scam that involved the mass sale of mismarked, fraudulent mortgage-backed securities — has ever been convicted. Their names by now are familiar to even the most casual Middle American news consumer: companies like AIG, Goldman Sachs, Lehman Brothers, JP Morgan Chase, Bank of America and Morgan Stanley. Most of these firms were directly involved in elaborate fraud and theft. Lehman Brothers hid billions in loans from its investors. Bank of America lied about billions in bonuses. Goldman Sachs failed to tell clients how it put together the born-to-lose toxic mortgage deals it was selling. What’s more, many of these companies had corporate chieftains whose actions cost investors billions — from AIG derivatives chief Joe Cassano, who assured investors they would not lose even “one dollar” just months before his unit imploded, to the $263 million in compensation that former Lehman chief Dick “The Gorilla” Fuld conveniently failed to disclose. Yet not one of them has faced time behind bars.

Instead, federal regulators and prosecutors have let the banks and finance companies that tried to burn the world economy to the ground get off with carefully orchestrated settlements — whitewash jobs that involve the firms paying pathetically small fines without even being required to admit wrongdoing. To add insult to injury, the people who actually committed the crimes almost never pay the fines themselves; banks caught defrauding their shareholders often use shareholder money to foot the tab of justice. “If the allegations in these settlements are true,” says Jed Rakoff, a federal judge in the Southern District of New York, “it’s management buying its way off cheap, from the pockets of their victims.”

To understand the significance of this, one has to think carefully about the efficacy of fines as a punishment for a defendant pool that includes the richest people on earth — people who simply get their companies to pay their fines for them. Conversely, one has to consider the powerful deterrent to further wrongdoing that the state is missing by not introducing this particular class of people to the experience of incarceration. “You put Lloyd Blankfein in pound-me-in-the-ass prison for one six-month term, and all this bullshit would stop, all over Wall Street,” says a former congressional aide. “That’s all it would take. Just once.”

But that hasn’t happened. Because the entire system set up to monitor and regulate Wall Street is fucked up.

Just ask the people who tried to do the right thing.

Read moreMatt Taibbi: Why Isn’t Wall Street in Jail? (Rolling Stone)