– Five Years After Lehman, BIS Ex-Chief Economist Warns “It’s Worse This Time” (ZeroHedge, Sep 15, 2013):

The froth is back. As we noted yesterday, corporate leverage has never been higher – higher now than when the Fed warned of froth, and as the BIS (following their “party’s over” rant 3 months ago) former chief economist now warns, “this looks like to me like 2007 all over again, but even worse.” The share of “leveraged loans” or extreme forms of credit risk, used by the poorest corporate borrowers, has soared to an all-time high of 45% – 10 percentage points higher than at the peak of the crisis in 2007.

As The Telegraph reports, ex-BIS Chief Economist William White exclaims, “All the previous imbalances are still there. Total public and private debt levels are 30pc higher as a share of GDP in the advanced economies than they were then, and we have added a whole new problem with bubbles in emerging markets that are ending in a boom-bust cycle.”

Crucially, the BIS warns, nobody knows how far global borrowing costs will rise as the Fed tightens or “how disorderly the process might be… the challenge is to be prepared.” This means, in their view, “avoiding the tempatation to believe the market will remain liquid under stress – the illusion of liquidity.”

Via The Telegraph,The Swiss-based `bank of central banks’ said a hunt for yield was luring investors en masse into high-risk instruments, “a phenomenon reminiscent of exuberance prior to the global financial crisis”.…

[The BIS] was the only major global body that clearly foresaw the global banking crisis, calling early for a change of policy at a time when others were being swept along by the euphoria of the era.

Mr White said the five years since Lehman have largely been wasted, leaving a global system that is even more unbalanced, and may be running out of lifelines. “The ultimate driver for the whole world is the US interest rate and as this goes up there will be fall-out for everybody. The trigger could be Fed tapering but there are a lot of things that can go wrong. I very am worried that Abenomics could go awry in Japan, and Europe remains exceedingly vulnerable to outside shocks.”

…

The BIS quietly scolded Bank of England Governor Mark Carney and his eurozone counterpart Mario Draghi, saying the attempt to use “forward guidance” to hold down long-term rates by rhetoric alone had essentially failed. “There are limits as to how far good communications can steer markets. Those limits have become all too apparent,” said Mr Borio.

Think its different this time and that we are indeed invincible – after all Maria Bartiromo and Hank Paulson told us so on Meet The Press this morning, right? Wrong! Here are the fact… (Via The BIS),

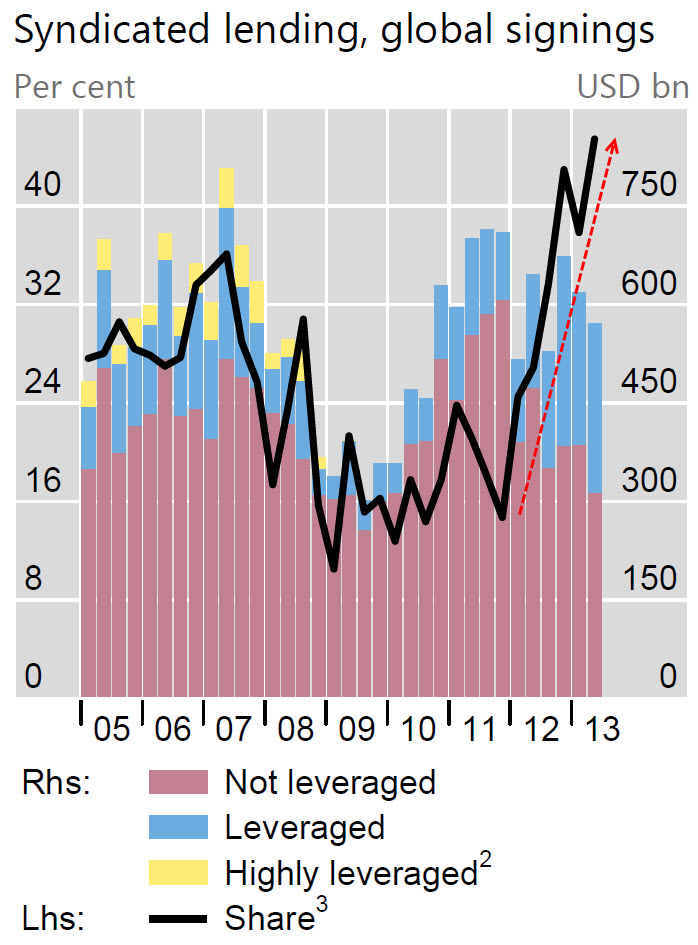

A trend favouring riskier lending was also evident in the syndicated loans market. A concrete manifestation was the growing popularity of “leveraged” loans, which are extended to low-rated, highly leveraged borrowers paying spreads above a certain threshold. The share of these loans in total new signings reached 45% by mid-2013, 30 percentage points above the trough during the crisis and 10 percentage points above the pre-crisis peak.

Market commentary attributed part of this increase to renewed investor demand for collateral loan obligations, which furthered a shift of negotiating power to borrowers. Thus, just as leveraged loans were gaining in importance, a declining portion of the new issuance volume featured creditor protection in the form of covenants.

and so back to Mr. White for the endgame…

Mr White said the world has become addicted to easy money, with rates falling ever lower with each cycle and each crisis. There is little ammunition left if the system buckles again. “I don’t know what they will do: Abenomics for the world I suppose, but this is the last refuge of the scoundrel,” he said.

NOTHING was done to fix anything. Nobody investigated, nobody went to jail, no regulations were passed to stop it reoccurring. Instead, they put a big media Band-Aid on it and said the recession was over.

The banks were given (and continue to receive) trillions in free cash out of the pocketbooks of the US citizens. No loans available for small business, no help with payroll stabilization, just all for the Greedy Guts.

No home loans, regardless of the low rates except to those who could afford to pay cash for the properties. Nobody else could get anything, the banks were too busy gambling. If they lost their bets, they went to the FED for more cash, if they won, they pocketed the profits.

Jobs deflated, wages and property values slid downward, growth in all areas, except debt, came to a screeching halt.

No help for homeowners or anyone in the real economy, just endless money to continue the gambling on Wall Street. Gambling creates no jobs and no product. On paper, the market has been booming, but one only need go to any shopping mall to see the truth……..a consumer-based economy that depends on demand cannot create buyers where none exist.

Now, debt levels are at new highs, and new jobless claims continue in the six figures every week. The FED has been handing out free money to the Greedy Guts like candy, and now they are saying if US interest rates go up, the whole system can collapse?/?? WTF? At $85 Billion a MONTH, what else can they expect?

As long as the US was the world reserve currency, it had more strength than other nations, but that entire concept has become obsolete thanks to technology, Hugo Chavez, Russia, China, and some others. The US is no longer #1, less than 50% of the world use the dollar in international trading. The FED’s abuse of the dollar with the endless printing press has not helped. There is far more currency

there is far more currency out there than there is wealth, or GDP from the US to support it. Soon, the US will be sitting on piles of currency that nobody wants. The FED is no longer the most powerful financial force in the world, and interest rates are no longer completely controlled by the US. Not when half of the world no longer uses the dollar….these clowns seem to think this is still 1964 when the US was the #1 country……..but those days are over.

Our credibility is gone. The crash of 2007-08 was caused by Wall Street, entire nations went bankrupt, and the total lack of concern or response to fix the problem destroyed world trust in the US. It became clear nothing would be done to fix the problem, or prevent it happening again.

The world started moving away from the US. Electronic currency was developed to enable nations to trade with each other leaving the dollar out. The more the US lost, the more it started bullying other nations. We have dropped from dollar involvement in 100% of world trades to less than 50%.

As a result, the FED can no longer control the world economic system. Interest rates are going up, mortgage rates and bond rates are climbing slowly but steadily. The FED now carries the majority of the US national debt, as rates go up, so will the costs.

Even worse is the fact most other nations have followed the FED lead of printing money to get out of pain. Japan is a good example. They used to be our #2 lender, led only by China. No longer.

We are over the cliff, all that is left is the fall. We have fools in power. If Obama puts Larry Summers or one of his other crooked friends as FED Chairman……..God help us. He is known around the world as a crook.

They are correct when they say it will be worse this time. The debt level is too high to be paid.

It will be a disaster.

Bernanke is set to start his cut backs on the “electronically generated $85 billion a month. Here is an interesting article from the UK Guardian……

http://www.theguardian.com/business/2013/sep/15/bernanke-fed-tapering-quantitative-easing?INTCMP=ILCNETTXT3487