From the article:

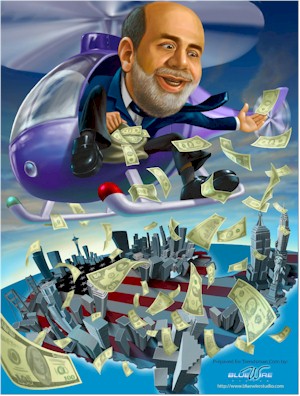

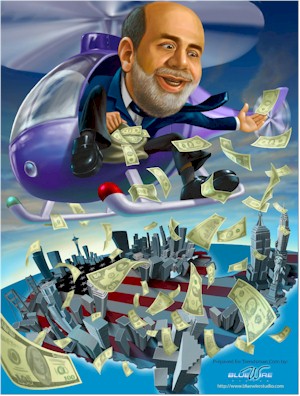

“Rather than trying to spur private-sector spending through asset purchases or interest-rate changes, central banks, such as the Fed, should hand consumers cash directly…. Central banks, including the U.S. Federal Reserve, have taken aggressive action, consistently lowering interest rates such that today they hover near zero. They have also pumped trillions of dollars’ worth of new money into the financial system. Yet such policies have only fed a damaging cycle of booms and busts, warping incentives and distorting asset prices, and now economic growth is stagnating while inequality gets worse. It’s well past time, then, for U.S. policymakers — as well as their counterparts in other developed countries — to consider a version of Friedman’s helicopter drops. In the short term, such cash transfers could jump-start the economy… The transfers wouldn’t cause damaging inflation, and few doubt that they would work. The only real question is why no government has tried them”…

– It Begins: Council On Foreign Relations Proposes That “Central Banks Should Hand Consumers Cash Directly” (ZeroHedge, Aug 26, 2014):

… A broad-based tax cut, for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices. Even if households decided not to increase consumption but instead re-balanced their portfolios by using their extra cash to acquire real and financial assets, the resulting increase in asset values would lower the cost of capital and improve the balance sheet positions of potential borrowers. A money-financed tax cut is essentially equivalent to Milton Friedman’s famous “helicopter drop” of money

– Ben Bernanke, Deflation: Making Sure “It” Doesn’t Happen Here, November 21, 2002

A year ago, when it became abundantly clear that all of the Fed’s attempts to boost the economy have failed, leading instead to a record divergence between the “1%” who were benefiting from the Fed’s aritficial inflation of financial assets, and everyone else (a topic that would become one of the most discussed issues of 2014) and with no help coming from a hopelessly broken Congress (who can forget the infamous plea by a desperate Wall Street lobby-funding recipient “Get to work Mr. Chariman”), we wrote that “Bernanke’s Helicopter Is Warming Up.”

Read moreIt Begins: Council On Foreign Relations Proposes That ‘Central Banks Should Hand Consumers Cash Directly’