– Amazon, Berkshire And JPMorgan To Form Healthcare Company “Free From Profit-Making Incentives”:

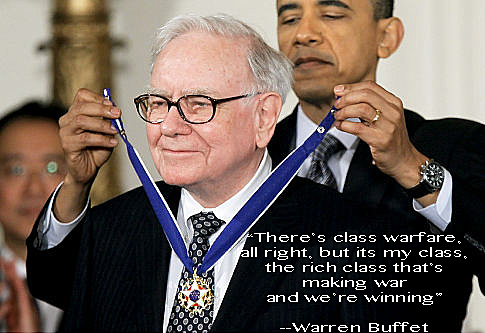

In a move that might explain why Amazon has been quietly acquiring pharmacy licenses (not to mention hitting daily all time highs) the e-commerce giant – along with Warren Buffett’s Berkshire Hathaway and JP Morgan Chase & Co. – announced on Tuesday morning that they would partner to form a new health-care venture.

As stated in the press release, “Amazon, Berkshire Hathaway and JPMorgan Chase & Co. announced today that they are partnering on ways to address healthcare for their U.S. employees, with the aim of improving employee satisfaction and reducing costs. The three companies, which bring their scale and complementary expertise to this long-term effort, will pursue this objective through an independent company that is free from profit-making incentives and constraints. The initial focus of the new company will be on technology solutions that will provide U.S. employees and their families with simplified, high-quality and transparent healthcare at a reasonable cost.”