– Gasoline Rationing Comes To New York (ZeroHedge, Nov 8, 2012)

From the mayor who made owning an 18oz+ container of coke a summary offense, comes this:

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

– Gasoline Rationing Comes To New York (ZeroHedge, Nov 8, 2012)

From the mayor who made owning an 18oz+ container of coke a summary offense, comes this:

YouTube Added: Nov 1, 2012

– As cold snap looms, Sandy sets NY up for a new fuel crisis (Reuters, Nov 3, 2012):

Northeast residents lucky enough to have a roof after Hurricane Sandy struck now face a new problem: a heating oil shortage and widespread power outages mean some homes may go cold as the weather turns wintry.

A cold snap in the New York City area – with daily low temperatures set to drop into the upper 30s Fahrenheit (2-4 degrees Celsius) early next week – is raising concerns that residents of the storm-stricken areas of New York, New Jersey or Connecticut could be left without heat as they recover from one of the worst storms in U.S. history.

Read moreAs Cold Snap Looms, Northeast Residents Now Face Heating Oil Shortage

– New Yorkers in fuel scramble as storm-hit pumps dry up (Reuters, Oct 31, 2012):

NEW YORK – Drivers and homeowners scrambled to secure fuel for their cars and generators in the U.S. Northeast on Wednesday as storm-hit gasoline stations started to run dry.

More than half of all gasoline service stations in the New York City area and New Jersey were shut because of depleted fuel supplies and power outages, frustrating attempts to restore normal life, industry officials said.

Reports of long lines, dark stations and empty tanks circulated across the region. Some station owners were unable to pump fuel due to a lack of power, while others quickly ran their tanks dry because of increased demand and logistical problems in delivering fresh supplies.

The lack of working gasoline stations is likely to compound travel problems in the region, with the New York City subway system down until at least Thursday and overland rail and bus services severely disrupted.

Homeowners and businesses relying on back-up generators during the power cuts, including many Wall Street banks in lower Manhattan, may also run short of fuel.

Concerns that the sovereign debt crisis may be entering a new phase and the risk of contagion has seen peripheral eurozone bonds fall sharply and the euro fall against major currencies and gold today.

Sovereign debt risk, global inflation concerns, geopolitical risk, disappointing European earnings and concerns about Japan’s coming reporting season have seen equities weaken and new record nominal highs for gold and silver (all time and 31 year).

Greek bond yields have continued their relentless march higher and have risen above 14.07% (10 year) and Portuguese debt (10 year) has risen to a euro era record over 9.27%.Spanish and Irish debt are also under pressure this morning.

Euro gold has been in a range between €900 and €1,070 for nearly a year (since last May – see chart) and this period of consolidation looks set to come to an end as gold pushes higher. Once the technical resistance at the record high of €1,072/oz (12/28/10) is breached, gold will challenge €1,100/oz .

In the current bull market, euro gold has seen many long periods of correction and consolidation prior to rapid gains and sharp moves upwards. The length of the recent correction (almost a year) suggests that the coming move could be very sharp and see gold rise to €1,200/oz in the coming weeks.

Gold is increasingly being seen as the superior currency in a world of trillion dollar and euro deficits and bailouts. Indeed, the printing and electronic creation of billion and trillions of the major paper currencies is increasingly making gold and silver the currencies of last resort.

Governments and central banks are debasing currencies through bailouts, deficit spending and quantitative easing which is leading to a massive increase in the supply of fiat currencies. Precious metals are rare and finite and this is why major currencies are falling in value versus gold and silver.

The scramble for non-dilutable currencies hits a frenzy as silver just touches on a fresh 31 year high of $34.90.

To commemorate this historic event, the US Mint has halted American Eagle silver coing production, in addition to its ongoing halt of American Buffalo coins:

“because of the continued demand for American Eagle Silver Bullion Coins, 2010-dated American Eagle Silver Uncirculated Coins will not be produced. The United States Mint will resume production of American Eagle Silver Uncirculated Coins once sufficient inventories of silver bullion blanks can be acquired to meet market demand for all three American Eagle Silver Coin products.”

Submitted by Tyler Durden on 03/02/2011 09:45 -0500

Source: ZeroHedge

And of course Blythe Masters was right that nobody can manipulate the silver market, right?:

Added: 05.07.2010

Sure Blythe! Nobody believes that BS anymore. Game over.

It’s just a fact now that there is nothing left!

Silver is still incredibly cheap.

I would buy every silver Maple Leaf, American Eagle or Wiener Philharmoniker I could get my hands on.

Only physical gold and silver are real, everything else is an illusion.

– Exposed: The iShares Silver Trust (SLV) Scam

More on gold and silver:

Silver:

– CNBC: Total Silver Demand At 127% ! – The Case For $130 Silver

– Dollar Ready to Collapse, Silver Squeeze to Continue

– Even The Royal Canadian Mint Now Says It’s Difficult To Secure Silver

– Unprecedented: Silver Backwardation Surges To Over $1.00

– Eric Sprott on Silver: ‘THERE IS NOTHING LEFT’

– Fractal Analysis Suggests Silver to Reach $52 – $56 by May – June 2011

With continued reports of booming sales and tightness in the silver market, today King World News interviewed Dave Madge director of sales at the Royal Canadian Mint. When asked if the RCM is having trouble acquiring silver Madge responded, “Demand right now for silver is through the roof and it shows no signs of slowing at this point. Sourcing silver is becoming very difficult. We are competing with a great many players when it comes to purchasing silver and many of these players are bidding the price higher.”

Dave Madge of the Royal Canadian Mint continues:

“Our advantage is that we have had long-term relationships with our suppliers and that has helped us in this situation. We have been able to leverage off of those relationships to get supply, but it still remains a big challenge sourcing material. We’re looking at ways of mitigating our risk regarding supply of silver.

We are anticipating it to become even more difficult to secure supplies in the future. This is based on what we are seeing firsthand and what our suppliers are telling us. We work closely with these banks to secure silver and they tell us there is a lot of competition.”

…..

Full article here: King World News

See also:

– Unprecedented: Silver Backwardation Surges To Over $1.00

– Eric Sprott on Silver: ‘THERE IS NOTHING LEFT’

– Fractal Analysis Suggests Silver to Reach $52 – $56 by May – June 2011

On September 21, 2010 I published an article entitled “More Forensic Evidence of Gold & Silver Price Manipulation”. In that article I showed how silver from 2003 to 2010 had never traded freely at all; I showed that silver was algorithmically traded with gold and there was a very clear relationship between the price of gold and the price of silver. For those who haven’t read the previous article the following figure 1 (figure 4 in the previous article) demonstrates the inter-relationship.

Figure 1 Cross-plot of Silver versus Gold 2003-2010

Figure 1 is a cross-plot of the price of gold against the price of silver for every trading day from June 2003 to September 2010. There are two linear relationships, one is pre-2008 (black line) and the second is post 2008 (green line). The best fit equations for the two data sets are also given on the chart.

The stunning revelation from the data analysis was that if on any day I knew what the price of gold was I would be able to calculate the silver price from the equation of the relationship! How is that possible in a free market? It simply is not possible and so the conclusion is that silver is not in a free market but is manipulated to move algorithmically with the price of gold. I have written many articles that show that gold is itself manipulated and suppressed (for example, see Gold Market is not “Fixed”, it’s Rigged)

I have updated the chart of Figure 1 which is shown in Figure 2.

Figure 2 Cross-plot of Silver versus Gold 2003-2011

Since September 2010 silver has broken its golden shackles. The algorithmic trading that kept the price of silver subdued for seven years has been completely annihilated.

On Friday silver closed in complete backwardation on the Comex. Spot silver closed at $29.075/oz while FEB 2011 closed at $29.064/oz and DEC 2015 closed at $29.026/oz. I believe this is the first time in history that this has happened. Silver traded in backwardation between the spot price and futures contract up to one year out during the blatantly manipulative precious metals bashing of January, but now the entire futures structure is in backwardation. This is a sure sign there are shortages of silver because it means that buyers will pay a premium for silver delivered sooner rather than later.

Signs of shortages have also been apparent from a shrinking silver inventory on the Comex in the face of rising prices. The registered inventory stands at a paltry 43 Mozs. In addition there is lots of anecdotal evidence that there are tight supplies everywhere. There are reports of refineries refusing to take new orders due to insufficient silver feedstock.

Read moreSilver Breaks Its Golden Shackles And More Signs of Silver Shortages

New Mexican Governor Susana Martinez makes announcements regarding gas shortages from the Emergency Operating Center on the National Guard Base just south of Santa Fe, N.M., on Thursday, Feb. 3, 2011. Secretary of Homeland Security and Emergency Management Michael Duvall, left, and Major General Kenny C. Montoya, right, look on. Martinez has declared a state of emergency as thousands of New Mexico residents lost natural gas service due to the bitter cold. Martinez sent all nonessential state workers home for the day Thursday, and urged all residents to turn down their thermostats, bundle up and shut off appliances they don’t need for the next 24 hours. (AP Photo/The New Mexican, Natalie Guillén)

ALBUQUERQUE, N.M.—With tens of thousands of people across New Mexico without natural gas service, Gov. Susana Martinez on Thursday declared a state of emergency, ordered all government offices be shut down Friday and urged schools to “strongly consider” remaining closed for the day.

Demand has soared because of extremely cold weather across the state since Tuesday. New Mexico Gas Company said rolling blackouts in West Texas also impeded the delivery of natural gas into New Mexico.

Martinez declared a state of emergency for all of New Mexico, urging residents to turn down their thermostats, bundle up and shut off appliances they don’t need for the next 24 hours.

She later announced all state operations not providing critical services would be closed Friday to decrease the strain on energy resources throughout the state.

“Due to statewide natural gas shortages, I have ordered all government agencies that do not provide essential services to shut down and all nonessential employees to stay home” on Friday, Martinez said after meeting with public safety personnel in Albuquerque.

“I have also encouraged all schools that have not already announced closures to strongly consider doing so,” she said.

And ATM’s are running out of cash:

– Cash machines are running out of money due to snow (Telegraph):

Cash machines are running out of money ahead of what is traditionally one of the busiest shopping weekends of the year.

The heaviest snowfall for 20 years means security vans carrying cash are being prevented from making deliveries to their regular destinations.

High street bank HSBC confirmed yesterday that snow was causing problems for some of its drivers.

It reported that 7 per cent of its cash machines were closed yesterday and that if levels dropped any further, it would be reach “unacceptable levels”.

* Two pensioners die after collapsing in their gardens

* Milder temperatures expected tomorrow but falling again on Sunday

* Short-haul flights from Gatwick cancelled until 5pm

* Petrol forecourts run dry as deliveries are held up

* Rail networks cancel services for the third day running

Petrol forecourts were today running dry and food stores were struggling to replenish their shelves as icy conditions halted deliveries.

‘Critical’ shortages of petrol have been reported by the RMI Petrol Retailers Association, with remote areas being particularly badly affected.

Some fuel stations have also been accused of ‘cashing in’ on the crisis by increasing their prices – with one garage in Surrey putting up the cost of diesel per litre from £1.24 to £1.28 within the past four days.

The news came as snowfalls eased but temperatures plummeted even further, dropping -20.1C in Scotland and -7C in London and Birmingham overnight.

Read moreUK: Food shelves empty and petrol running out as icy roads make deliveries impossible…

DES MOINES, Iowa — Dreaming of biting into a garden-fresh cucumber sandwich this summer? Better order your seeds now.

A poor growing season last year and increased orders from Europe could make it difficult for home gardeners to get seeds for the most popular cucumber variety and some vegetables this spring. Farmers, who usually grow different varieties than home gardeners, aren’t likely to be affected.

Seeds for what’s known as open-pollinated cucumbers seem to be most scarce, but carrots, snap peas and onions also could be in short supply.

“I suspect there will be some seeds you just won’t be able to buy if you wait too long on it,” said Bill Hart, the wholesale manager in charge of seed purchasing at Chas. C. Hart Seed Company in Wethersfield, Conn. “The sugar snap peas we’re not able to get at all, and other companies that have it will sell out pretty quickly.”

The problem is primarily due to soggy weather last year that resulted in a disappointing seed crop. European seed growers also had a bad year, leading to a big increase in orders for American seeds.

Demand for seeds in the U.S. soared last year, as the poor economy and worries about chemical use and bacteria contamination prompted many people to establish gardens. Homegrown food seemed safer and more affordable. But some wonder if the wet weather that ruined gardens in many areas last summer will discourage first-time gardeners from planting again.

“Tens of millions of people unemployed, inflation spiraling out of control, the government instituting price controls that result in shortages and blackouts and long lines for things. I think things are going to get very bad.”

“From an investment point of view, investors need to stay clear, because they need to realize that it’s not just U.S. stocks and real estate that are going to lose value, but U.S. bonds. This is the last bubble yet to burst. I think we’re going to see a collapse of the bond market sometime during Obama’s first term, and interest rates are going to spiral out of control, and the dollar is going to just be destroyed.”

____________________________________________________________________________

People aren’t laughing any more at the way-out-there predictions of Peter Schiff, whose long-standing pessimism about the economy and stock market has been largely borne out.

Schiff heads Euro Pacific Capital, a brokerage in Darien, Conn. with more than $1 billion in assets under management. He has silenced critics because he predicted the collapse of the housing market, the subprime crisis and the soaring of oil prices in his market commentaries before they came to pass.

A YouTube video called “Peter Schiff Was Right” shows him being repeatedly mocked when he went on TV stock shows to make those ultimately correct calls in 2006 and 2007, including forecasting a recession 2 1/2 years ago.

Now, in the midst of what’s already the biggest financial crisis in decades, the prominent purveyor of gloom and doom still sees far tougher times ahead – including a depression and a bear market he thinks will last another five years or more.

Dec. 5 (Bloomberg) — The fundamentals of commodities are “unimpaired” and prices will rebound when a lack of new supply leads to shortages, said Jim Rogers, chairman of Rogers Holdings.

“Commodities will be the place to be if and when we come out of” the downturn, Rogers said yesterday in an interview from Miami. “The only thing where fundamentals are unimpaired are commodities. Farmers cannot get loans for fertilizer now. Nobody can get a loan to open a zinc mine. So we are going to have some serious, serious supply problems before too much longer.”

The Reuters/Jefferies CRB Index of 19 commodities has plunged 53 percent from a record in July on concern that a global recession will sap demand for raw materials. The index almost doubled between its low in 2001 and the end of last year.

Rogers said crude oil and agricultural commodities were the most likely to have shortages and the outlook for zinc and cotton had “improved.” “I haven’t sold any commodities since the bull market began,” he said.

“I own some gold and if gold goes down I’ll buy some more and if gold goes up I’ll buy some more,” Rogers said. “Gold during the course of the bull market, which has several more years to go, will go much higher.”

Read moreCommodity Fundamentals Are ‘Unimpaired,’ Rogers Says

With retail and wholesale clients around the world stocking up on the precious metal, the Perth Mint has been forced to suspend orders.

As the World Gold Council reported that the dollar demand for gold reached a quarterly record of $US32 billion ($50.73 billion) in the third quarter, industry insiders said the race to secure physical gold had reached an intensity that had never been witnessed before.

Perth Mint sales and marketing director Ron Currie said the unprecedented demand had forced the Mint to cease orders until January, with staff working seven days a week, 24-hour days, over three shifts to meet orders.

He said Europe was leading the demand, with Russia, Ukraine, Middle East and US all buying — making up 80 per cent of its sales. One European client purchased 30,000 ounces for $33 million.

“We have never seen this before and are working right at capacity. And we are seeing it from clients in the shop buying one ounce, right up to 30,000 ounces from overseas clients,” Mr Currie said.

Many Gazans are dependent on food aid Many Gazans are dependent on food aid |

“People in Gaza are waiting in lines for almost everything, and that’s if they’re lucky enough to find something to wait for,” says Bassam Nasser, 39.

An aid worker in Gaza City, he, like so many others there, including the UN relief agency, says living conditions are the worst he has ever seen in the strip.

“People queue for two or three hours for bread, but sometimes there’s no cooking gas or flour, so no bread.

“People wait in line for UN food handouts, but sometimes there aren’t any. The suffering is reaching every aspect of life.”

As well as working for an American development agency, Mr Nasser is a Gazan, and a father.

“I’ve got three young children. It’s difficult to explain to them that it’s not my fault we don’t have electricity and that it’s not in my control.”

Russian shoppers have been served an uncomfortable reminder of the Soviet era after finding shelves in some Moscow supermarkets empty, a further sign that the woes of the financial markets have begun to affect the mainstream economy.

For a generation of Russians who queued daily in the snow for the most basic of staples, the symbolism of a bare supermarket shelf is so powerful that it could potentially destroy the reputation of Vladimir Putin, the prime minister, as saviour of the world’s largest country.

The shortages are not yet widespread. Even so, goods have begun to vanish from dozens of Moscow supermarkets over the past fortnight.

At a branch of the supermarket chain Samokhval in southwestern Moscow, a handful of shoppers pushed their trolleys through empty rows of shelves that once groaned under the weight of imported wares.

The deep freezes hummed, although there was nothing to freeze. Only a row of baked beans, a few jars of olives and sealed cupboards filled with vodka and cheap wine interrupted the void.

Read moreFinancial crisis: Moscow supermarket shelves increasingly empty in Soviet era reminder

Investors in gold are demanding “unprecedented” amounts of bullion bars and coins and moving them into their own vaults as fears about the health of the global financial system deepen.

Industry executives and bankers at the London Bullion Market Association annual meeting said the extent of the move into physical gold was unseen and driven by the very rich.

“There is an enormous pick-up in investment demand. I have never seen a market like this in my 33-year career,” said Jeremy Charles, chairman of the LBMA. “The gold refineries cannot produce enough bars.”

If Drivers Can Fill Up, They Get Sticker Shock

People wait to fill their tanks at a Citgo station in Charlotte, where drivers have reported gas lines 60 cars long after 11 p.m. (By Davie Hinshaw — The Charlotte Observer)

Gasoline shortages hit towns across the southeastern United States this week, sparking panic buying, long lines and high prices at stations from the small towns of northeast Alabama to Charlotte in the wake of Hurricanes Gustav and Ike.

In Atlanta, half of the gasoline stations were closed, according to AAA, which said the supply disruptions had taken place along two major petroleum product pipelines that have operated well below capacity since the hurricanes knocked offshore oil production and several refineries out of service along the Gulf of Mexico.

Drivers in Charlotte reported lines with as many as 60 cars waiting to fill up late Wednesday night, and a community college in Asheville, N.C., where most of the 25,000 students commute, canceled classes and closed down Wednesday afternoon for the rest of the week. Shortages also hit Nashville, Knoxville and Spartanburg, S.C., AAA said.

Read moreGas Shortage In the South Creates Panic, Long Lines

Californians could face mandatory water rationing unless they drastically reduce consumption because of a state-wide water crisis, governor Arnold Schwarzenegger has said.

The warning came as he declared the first official drought in California in 17 years, citing two years of arid conditions that threaten the state’s massive agriculture industry and increase the risk of wildfires such as those that destroyed 1,500 homes last October.

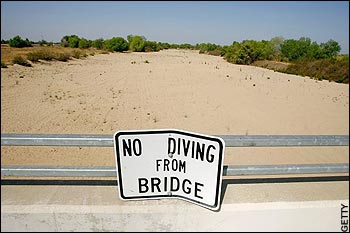

Kern River in California is dry and is expected to remain so

The governor called for a state-wide reduction of 20 per cent and issued an executive order commanding water officials to direct supplies to the driest areas, help districts conserve and aid stricken farmers who have already suffered huge losses.

Mr Schwarzenegger said mandatory restrictions could follow if residents and water authorities failed to make cutbacks and another dry winter ensued.

“We must recognise the severity of the crisis that we face,” the Republican governor said.

California has never resorted to statewide water rationing to cope with shortages. Since the last drought, however, its population has shot up as water supplies have decreased.

The governor himself does not have the authority to impose statewide rationing but the Department of Water Resources could slash water supplies to local authorities, who in turn would have to enforce limits.

Some regions already impose rationing with the threat of punitive measures for violators and many areas have appealed for conservation. Restrictions on outdoor water use, such as bans on washing cars or driveways, are in force in some cities along with orders stopping restaurants from automatically serving drinking water.

This week, Los Angeles approved a fleet of “drought busters” to patrol residential areas and enforce a ban on some types of outdoor water use. More districts are expected to impose limits of some kind as the long, hot days of summer loom.

This spring, the driest on record, follows two years of below average rainfall. The situation has been exacerbated by reduced mountain snow packs, which normally provide much of the state’s supply, and a court order limiting the amount of water that can be taken from a key river delta to protect a threatened fish.

“We’re suffering the perfect storm, if you will,” said Timothy Quinn, executive director of the Association of California Water Agencies.

The prospect of cuts alarmed some sectors of the business community who feared it could harm productivity and increase the chance of full-blown recession.

In Quebec, St. Lawrence water levels were so low this fall in places like Haut Gorge park that water had to be pumped in from Lake Ontario. Photograph by : Allen McInnis, Canwest News Service

In Quebec, St. Lawrence water levels were so low this fall in places like Haut Gorge park that water had to be pumped in from Lake Ontario.

In Quebec, St. Lawrence water levels were so low this fall in places like Haut Gorge park that water had to be pumped in from Lake Ontario.

Canada is crisscrossed by innumerable rivers, some of which flow into three oceans.

Yet Canada’s fresh water isn’t as abundant as you may think. And it’s facing serious challenges and the looming menace of climate change, which is expected to exacerbate Canada’s water problems and leave more of the world thirsting after our precious liquid resource.

“They say you need a crisis before people get jerked into taking responsible action,” says Chandra Madramootoo, a water researcher and founding director of McGill University’s Brace Centre for Water Resources Management.

“When are we going to finally say, ‘Jeez, we’re not as water rich as we thought we were and maybe we better start doing something?’ Is it going to be the day when we [must] ration water?”

Some think the crisis is already here. They say it’s time to take action — by, for example, conserving water, cracking down on polluters, preparing for the effects of climate change and coming to the aid of waterless poor in the developing world.

(Important article! Please continue to read. – The Infinite Unknown)

A child carries a tray of bread in Cairo. Photograph: Nasser Nuri/Reuters

World leaders are to meet next week for urgent talks aimed at preventing tens of millions of the world’s poor dying of hunger as a result of soaring food prices.

The summit in Rome is expected to pledge immediate aid to poor countries threatened by malnutrition as well as charting longer-term strategies for improving food production.

Hosted by the UN’s Food and Agriculture Organisation, it will hear calls for the establishment of a global food fund, as well as for new international guidelines on the cultivation of biofuels, which some have blamed for diverting land, crops and other resources away from food production.

The urgency of the meeting follows historic spikes in the price of some staple foods. The price of rice has doubled since January this year, while the cost of dairy products, soya beans, wheat and sugar have also seen large increases.

The world’s urban poor have been hit hardest, sending a wave of unrest and instability around the world. Thirty-seven countries have been hit by food riots so far this year, including Cameroon, Niger, Egypt and Haiti.

The Rome summit is the first of a series of high-level meetings aimed at tackling what many leaders now see as a much bigger threat to international stability than terrorism.

A fortnight after the UN meeting, the EU council will focus much of its time on the food crisis. A ministerial meeting of the World Trade Organisation in late June will make a last-ditch attempt in Geneva at agreeing the lowering of international trade barriers, with the aim of cutting food prices and making it easier for farmers in poor countries to export their produce.

Food and climate change will also be the twin top themes of the G8 summit in Japan in early July, and then in September a UN summit will attempt to put the world back on course towards meeting the millennium development goals, agreed eight years ago, one of which was the halving of the number of the world’s hungry.

Supermarket chains have begun rationing rice as the effects of rising prices and disruptions to supply spill over from specialist grocers and suppliers to larger stores.

Netto, the Danish-owned discount store, has been restricting sales of larger bags of rice to one per person in all stores in recent weeks across the UK.

Mike Hinchcliffe, marketing manager for Netto UK, said: “We’re temporarily limiting our larger 10 kg bags of rice to one per customer because, like most other UK supermarkets, we are having to manage and minimise the impact the global rice shortage is having on our suppliers.

“We are experiencing a high demand for rice and have introduced this measure across our 184 UK stores to ensure that all of our customers have a fair opportunity to make their regular rice purchases. Our smaller 1kg packs remain on free sale with no restrictions planned at this time.” It expects the restriction to continue “indefinitely”.

By Lucy Killgren

Published: May 30 2008 23:45 | Last updated: May 30 2008 23:45

Source: Financial Times

Fishermen across western and southern Europe are threatening an open-ended strike from Wednesday in protest at rising fuel costs. Several ports in France have remained blocked for more than a week despite a government aid deal, and fishermen in the Spanish region of Catalonia began strike action yesterday.

Their colleagues across Spain, Portugal and Italy plan to join them tomorrow. The industry has seen marine diesel prices almost double in six months. French President Nicolas Sarkozy has said he’ll look for a cap in fuel sales tax across the EU. He told a French radio station this morning: “I will ask our European partners: if the price of oil continues to rise, shouldn’t we suspend the VAT tax part of oil prices?” For that to happen, all 27 EU members would need to agree.

However the European Commission has responded negatively to Sarkozy’s proposal, saying modifying tax levels on oil products to fight inflation would be sending a bad message to oil producing countries.

The French haulage industry has joined the fishermens’ protest, leading to some fuel depot blockades and fears of petrol shortages.

Read moreFrench fishermens’ fuel strikes set to go Europe-wide