Ben Bernanke IS RIGHT, ‘the recession is over.’

It is now the ‘Greatest Depression’.

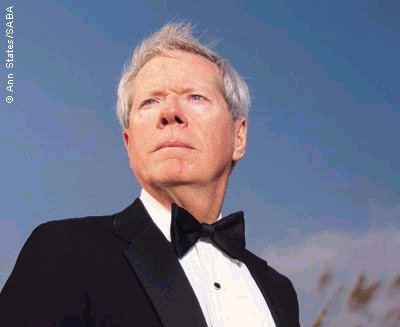

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

Paul Craig Roberts

Americans cannot get any truth out of their government about anything, the economy included. Americans are being driven into the ground economically, with one million school children now homeless, while Federal Reserve chairman Ben Bernanke announces that the recession is over.

|

|

|

|

|

|

|

At the urging of Larry Summers and Goldman Sachs’ CEO Henry Paulson, the Securities and Exchange Commission and the Bush administration went along with removing restrictions on debt leverage. |

|

|

The spin that masquerades as news is becoming more delusional. Consumer spending is 70% of the US economy. It is the driving force, and it has been shut down. Except for the super rich, there has been no growth in consumer incomes in the 21st century. Statistician John Williams of shadowstats.com reports that real household income has never recovered its pre-2001 peak.

The US economy has been kept going by substituting growth in consumer debt for growth in consumer income. Federal Reserve chairman Alan Greenspan encouraged consumer debt with low interest rates. The low interest rates pushed up home prices, enabling Americans to refinance their homes and spend the equity. Credit cards were maxed out in expectations of rising real estate and equity values to pay the accumulated debt. The binge was halted when the real estate and equity bubbles burst.

As consumers no longer can expand their indebtedness and their incomes are not rising, there is no basis for a growing consumer economy. Indeed, statistics indicate that consumers are paying down debt in their efforts to survive financially. In an economy in which the consumer is the driving force, that is bad news.

The banks, now investment banks thanks to greed-driven deregulation that repealed the learned lessons of the past, were even more reckless than consumers and took speculative leverage to new heights. At the urging of Larry Summers and Goldman Sachs’ CEO Henry Paulson, the Securities and Exchange Commission and the Bush administration went along with removing restrictions on debt leverage.

When the bubble burst, the extraordinary leverage threatened the financial system with collapse. The US Treasury and the Federal Reserve stepped forward with no one knows how many trillions of dollars to “save the financial system,” which, of course, meant to save the greed-driven financial institutions that had caused the economic crisis that dispossessed ordinary Americans of half of their life savings.

The consumer has been chastened, but not the banks. Refreshed with the TARP $700 billion and the Federal Reserve’s expanded balance sheet, banks are again behaving like hedge funds. Leveraged speculation is producing another bubble with the current stock market rally, which is not a sign of economic recovery but is the final savaging of Americans’ wealth by a few investment banks and their Washington friends. Goldman Sachs, rolling in profits, announced six figure bonuses to employees.

The rest of America is suffering terribly.

The unemployment rate, as reported, is a fiction and has been since the Clinton administration. The unemployment rate does not include jobless Americans who have been unemployed for more than a year and have given up on finding work. The reported 10% unemployment rate is understated by the millions of Americans who are suffering long-term unemployment and are no longer counted as unemployed. As each month passes, unemployed Americans drop off the unemployment role due to nothing except the passing of time.

The inflation rate, especially “core inflation,” is another fiction. “Core inflation” does not include food and energy, two of Americans’ biggest budget items. The Consumer Price Index (CPI) assumes, ever since the Boskin Commission during the Clinton administration, that if prices of items go up consumers substitute cheaper items. This is certainly the case, but this way of measuring inflation means that the CPI is no longer comparable to past years, because the basket of goods in the index is variable.

The Boskin Commission’s CPI, by lowering the measured rate of inflation, raises the real GDP growth rate. The result of the statistical manipulation is an understated inflation rate, thus eroding the real value of Social Security income, and an overstated growth rate. Statistical manipulation cloaks a declining standard of living.

In bygone days of American prosperity, American incomes rose with productivity. It was the real growth in American incomes that propelled the US economy.

In today’s America, the only incomes that rise are in the financial sector that risks the country’s future on excessive leverage and in the corporate world that substitutes foreign for American labor. Under the compensation rules and emphasis on shareholder earnings that hold sway in the US today, corporate executives maximize earnings and their compensation by minimizing the employment of Americans.

Try to find some acknowledgement of this in the “mainstream media,” or among economists, who suck up to the offshoring corporations for grants.

The worst part of the decline is yet to come. Bank failures and home foreclosures are yet to peak. The commercial real estate bust is yet to hit. The dollar crisis is building.

When it hits, interest rates will rise dramatically as the US struggles to finance its massive budget and trade deficits while the rest of the world tries to escape a depreciating dollar.

Since the spring of this year, the value of the US dollar has collapsed against every currency except those pegged to it. The Swiss franc has risen 14% against the dollar. Every hard currency from the Canadian dollar to the Euro and UK pound has risen at least 13 % against the US dollar since April 2009. The Japanese yen is not far behind, and the Brazilian real has risen 25% against the almighty US dollar. Even the Russian ruble has risen 13% against the US dollar.

What sort of recovery is it when the safest investment is to bet against the US dollar?

Read morePaul Craig Roberts: The Economy is a Lie, too