H/t reader squodgy:

“As predicted.”

– Hanjin Shipping To Shut Down EU Operations As Global Demand Falls:

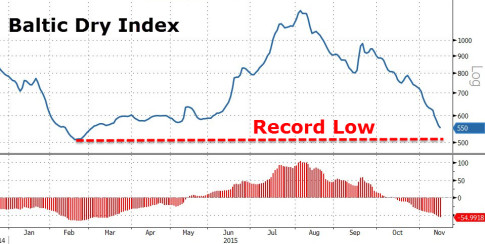

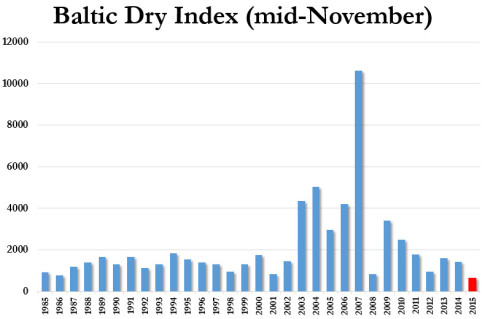

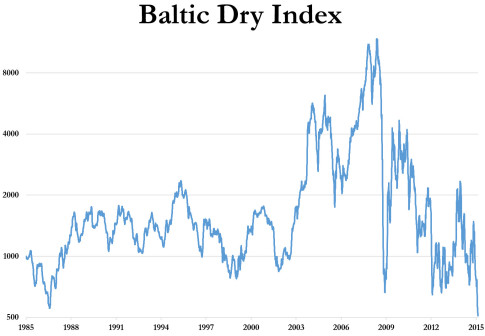

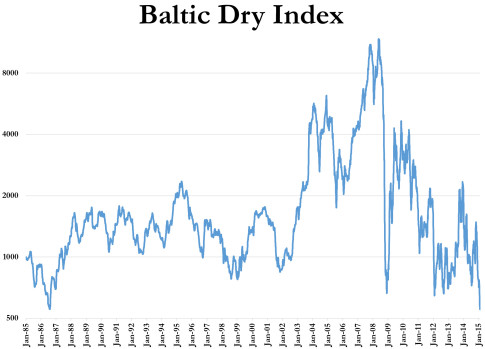

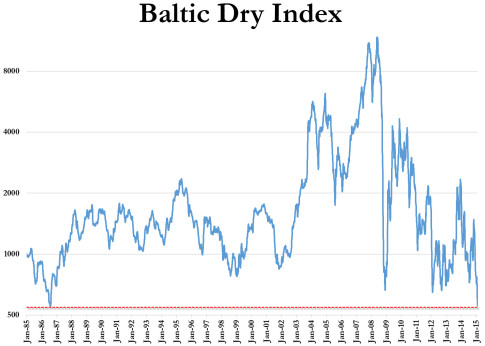

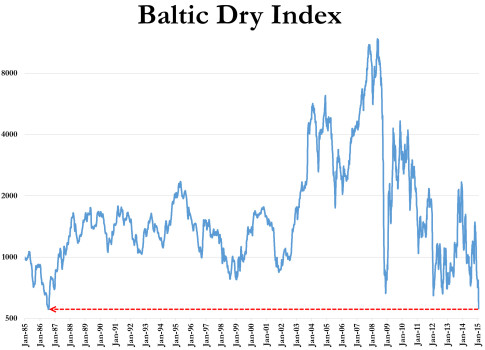

Remember all those mainstream pundits and the lie-mongers at Forbes that claimed the collapse of the Baltic Dry Index was due to an “oversupply of ships” and not falling global demand? Well, they seem to have disappeared recently as shipping agencies like Maersk Lines have openly admitted that falling demand around the world for raw materials and oil have resulted in dismal shipping rates. The latest nail in the coffin of the mainstream fantasy has been the implosion of Hanjin Shipping, a massive shipping conglomerate that is now essentially bankrupt, and this has been due to FALLING DEMAND in a dwindling marketplace, not too many cargo ships active on the seas. It might take longer than expected, but almost every single argument made by the alternative financial media over the years is being proven correct…

Hanjin Shipping Co., South Korea’s largest container line that has put its Asia-U.S. business on sale after filing for bankruptcy protection late August, won approval from a court to wind down its European operations as demand for its services to the continent slumped.

Read moreHanjin Shipping To Shut Down EU Operations As Global Demand Falls