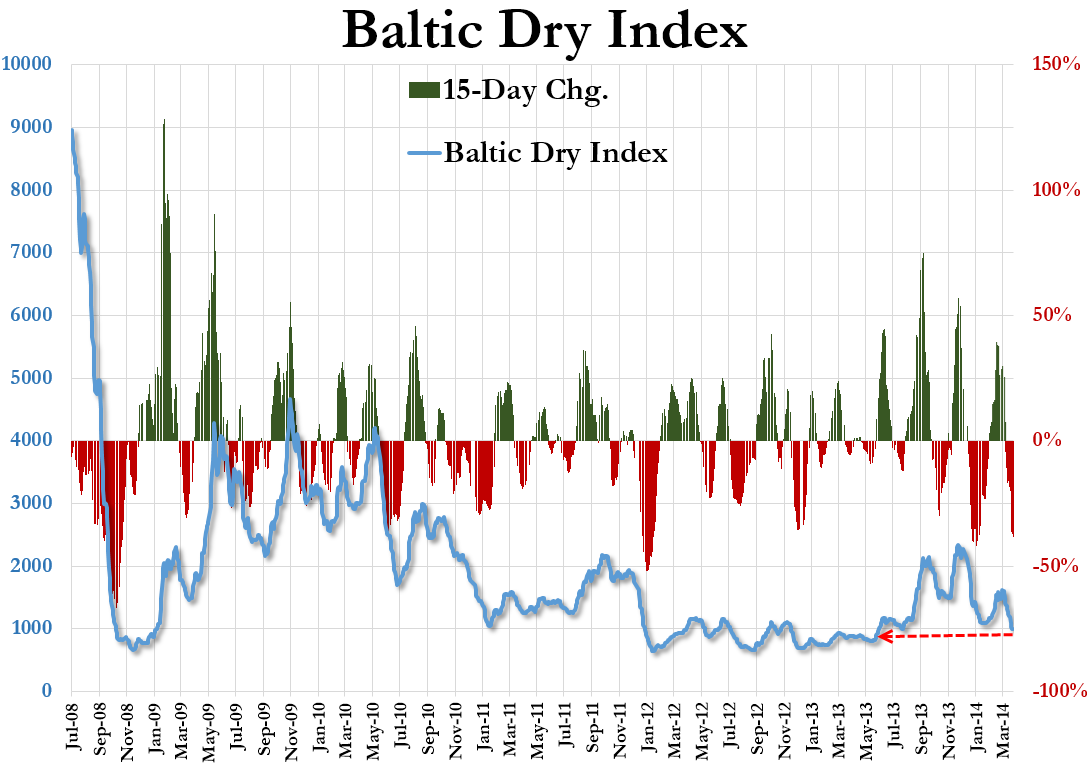

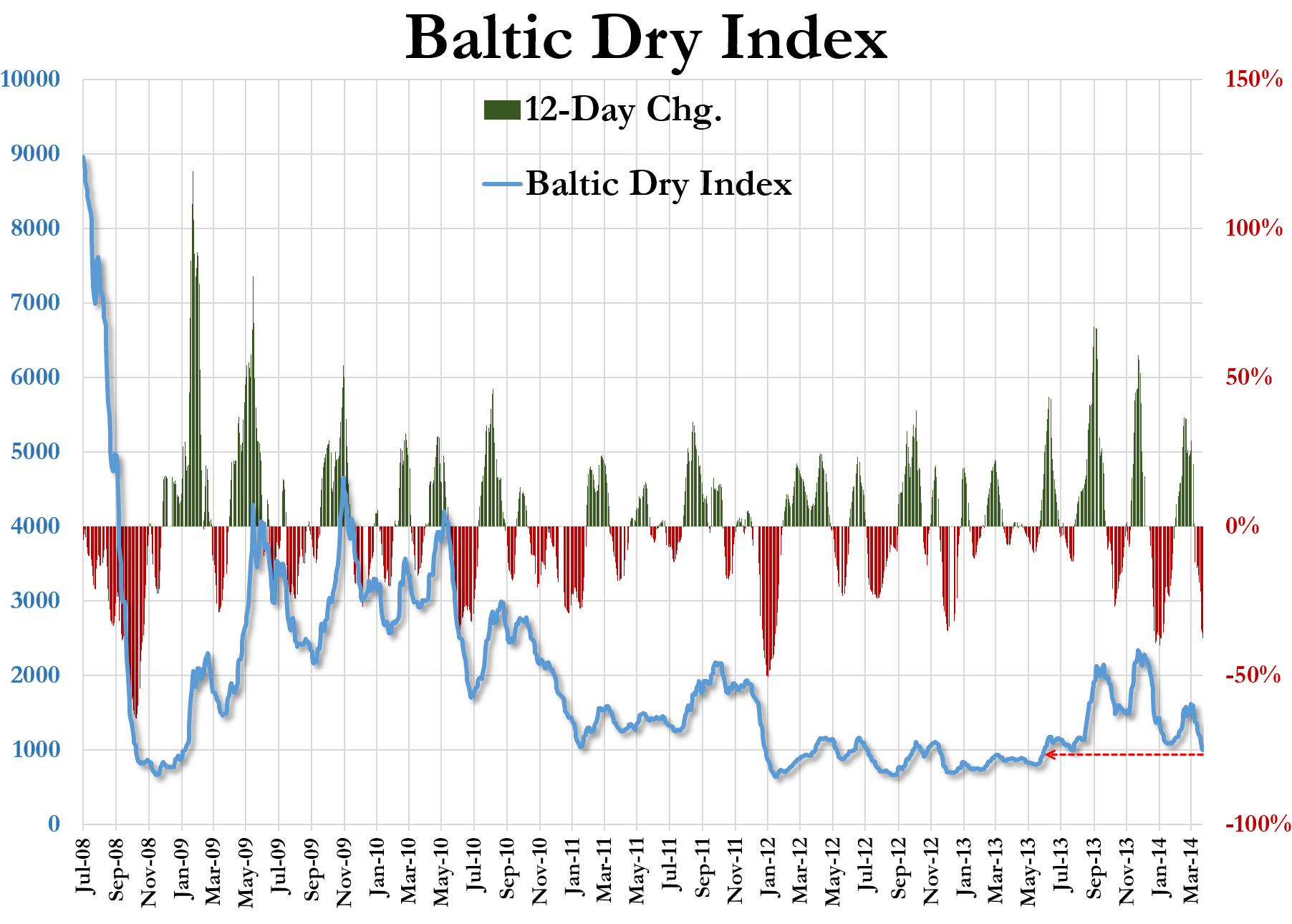

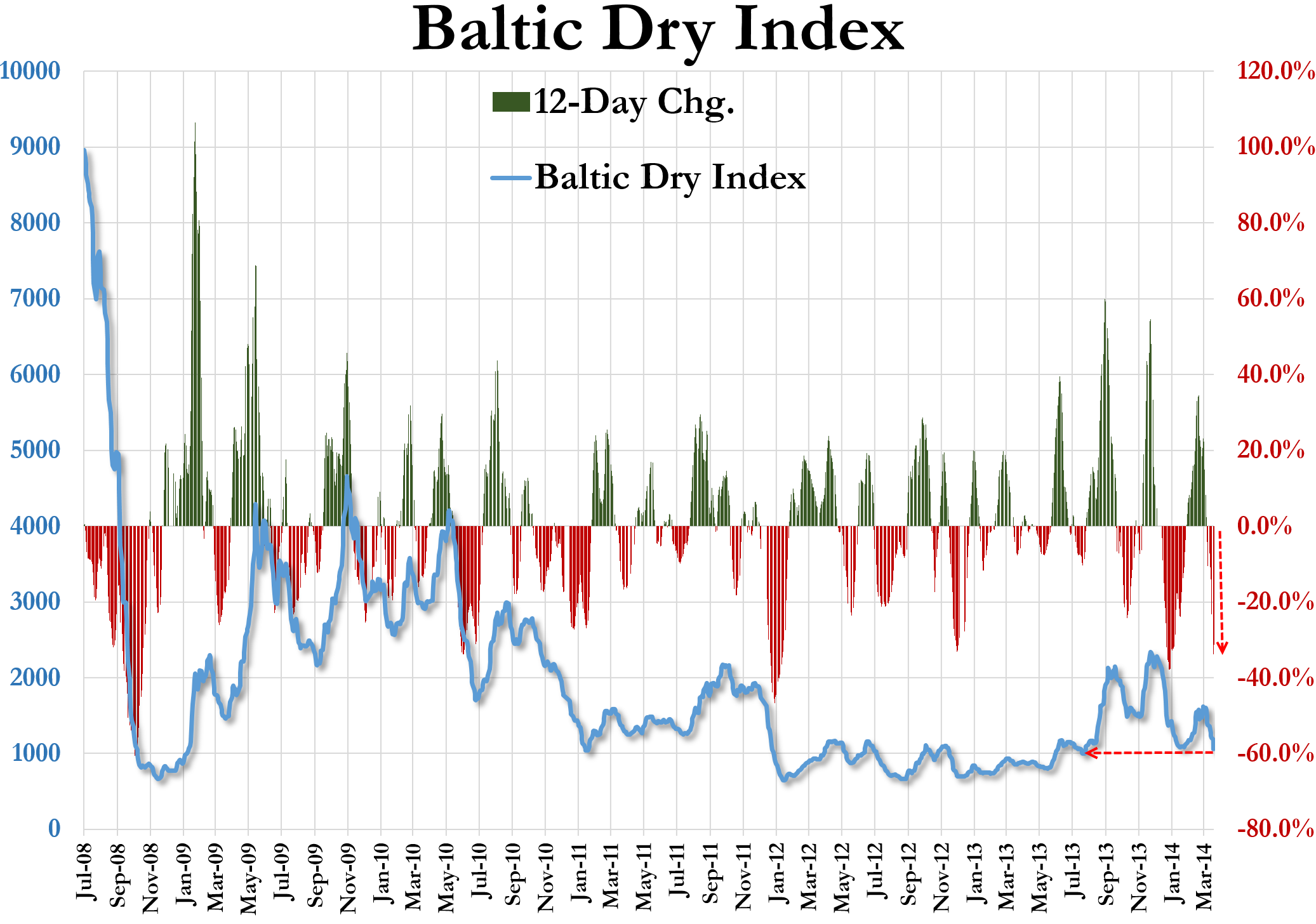

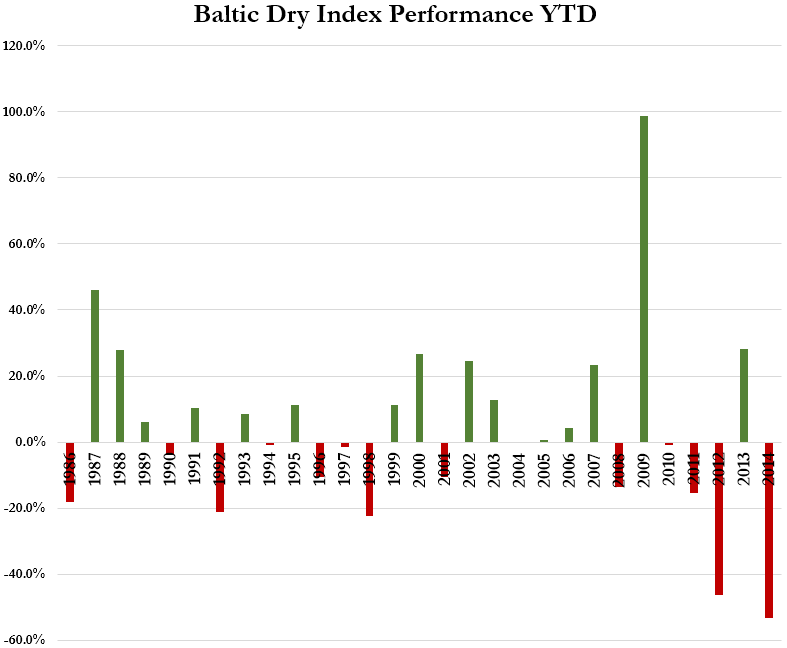

– Bulk Shipping Bankruptices Begin As Baltic Dry Collapse Continues (ZeroHedge, Feb 5, 2015):

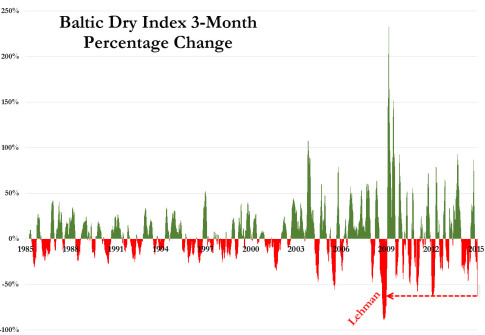

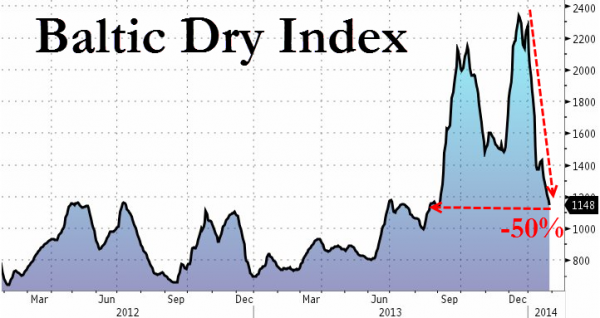

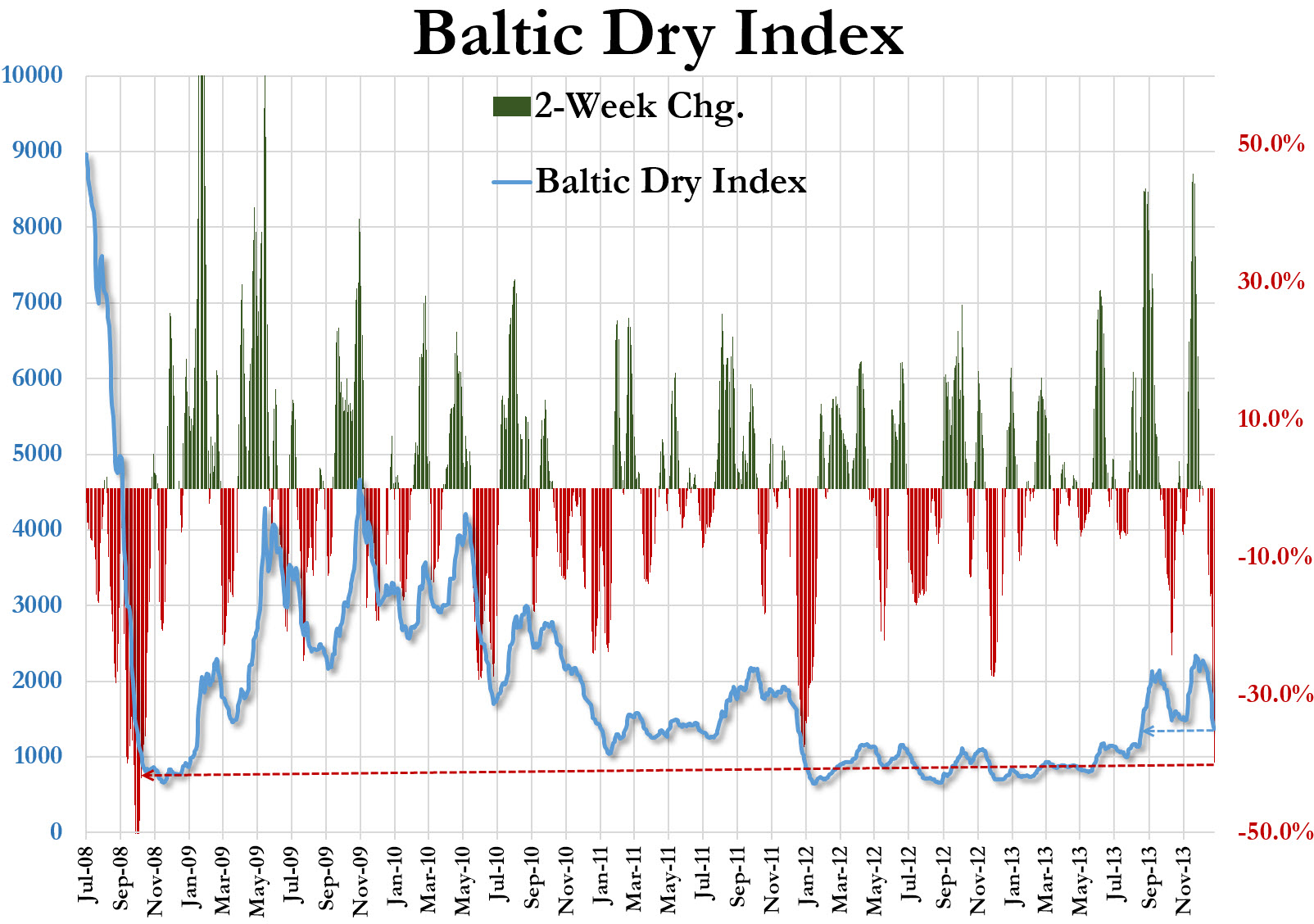

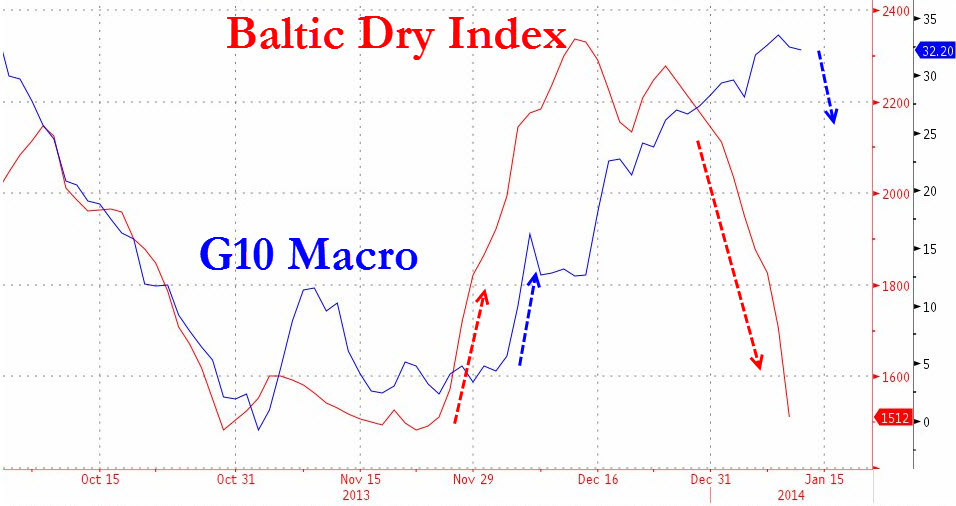

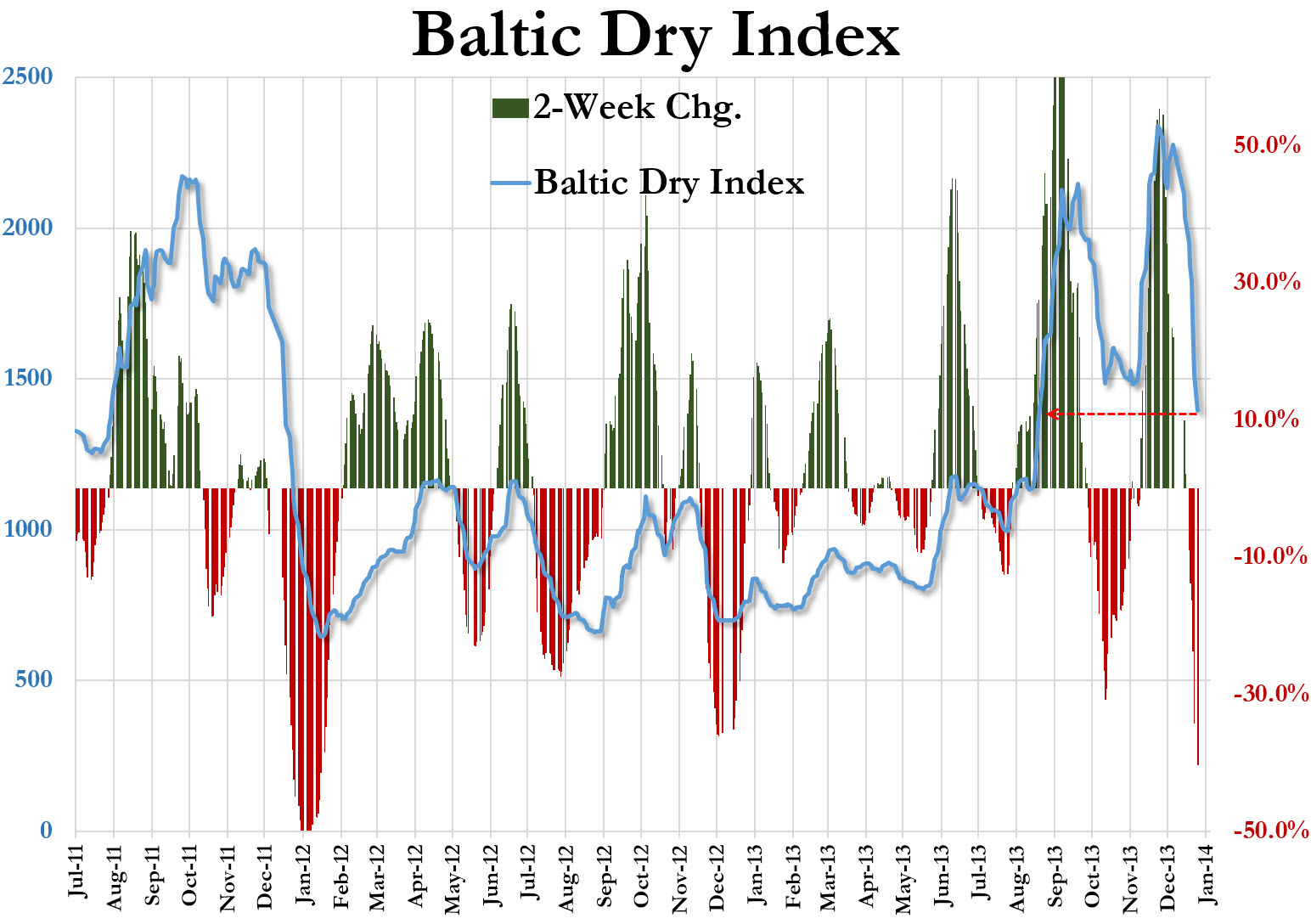

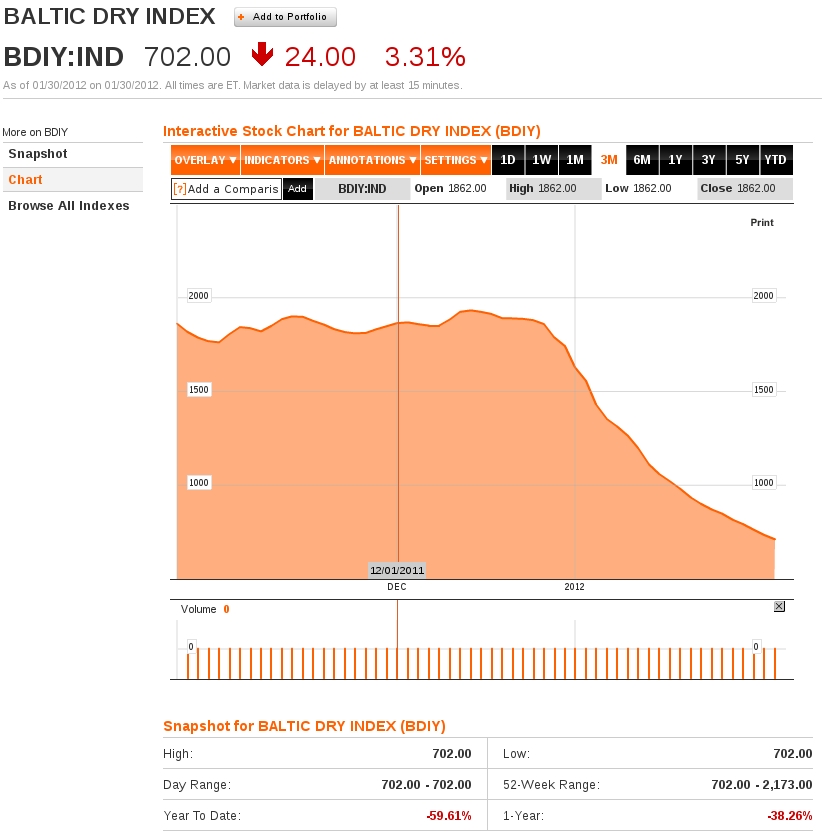

With one of the world’s leading dry bulk shipping companies, Copenhagen-based D/S Norden, having made huge losses for the last 2 years and expected to report dramatic losses in 2014 also, it is hardly surprising that the smaller bulk shipping firms are struggling as The Baltic Dry Index collapses ever closer to record all-time lows. As Reuters reports, privately-owned shipping company Copenship has filed for bankruptcy in Copenhagen after losses in the dry bulk market, with the CEO exclaiming, “we have reached a point where there is not more to do.” We suspect, given the crash in shipping fees, that this is the first of many…

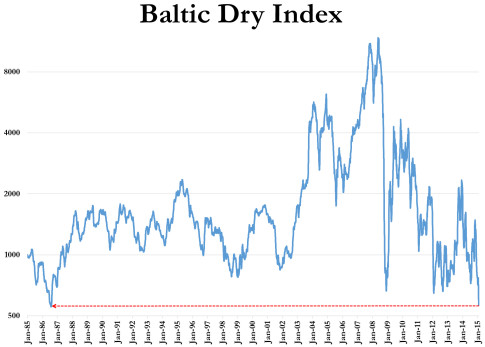

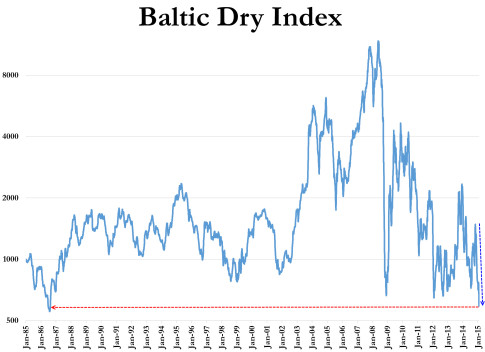

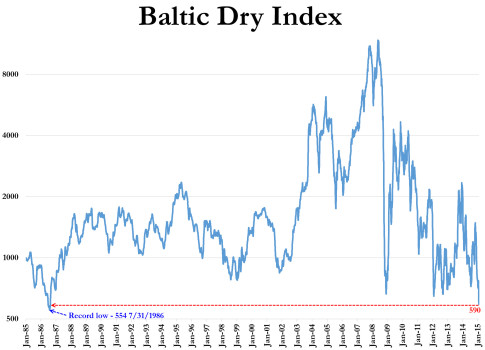

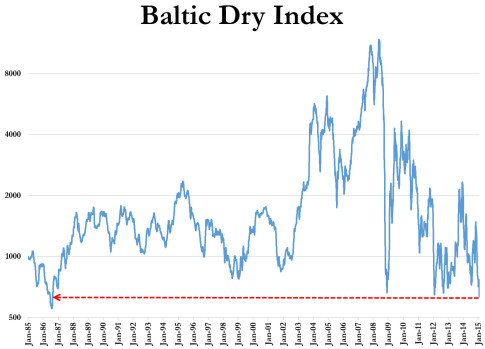

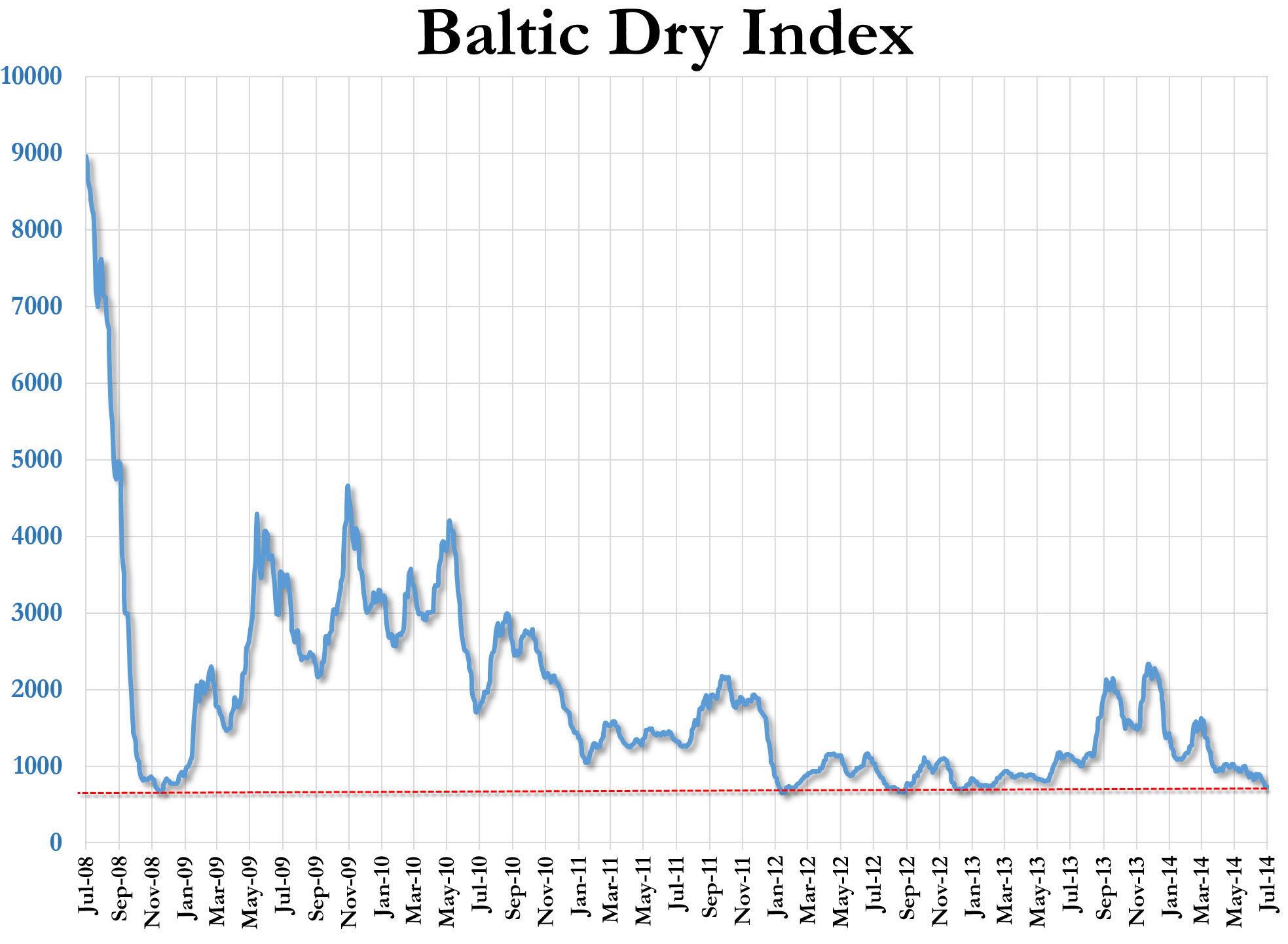

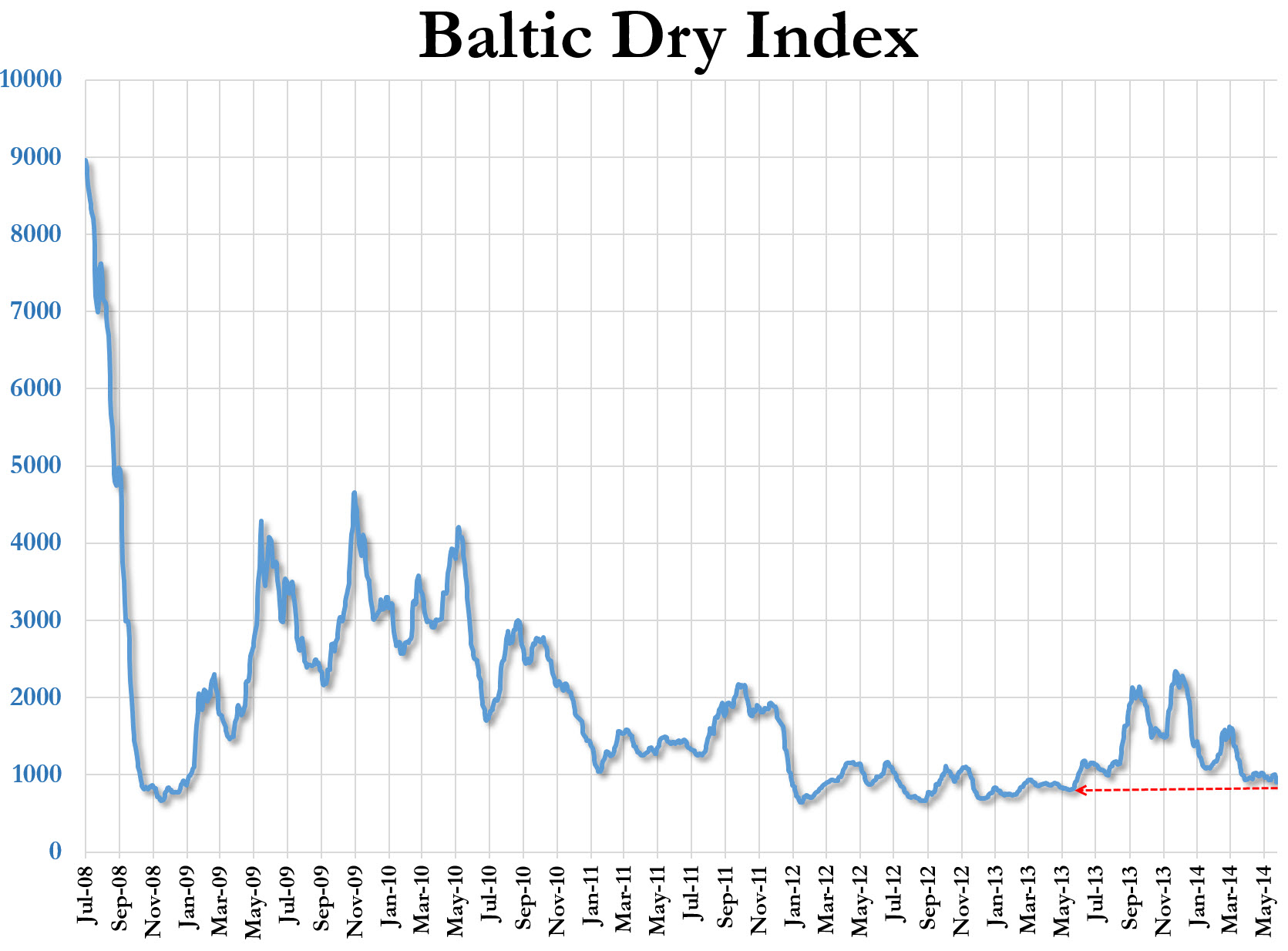

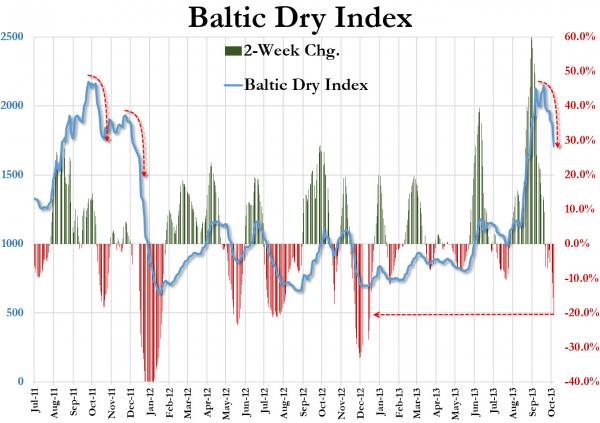

On Thursday the index stood at 564, close to the historic low level of 554 set in July 1986.

Privately-owned shipping company Copenship has filed for bankruptcy in Copenhagen after losses in the dry bulk market, its Chief Executive Michael Fenger told Reuters.

Read moreBulk Shipping Bankruptices Begin As Baltic Dry Collapse Continues