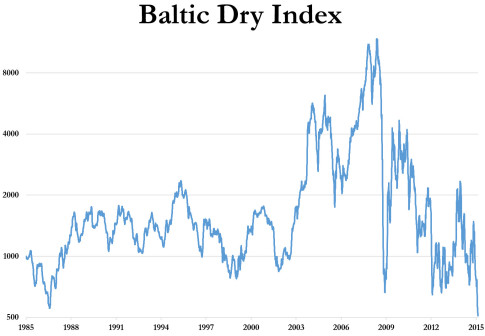

– Record Low Baltic Dry Casualties Emerge: Third Dry-Bulk Shipper Files For Bankruptcy In Past 3 Weeks (ZeroHedge, Feb 23, 2015):

The unintended consequences of a money-printed, credit-fueled, mal-investment-boom in commodities (prices – as opposed to physical demand per se) and the downstream signals that sent to any and all industries are starting to bite. The Baltic Dry Index has plunged once again to new record lows and the collapse of the non-financialized ‘clean’ indicator of the imbalances between global trade demand and freight transport supply has the real-world effects are starting to be felt, as Reuters reports the third dry-bulk shipper this month has filed for bankruptcy… in what shippers call “the worst market conditions since the ’80s.”

Spot the credit-based mal-investment boom

After 2 brief days of very marginal gains, The Baltic Dry Index dropped again…

A third dry cargo shipper has filed for bankruptcy this month following a collapse in freight rates to historic lows in what shippers call the worst market conditions since the 1980s.

South Korea’s Daebo International Shipping Co Ltd filed a court receivership, a form of corporate bankruptcy, on Feb. 11, mainly due to poor dry bulk market conditions, a company official said on Monday. It is the third known bulk shipper bankruptcy this month.

Weaker demand from China and an oversupply of ships has led to the industry downturn, pushing the Baltic dry index .BADI – the industry benchmark for freight rates – to an all-time low this month. The index has slumped by nearly two-thirds in the past 15 months.

“The dry bulk market is in a really bad shape, which has hit us hard,” the Daebo International official told Reuters by phone. He declined to be identified as he was not authorized to speak to media. “We did our best but we cannot help it.”

…

Daebo International mainly provides panamax-sized dry bulk shipping services such as iron ore, coal, grains and steel products, according to its website.

South Korea is the latest major shipping country to be hit by a bankruptcy in the sector.

China’s Winland Ocean Shipping Corp filed for Chapter 11 bankruptcy protection in the United States on Feb. 12, court documents show, also citing difficult market conditions.

In Denmark, privately owned Copenship filed for bankruptcy earlier in February after losses in the dry bulk market.

“The combination of lower steel demand in China and the huge volume of new tonnage coming on line is what is causing panic and making this the worst bulk market since the mid-1980s,” Hsu Chih-chien, chairman of Hong Kong and Singapore-listed dry bulk shipper Courage Marine said this month.

* * *

More to come…

Commodities and shipping tell the story. I remember when playing in commodities in the 1980s, I noticed Russia was dumping record levels of gold. When I ventured this information to friends, they looked at me as if I were nuts. They did not believe the USSR could crash……..but it did. And, the gold records were a clear warning.

This ought to tell everyone that the real economy, the one that Wall Street ignores and no longer represents is coming head on to the false one led by Wall Street greedy guts. At some point, reality slams fiction, even in a corporate media world that talks daily of the strong dollar, regardless only 30% of the world still uses it to complete international trades……the EU.

Truth is relentless, and eventually wills out.