This article is a MUST-READ!

This is not a conspiracy. This is politics and economics.

Wake up America! You will lose everything, if you do not act NOW.

Prepare yourself for a complete controlled meltdown. The greatest financial collapse in world history.

A hyperinflationary depression. THE Greatest Depression.

The Fed and the US government are destroying America!

(More information at the end of the following article.)

“The people no longer have elected representatives; they have elected traitors.”

By Stewart Dougherty

Stewart Dougherty is a specialist in inferential analysis, the practice of identifying historic and contemporary patterns and then extrapolating their likely effects upon the future. Dougherty was educated at Tufts University (B.A., magna cum laude), and Harvard Business School (M.B.A. and an academic Fellow).

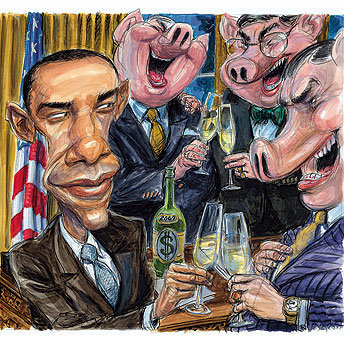

FOREWORD: At certain times, focusing on the big picture is important not just for investment success, but for personal welfare, and even survival. We believe such times are here. It is estimated that 98% of Americans have never held a gold coin in their hands. Yet 100% of Americans regularly handle Federal Reserve Notes. From a contrarian standpoint, the financial message from those two statistics is clear. Even so, gold is much more than money or an investment medium; it stands for liberty and throughout history has facilitated escape and ensured freedom. Never having touched a gold coin is the monetary equivalent to never having breathed fresh air, felt the warmth of sunshine, looked up at the stars or risen from the gutter. Fiat Federal Reserve Notes are becoming nothing more than sewage decomposing in the vast, toxic septic tank of predatory Washington politics, epic Federal Reserve arrogance and error, blatant Wall Street fraud and outright Master Class plunder. Below, we outline America’s troubling and compounding predicament, and urge you to think about how to protect yourself from its consequences, both financially and personally.

Thanks to the endless barrage of feel-good propaganda that daily assaults the American mind, best epitomized a few months ago by the “green shoots,” everything’s-coming-up-roses propaganda touted by Federal Reserve Chairman Bernanke, the citizens have no idea how disastrous the country’s fiscal, monetary and economic problems truly are. Nor do they perceive the rapidly increasing risk of a totalitarian nightmare descending upon the American Republic.

One stark and sobering way to frame the crisis is this: if the United States government were to nationalize (in other words, steal) every penny of private wealth accumulated by America’s citizens since the nation’s founding 235 years ago, the government would remain totally bankrupt.

According to the Federal Reserve’s most recent report on wealth, America’s private net worth was $53.4 trillion as of September, 2009. But at the same time, America’s debt and unfunded liabilities totaled at least $120,000,000,000,000.00 ($120 trillion), or 225% of the citizens’ net worth. Even if the government expropriated every dollar of private wealth in the nation, it would still have a deficit of $66,600,000,000,000.00 ($66.6 trillion), equal to $214,286.00 for every man, woman and child in America and roughly 500% of GDP. If the government does not directly seize the nation’s private wealth, then it will require $389,610 from each and every citizen to balance the country’s books. State, county and municipal debts and deficits are additional, already elephantine in many states (e.g., California, Illinois, New Jersey and New York) and growing at an alarming rate nationwide. In addition to the federal government, dozens of states are already bankrupt and sinking deeper into the morass every day.

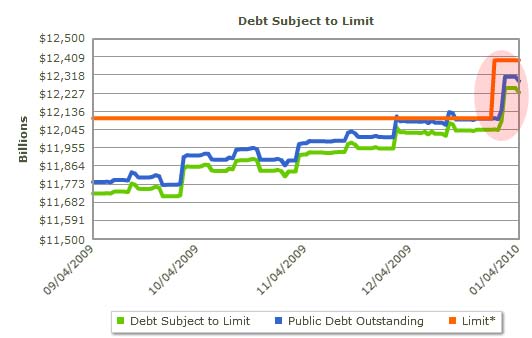

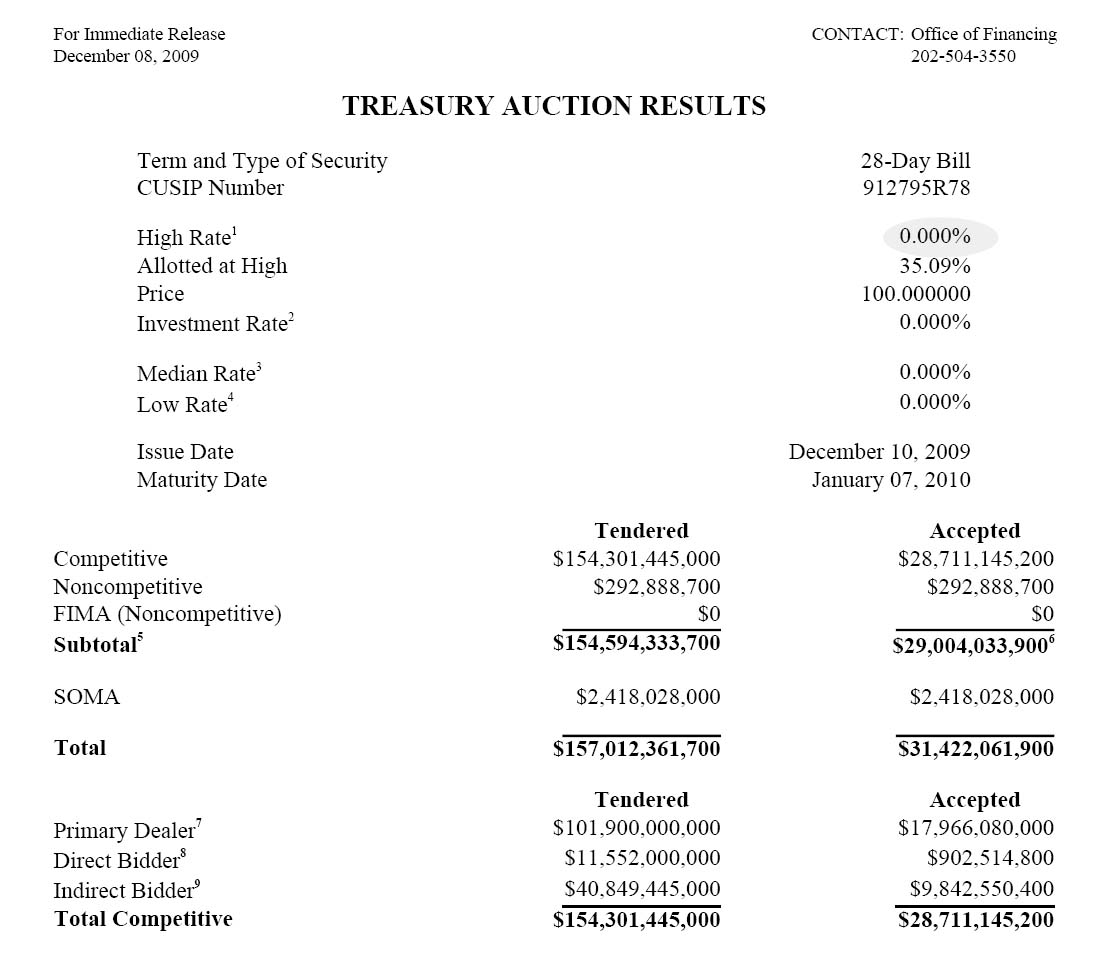

The government continues to dig a deeper and deeper fiscal grave in which to bury its citizens. This year, the federal deficit will total at least $1,600,000,000,000.00 ($1.6 trillion), which represents overspending of $4,383,561,600.00 ($4.38 billion) per day. (The deficit during October and November, 2009, the first two months of Fiscal Year 2010, totaled $296,700,000,000.00 ($297 billion), or $4,863,934,000.00 ($4.9 billion) per day, a record.) Using the GAAP accounting method (which is what corporations are required to use because it presents a far more accurate and honest picture of a company’s finances than the cash accounting method primarily and misleadingly used by the U.S. government), the nation’s fiscal year 2009 deficit was roughly $9,000,000,000,000.00 ($9 trillion), or $24,700,000,000.00 ($24.7 billion) per day, as calculated by brilliant and well-respected economist John Williams. (www.shadowstats.com) Fiscal Year 2010’s cash- and GAAP-accounting deficits will likely be worse than 2009’s, given government bailout and new program spending that is on steroids and psychotic.

Putting Fiscal Year 2009’s $9,000,000,000,000.00 ($9 trillion) deficit another way, 17% of America’s private wealth, accumulated over a period of 235 years, was wiped out by just one year’s worth of government deficit spending insanity.

Given this, is it any surprise that Treasury Secretary Geithner has announced that the release of the nation’s FY 2009 supplemental GAAP financial statements has been delayed? Remember, this is the same Secretary Geithner who bullied people to cover up the sordid details of the AIG, or more accurately, the taxpayer-funded, multi-billion dollar, Santa Claus bailout and bonus bonanza for Goldman Sachs. Do you really think this government, characterized as it is by fiscal and monetary secrecy, lies, chicanery, cronyism and stonewalling, wants the people to know what is actually happening? Obviously, it does not, so it hides from the public the inexcusable facts.

Read moreAmerica’s Impending Master Class Dictatorship!