FYI.

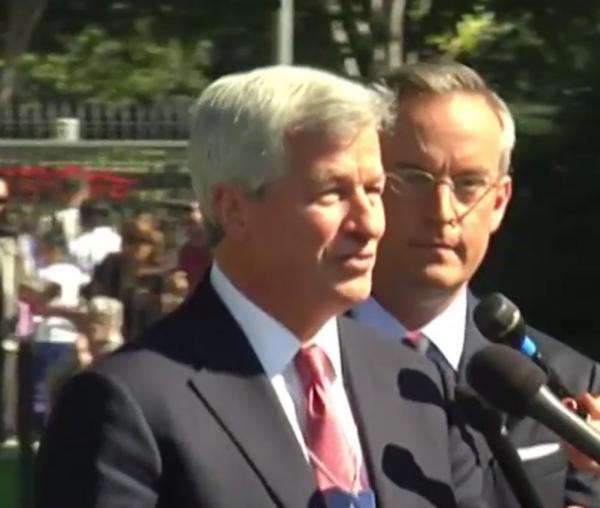

– ‘Im Open’ to Bitcoin: Goldman Sachs CEO Lloyd Blankfein:

Goldman Sachs CEO Lloyd Blankfein is not comfortable with bitcoin, but he says that he understands that it may ultimately prove to be the next step in the evolution of money

The investment banking executive, who last month used a rare tweet to state that he was “thinking about bitcoin” but had not formed a definitive opinion, shared his updated thoughts on cryptocurrency in an interview with Bloomberg held at the investment banking firm’s Sustainable Finance Innovation Forum in New York.

He stated that the thought of bitcoin gave him a “level of discomfort” but conceded that he felt the same level of skepticism when he first encountered the cell phone:

“I have a level discomfort with [bitcoin], as I have a level of discomfort with anything that’s new,” he said. “But I’ve learned over the years that there’s a lot of things that work out pretty well that I don’t love.”

A self-described history buff, Blankfein reflected that the evolution of money has taken paths that many people from earlier eras might not have predicted. “Maybe in the new world, something gets back by consensus. Instead of a government fiat, maybe it’s a consensual arrangement by people that agree that it’s worth something,” he stated.

https://youtu.be/YIMWLOSRZ_A

Consequently, Blankfein does not intend to let his personal discomfort get in the way of a potentially disruptive technology. Perhaps this is why Goldman Sachs is considering launching a bitcoin trading operation at the same time that JPMorgan CEO Jamie Dimon is publicly threatening to fire “stupid” employees who engage in bitcoin trading.

Read more‘Im Open’ to Bitcoin: Goldman Sachs CEO Lloyd Blankfein