– Lieborgate’s Next Casualty: Bob Diamond’s Daughter (ZeroHedge, Aug 6, 2012)

Bob Diamond

Keiser Report: Financial Feeding Frenzy (Video)

YouTube Added: 24.07.2012

JPMorgan Mispriced Hundreds Of Billions In CDS: Is Dimon The Next Diamond?

– Criminal Inquiry Shifts To JPMorgan’s Mispricing Of Hundreds Of Billions In CDS: Is Dimon The Next Diamond? (ZeroHedge, July 16, 2012):

On the last day of May, when we first learned via Bloomberg that there was even the scantest likelihood that JPM may have been massaging its CDS marks within the (London-based of course) CIO organization – the backbone of hundreds of billions in notional exposure, and thus a huge counterfeited benefit to trader bonuses and corporate earnings – we wrote, “The Second Act Of The JPM CIO Fiasco Has Arrived – Mismarking Hundreds Of Billions In Credit Default Swaps“ in which we explained precisely how this activity would and did take place, precisely why other traders caught doing the same are on the verge of being thrown in jail, precisely why everyone else does it, and precisely why the biggest CDS self-reporting and client/banker owned-organization (this is where images of Libor should appear), MarkIt, may well be implicated in everything – very much in the same way that the BBA is the heart of Lie-borgate. Because unlike all other allegations of impropriety, most of which rely on Level 2 and Level 3 assets whose valuations are in the eye of the oh so very sophisticated beholder (in this case JPM) who has complex DCFs and speaks confidently when explaining marks to naive, stupid outsiders (in other words baffles with bullshit), when it comes to one of the last places where Mark to Market is still applicable and used: the OTC CDS market, and where daily P&L records are kept, it will take any regulator, enforcer, or criminal investigator precisely 1 minute to find out if there was fraud, or gambling, going on here.

Then lo and behold, none other than JPM admitted minutes before releasing its Q2 earnings that it had been doing precisely what Zero Hedge accused it of doing nearly 2 months earlier (but of course Jamie Dimon had no idea, no idea, what the media accused his firm of doing), and in doing so exposed itself to just as much litigation risk as Barclays in the Lie-borgate scandal, while further throwing a monkey wrench into the CDS market, where all the other banks (who had been doing just the same), will no longer be able to pick off the bid/ask spread in the process crushing CDS trader bonuses, and resulting in billions in foregone imaginary profits.

Most importantly, it opened up the firm to a criminal investigation. Which as Reuters reports, is precisely what has now happened.

From Reuters’ Matt Goldstein and Jennifer Ablan:

Read moreJPMorgan Mispriced Hundreds Of Billions In CDS: Is Dimon The Next Diamond?

How JPMorgan Made The Lehman Bankruptcy A Certainty

– CONFIRMED AT LAST: The attempted cover-up of how JP Morgan torpedoed Lehman Brothers (The Slog, July 15, 2012):

As an early propagator of the allegation that JP Morgan Chase deliberately hastened the Lehman collapse, the Slog finds itself vindicated three years on by a successful regulator action against JPM, and contemporary documentation.

“And then when you have the suckers by the balls, you squeeze just like this”

Around the time of the Lehman disaster, a senior insider at the firm relayed to me what seemed an astonishing allegation: that in the weeks prior to the eventual collapse, JP Morgan deliberately withheld huge monies owed to Lehman in order to make the bankruptcy a certainty from which they could benefit. I relayed this story to another contact the following year, and he not only corroborated the charge, he also said he was sure Barclays had done the same. The now disgraced Barclays CEO Bob Diamond took over Lehman in a fire sale only weeks later (using taxpayers’ money as a bridging loan to do it) and rapidly built up a commanding position for the division he then headed up, Barcap – the investment arm of the bank.

Now, more than three years later, regulators have penalised JPMorgan for actions tied to Lehman’s demise. The bank settled the Lehman matter and agreed to pay a fine of approximately $20 million. The action took place because of Morgan’s ‘questionable treatment of [Lehman] customer money’: regulators accused JPMorgan of withholding Lehman customer funds for nearly two weeks. So it had been true after all.

Jamie Dimon’s Morgan Chase dodged and dived on this one for three years in an attempt to smooth over the tracks. As late as April this year, the Pirate insisted that the ‘monies involved were small’: but that doesn’t tally with this Wall Street Journal snippet from the time as follows:

‘Lehman Brothers Holdings Inc., the securities firm that filed the biggest bankruptcy in history yesterday, was advanced $138 billion this week by JPMorgan Chase & Co. to settle Lehman trades and keep financial markets stable, according to a court filing.’

Advancing cash to keep the markets stable is simply double-talk bollocks: many observers are sure this was the Lehman trades money withheld by JPM. The Lehman administrators continued to air their grievances about it, and in late May 2010 the bankruptcy estate of Lehman Brothers Holdings, Inc. filed suit against JPMorgan Chase, alleging that JPMorgan’s actions in the weeks preceding bankruptcy were wrongful. The claims arose from amendments and supplements to the Clearance Agreement between Lehman and JPMorgan in the weeks immediately preceding the bankruptcy. (In a nutshell, JPM changed the terms without notice to include onerous requirements for massive collateral against giving Lehman its own money back – a form of crooked logic that only a banker could construct. The weight of this collateral requirement on already serious debts took Lehman Brothers from intensive care to the Pearly Gates).

Read moreHow JPMorgan Made The Lehman Bankruptcy A Certainty

Federal Reserve Admits It Knew Of Barclays Libor ‘Problems’ In 2007 And 2008

From the article:

Via Reuters:

According to the calendar of then New York Fed President, Timothy Geithner, who is now U.S. Treasury Secretary, it even held a “Fixing LIBOR” meeting between 2:30-3:00 pm on April 28, 2008. At least eight senior Fed staffers were invited.

It is unclear precisely what was discussed at this meeting or who attended. Among those invited, along with Geithner, was William Dudley, who was then head of the Markets Group at the New York Fed and who succeeded Geithner as its president in January 2009. Also invited was James McAndrews, a Fed economist who published a report three months later that questioned whether Libor was manipulated.

– Federal Reserve Admits It Knew Of Barclays Libor “Problems” In 2007 And 2008 (ZeroHedge, July 10, 2012):

Last Tuesday we suggested that “Now The Fed Gets Dragged Into LiEborgate“ when we observed that “Barclays also cited subsequent research by the New York Federal Reserve staff members that, according to the lender, concluded that banks’ Libor quotes were systematically below their borrowing rates by 39 basis points after the Lehman bankruptcy. “Barclays own submissions for tenors of 1 month to 1 year Libor were higher than actual Barclays trades on 97% of the occasions when Barclays had actual trades during the financial crisis,” the lender said.” It seems that unlike the BOE, which had no idea of any Barclays problems and was merely calling up Diamond now and then to make sure the bank’s money market risk mechanisms were operational and to chit chat about the weather (as per the BOE at least), the Fed has decided to take the high road and openly admit it was well aware of Barclays’ LIBOR “problems.” And like that the Senatorial circus just got exciting, while that popping noise is bottles of Bollinger going off at every class action lawsuit legal firm.

From Bloomberg:

The Federal Reserve Bank of New York was aware of potential issues involving Barclays Plc and the London interbank offered rate after the financial crisis began in 2007, according to a statement from the district bank.

“In the context of our market monitoring following the onset of the financial crisis in late 2007, involving thousands of calls and e-mails with market participants over a period of many months, we received occasional anecdotal reports from Barclays of problems with Libor,” New York Fed spokeswoman Andrea Priest said in an e-mailed statement.

“In the spring of 2008, following the failure of Bear Stearns and shortly before the first media report on the subject, we made further inquiry of Barclays as to how Libor submissions were being conducted,” the statement said. “We subsequently shared our analysis and suggestions for reform of Libor with the relevant authorities in the U.K.”

Read moreFederal Reserve Admits It Knew Of Barclays Libor ‘Problems’ In 2007 And 2008

The Wrecking Of Barclays Is Organised Looting By Those At The Very Top (Guardian)

Barclays’ top 238 employees took a total of £1.01bn home last year – or £4.27m each. Photograph: Nadia Isakova/Alamy

– The wrecking of Barclays is organised looting by those at the very top (Guardian, July 9, 2012):

You’d have learned precious little from watching Bob Diamond in parliament last week – apart, that is, from his love for his former employer. If pressed, you or I might admit to tolerating our jobs, to getting on with colleagues or, at the very least, to taking full advantage of the company stationery supplies. For the multimillionaire banker, however, this would be mere watery equivocation. The firm that had forced him out just the day before was “an amazing place”, packed with “wonderful people”. And, he told MPs over and over: “I love Barclays.”

Read moreThe Wrecking Of Barclays Is Organised Looting By Those At The Very Top (Guardian)

LIBOR Scandal: The Crime Of The Century? (TIME)

– ??LIBOR Scandal: The Crime of the Century? (TIME, July 9, 2012):

The latest interest-rate-fixing LIBOR scandal is being heralded as the most egregious in a generation

The 21st has been a banner century for financial and accounting scandals. Enron, the dotcom bust, the subprime-mortgage crisis and the bank bailouts have all contributed to the very low esteem in which the American public holds Corporate America in general, and high finance in particular. So it is no small feat that the latest interest-rate-fixing LIBOR scandal is being heralded as the most egregious in a generation or, as Robert Scheer put it in the Nation, “the crime of the century.”

LIBOR is an acronym for the London interbank offered rate, and it is the average interest rate the world’s largest banks pay when they borrow money. And this figure (or figures, as different LIBORs are calculated for different loan maturities and currencies) is used to price hundreds of trillions of dollars worth of financial instruments, from high-yield corporate debt to student loans.

Considering the importance of this benchmark rate and the financial industry’s recent track record, it is no wonder that many in the press are up in arms about Barclays’ recent admission that it intentionally submitted false rates in order to manipulate LIBOR for its own gain. Barclays has been fined more than $450 million by British and American regulators, but it is by no means the only bank thought to have deceptively tried to influence LIBOR — thus the outrage expressed this past week in the media.

Scheer, for instance, pulled no punches in his polemic:

“Modern international bankers form a class of thieves the likes of which the world has never before seen. Or, indeed, imagined … It reveals that behind the world’s financial edifice lies a reeking cesspool of unprecedented corruption. The modern-day robber barons pillage with a destructive abandon totally unfettered by law or conscience and on a scale that is almost impossible to comprehend.”

Barclays: ‘The Bank Of England Told Us To Do It’ (Telegraph)

– The Bank of England told us to do it, claims Barclays (Telegraph, July 3, 2012):

The Deputy Governor of the Bank of England encouraged Barclays to try to lower interest rates after coming under pressure from senior members of the last Labour government, documents have disclosed.

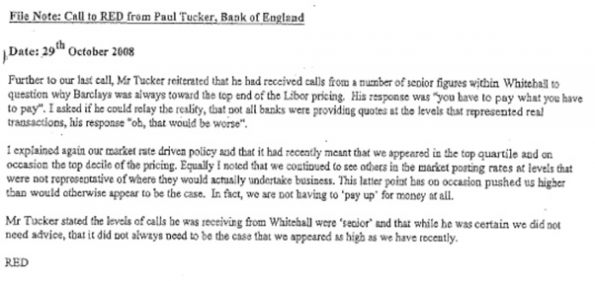

A memo published by Barclays suggested that Paul Tucker gave a hint to Bob Diamond, the bank’s chief executive, in 2008 that the rate it was claiming to be paying to borrow money from other banks could be lowered.

His suggestion followed questions from “senior figures within Whitehall” about why Barclays was having to pay so much interest on its borrowings, the memo states.

Barclays and other banks have been accused of artificially manipulating the Libor rate, which is used to set the borrowing costs for millions of consumers, businesses and investors, by falsely stating how much they were paying to borrow money.

The bank claimed yesterday that one of its most senior executives cut the Libor rate only at the height of the credit crisis after intervention from the Bank of England.

Read moreBarclays: ‘The Bank Of England Told Us To Do It’ (Telegraph)

Matt Taibbi: LIBOR Banking Scandal Deepens; Barclays Releases Damning Email, Implicates British Government (Rolling Stone)

– LIBOR Banking Scandal Deepens; Barclays Releases Damning Email, Implicates British Government (Rolling Stone, July 4, 2012):

This Libor-manipulation story grows crazier with each passing minute. We have officially disappeared now down the rabbit-hole of the international financial oligarchy.

Former Barclays CEO Bob Diamond is testifying before parliament in London today, and that’s sure to bring some shocking moments. But there’s already been one huge stunner. In advance of that testimony, Barclays released an email from October 29, 2008, written by Diamond to then-Chairman John Varley and COO Jerry del Messier (who also stepped down yesterday). The email from the CEO to the other two senior Barclays execs purports to detail the content of the conversation Diamond had with Bank of England deputy governor Paul Tucker that same day.

In the email, Diamond essentially tells the other two execs that he has been given permission by Tucker – encouraged, actually – to rig Libor rates downward. What’s even worse is that Diamond’s email suggests that Tucker was only following orders, i.e. that Tucker had received phone calls from “a number of senior figures within Whitehall” – that is, the British government – expressing concern about Barclays’ high Libor rates. Tucker in this version of events was acting as a middleman for the British government, telling Diamond to fake his borrowing rates in order to preserve the appearance of financial stability, for the good of Queen and country as it were.

Again: Libor, the London Interbank Exchange Rate, is the rate at which banks borrow from each other. A huge percentage of the world’s variable-rate investments are pegged to Libor. When Libor rates are high, it suggests that the banks’ confidence in each other is low, and high Libor rates are generally an indicator of shaky financial health among the banks. If the banks manipulated Libor, they did it to make themselves look healthier, but this had the consequence of affecting hundreds of trillions of dollars’ worth of financial products worldwide.

Matt Taibbi: Why Is Nobody Freaking Out About The LIBOR Banking Scandal? (Rolling Stone)

– Why is Nobody Freaking Out About the LIBOR Banking Scandal? (Rolling Stone, July 3, 2012):

The LIBOR manipulation story has exploded into a major scandal overseas. The CEO of Barclays, Bob Diamond, has resigned in disgrace; his was the first of what will undoubtedly be many major banks to walk the regulatory plank for fixing the interbank exchange rate. The Labor party is demanding a sweeping criminal investigation. Mervyn King, Governor of the Bank of England, responded the way a real public official should (i.e. not like Ben Bernanke), blasting the banks:

It is time to do something about the banking system…Many people in the banking industry are hardworking and feel badly let down by some of their colleagues and leaders. It goes to the culture and the structure of banks: the excessive compensation, the shoddy treatment of customers, the deceitful manipulation of a key interest rate, and today, news of yet another mis-selling scandal.

The furor is over revelations that Barclays, the Royal Bank of Scotland, and other banks were monkeying with at least $10 trillion in loans (The Wall Street Journal is calculating that that LIBOR affects $800 trillion worth of contracts).

Read moreMatt Taibbi: Why Is Nobody Freaking Out About The LIBOR Banking Scandal? (Rolling Stone)

Barclays Bankster Boss Bob Diamond Got £6.5 Million Bonus, Jerry del Missier Received £33 Million In Shares

• BarCap co-chief Jerry del Missier accrues £33m shares

• Bob Diamond awarded £6.5m bonus

• One banker received £10.9m in pay and bonuses

• Project Merlin means high-paid traders can stay anonymous

Barclays boss Bob Diamond Photograph: Stefan Wermuth/REUTERS

Barclays stoked the row over City pay on Monday by revealing that one of its key bankers – Jerry del Missier – received shares worth almost £33m earlier this month.

The bank reported that 231 of its key staff were paid a combined £554m in 2010 – an average of £2.4m each.

Bob Diamond, the chief executive, has been awarded a £6.5m bonus. But Diamond’s total pay structure is more complex than that, and what he takes home each year is based on performance in prior years. The remuneration report shows that he was also awarded £2.25m in a long-term incentive plan deal that could pay out in three years time and that £7m of shares were realised to him from deals going back to 2007, although the bank insisted these had been reported last year. A separate announcement showed that he also received £14m through cashing in share performance deals that were granted to him in previous years.

The announcement to the stock market showed that del Missier, co-chief executive of the Barclays Capital investment banking arm and a close lieutenant of Diamond, had shares worth almost £33m that were accrued from deals handed to him over the previous five years.