Flashback:

– Dubai and Abu Dhabi stock exchanges post record one-day falls (Telegraph, Nov 30, 2009)

Dubai’s index sank 7.3pc, its biggest one-day fall since October last year. Abu Dhabi’s Securities Exchange endured the largest one-day loss in its history as it ended the session down 8.3pc.

Only this time everything will be much, much worse.

Prepare for collapse.

– Ripple Effects Begin: Dubai Crashes Over 6.5%, Most In 14 Months (ZeroHedge, Oct 12, 2014):

It appears the weakness in US equity markets (the last of the hot money flow darlings to be hit) is now rippling back down the bubble-complex of world equity markets. Dubai, infamous for its huge surge in the last 2 years and 36x over-subscribed IPO of a company with no actual operations – which marked the top before a 30% collapse – was open for business today and crashed 6.5%. This the Dubai Financial Markets General Index biggest daily drop in 14 months… the ripple effect is beginning.

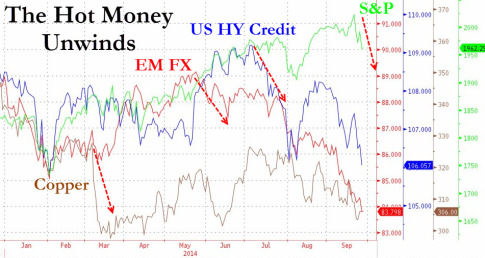

It appears the hot money trades are slowly being unwound… commodities, EM FX, HY credit, and now US equities…

And are now blowing-back to the rest of the world’s most bubblicious markets…

Charts: Bloomberg