– Greece “Scrambles”To Make Full Monthly Pension Payments: “Still Missing Several Hundred Million Euros” (ZeroHedge, April 30, 2015):

To be sure, Greece has been “running out of money” for quite some time. Given the incessant media coverage surrounding the country’s cash shortage and the fact that Athens somehow seems to scrape together the funds to make payments both to lenders and to public sector employees against impossible odds, it’s tempting to think that as dire as the situation most certainly is, the country might still be able to ride out the storm without suffering a major “accident.” Having said that, some rather alarming events have unfolded over the past week or so, including a government decree mandating the transfer of excess cash reserves from municipalities to the central bank. As it turns out, that didn’t go over well with local officials and as we reported on Tuesday, the government finally hit the brick wall, coming up some €400 million short on payments to pensioners.

Here’s what we said then:

According to Bloomberg, the Greek government is €400 million short of the amount needed for payment of pensions and salaries this month, citing a Kathimerini report.

Surprisingly, this takes place even as Greece’s IKA, OGA pension funds have been informed by the government that amount needed for payment of pensions will be deposited today, while the Greece’s OAEE pension fund has said payment of pensions won’t be a problem.

In other words, someone is not telling the truth: either there is enough money or there isn’t. And if the latter case is valid, then either the government or the pensions are now openly lying to the population.

Fast forward to Thursday and we learn that sure enough, the government ran out of money earlier this week. Here’s FT:

The Greek government was struggling on Thursday to complete payments to more than 2m pensioners after claiming that a “technical hitch” delayed an earlier disbursement.

Elderly Athenians waited at branches of the National Bank of Greece, the state-controlled lender handling the bulk of pension payments, which are staggered over several days.

On Tuesday, the main state social security fund, IKA, delayed pension payments by almost eight hours. The heavily lossmaking fund relies on a monthly subsidy from the budget to be able to cover its obligations.

“I went to the ATM in the morning before going to the supermarket but the money wasn’t there?. ?.?.?I went back at eight in the evening feeling quite anxious but it had arrived,” said Socrates Kambitoglou, a retired civil engineer.

Dimitris Stratoulis, deputy minister for social security, said a technical problem with the interbank payment system caused the delay. Payments were made normally on Wednesday, a senior Greek banker said.

But an official with knowledge of the government’s cash position denied that a technical hitch had occurred. He said the payments were held up because the state pension funds “were still missing several hundred million euros on Tuesday morning”.

Another official said inflows of €500m on Wednesday had eased the situation and €300m was due to be paid on Thursday. “We’re probably going to make it this month,” he said.

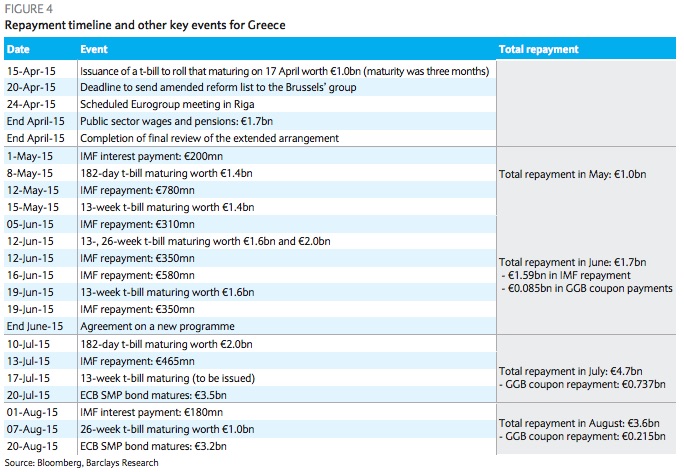

Yes, “probably,” considering Thursday is the last day of the month, but what about next month, when some €1 billion in total comes due to the IMF? No one really knows. What we do know is that the banking sector has lost €27 billion in deposits since December, local governments are being shaken down for every last euro, depositors holding cash abroad are being begged to bring their cash back to Greece, and now, pensioners are walking away from ATMs empty handed while Athens furiously scrambles to find cash to pay them.

The thing the Greeks need to watch out for is the privatization of their public ports. If the greedy guts get away with that maneuver, Greece will be thrown to the wolves. The ports are valuable, especially to the Russian economy…..and they will throw enough money at their problem to wrest control of them.

Greece needs to hold on, refuse to sell off national assets, and likely leave the Euro.

Just totaling only what funds are due the IMF between now and the middle of August, we are looking at a total exceeding 3 billion, 215 million………..

How can they meet it?

They need to leave the Euro and tell the bankers to go to hell.

A great article summing up the Greece problem…….from Bloomberg.

http://www.bloomberg.com/news/articles/2015-05-01/greek-default-for-dummies-your-questions-answered-on-creditors

The cashless society…..

http://www.gold-eagle.com/article/end-cash?utm_source=Gold+Eagle+Email+Newsletter&utm_campaign=455d99e9ab-RSS_THU&utm_medium=email&utm_term=0_654d25a6f9-455d99e9ab-116249365

Dear Marilyn, most Ports are already owned by Global Corporations, worldwide.

In UK, Associated British Ports, is already a private limited company.

http://www.bizdb.co.uk/company/abp-acquisitions-uk-limited-05839361/

It looks like the Chinks have already got their feet under the table…

http://www.wsj.com/articles/chinese-transform-greek-port-winning-over-critics-1416516560

AGENDA 21…..let’s encourage the little idiots to ask to be sprayed with poison so they think they’re saving the planet…..bloody genius.

http://stateofthenation2012.com/?p=13541