YouTube Added: 02.01.2013

Fiscal Cliff

‘Fiscal Cliff’ Deal To Add Nearly $4 Trillion To Federal Deficits Over A Decade

– Analysis: “Fiscal cliff” deal called a dud on deficit front (Reuters, Jan 1, 2013):

WASHINGTON – In the controversy surrounding the “fiscal cliff” issue, it’s easy to forget that the origin of the entire debate was a professed desire to reduce swollen federal deficits.

Whether the target was $4 trillion over 10 years, as proposed by the Bowles-Simpson deficit reduction commission, or in the $2 trillion range, as tossed around by House of Representatives Speaker John Boehner and President Barack Obama, the idea was to rein in total debt that now tops $16 trillion.

By those standards, the bill passed by the U.S. Senate early on New Year’s Day to avoid the cliff’s automatic steep tax hikes and across-the-board spending cuts, looks paltry indeed.

The legislation, which as of Tuesday evening had yet to be passed by the House, would add nearly $4 trillion to federal deficits over a decade compared to the debt reduction envisioned in the extreme scenario of the cliff, according to the non-partisan Congressional Budget Office.

Read more‘Fiscal Cliff’ Deal To Add Nearly $4 Trillion To Federal Deficits Over A Decade

Moody’s Warns On USAAA Rating

– Moody’s Warns On USAAA Rating; IMF Piles On (ZeroHedge, Jan 2, 2012):

Moody’s has stepped forward with the first warning shot across the bow that:

- *MOODY’S: MORE MEDIUM TERM ACTIONS MAY BE NEEDED TO SUPPORT Aaa

Has contradicted itself (from September) on the debt-ceiling breach; and warns that while the deal ‘mitigates’ some fiscal drag, it does not remove it. To wit: the IMF piles on:

- *IMF SAYS `MORE REMAINS TO BE DONE’ ON U.S. PUBLIC FINANCES

- *IMF SAYS U.S. DEBT CEILING SHOULD BE RAISED `EXPEDITIOUSLY’

Full statements below.

The ‘Fiscal Cliff’ Deadline Has Passed

See also:

– The “fiscal cliff” deadline has passed (AP, Jan 1, 2013):

WASHINGTON – The “fiscal cliff” deadline has passed – technically, at least.

The beginning of the New Year in theory means across-the-board tax increases and spending cuts kick in, but Congress is working to cancel them before they can have an impact.

Happy New Year Middle Class: The Fiscal Cliff Is Going To Rip You To Shreds

– Happy New Year Middle Class: The Fiscal Cliff Is Going To Rip You To Shreds (Economic Collapse, Dec 30, 2012):

The middle class has quite a gift welcoming them as the calendar flips over to 2013. Their payroll taxes are going to go up, their income taxes are going to go up, and approximately 28 million households are going to be hit with a huge, unexpected AMT tax bill on their 2012 earnings. So happy New Year middle class! You are about to be ripped to shreds. In addition to the tax increases that I just mentioned, approximately two million unemployed Americans will instantly lose their extended unemployment benefits when 2013 begins, and new Obamacare tax hikes which will cost American taxpayers about a trillion dollars over the next decade will start to go into effect. If Congress is not able to come to some sort of a deal, all middle class families in America will be sending thousands more dollars to Uncle Sam next year than they were previously. And considering the fact that the middle class is already steadily shrinking and that the U.S. economy is already in an advanced state of decline, that is not good news. You would think that both major political parties would want to do something to keep the middle class from being hit with this kind of tax sledgehammer. Unfortunately, at this point it appears that our “leaders” in Washington D.C. are incapable of getting anything done. So get ready for much smaller paychecks and much larger tax bills. What is coming is not going to be pleasant.

So what happened?

Read moreHappy New Year Middle Class: The Fiscal Cliff Is Going To Rip You To Shreds

Fiscal Cliff: By The Numbers (ABC News Video)

YouTube Added: 29.12.2012

A look at what will happen to your taxes if the Congress doesn’t come to an agreement.

Lou Dobbs: Our Fiscal Future (FOX News Video)

YouTube Added: 27.12.2012

How The Fiscal Cliff Talks Collapsed

Related info:

– Ellen Brown: Fiscal Cliff: Let’s Call Their Bluff

Dr. Paul Craig Roberts:

– The Fiscal Cliff Is A Diversion: The Derivatives Tsunami And The Dollar Bubble

– How The Fiscal Cliff Talks Collapsed (ZeroHedge, Dec 23, 2012):

The collapse of the Fiscal Cliff talks should come as no surprise to anyone (except, of course, for all those “expert” political commentators virtually all of whom saw a deal by December 31: a full list of names is forthcoming). The reason: a simple one – a House torn, polarized to a record extreme, and a political environment in which the two parties, in the aftermath of a presidential election humiliating to the GOP, reached unseen before antagonism toward each other. In this context, it was absolutely inevitable that America would see a replica of last summer’s debt ceiling collapse, which mandated a market intervention, in the form of a crash, and the wipeout of hundreds of billions in wealth – sadly the only catalyst that both parties and their electorate, understand. We had prefaced this explicitly in early November when we said that “the lame duck congress will posture, prance and pout. And it is a certainty that in the [time] remaining it will get nothing done. Which means, that once again, it will be up to the market, just like last August, just like October of 2008, to implode and to shock Congress into awakening and coming up with a compromise of sorts.” Which of course brought us to Thursday night’s mini-TARP moment.

If you missed Thursday’s ES flash crash, fear not: there will be more “TARP moments” as first the Fed is brought into action (as we reminded yesterday), and then, as the final deadline – that of the expiration of various debt ceiling extension gimmicks which takes place in March, and which is the real deadline for a deal. Nonetheless, there are those forensic detectives who are addicted to every single political twist and turn, and who are curious just where and when the Fiscal Cliff talks broke down in the past week. In this regard, the WSJ provides a useful timeline.

From the WSJ:

Mr. Obama repeatedly lost patience with the speaker as negotiations faltered. In an Oval Office meeting last week, he told Mr. Boehner that if the sides didn’t reach agreement, he would use his inaugural address and his State of the Union speech to tell the country the Republicans were at fault.

At one point, according to notes taken by a participant, Mr. Boehner told the president, “I put $800 billion [in tax revenue] on the table. What do I get for that?”

“You get nothing,” the president said. “I get that for free.”

Well, you can’t fault the man at not demonstrating “leadership” at crucial junctions: after all it’s only fair he gets something for free.

Ellen Brown: Fiscal Cliff: Let’s Call Their Bluff

FYI.

Dr. Paul Craig Roberts:

– The Fiscal Cliff Is A Diversion: The Derivatives Tsunami And The Dollar Bubble

And why do we hear very little about this?

– BREAKING NEWS: NDAA Indefinite Detention Provision Mysteriously Stripped From Bill

– Fiscal Cliff: Let’s Call Their Bluff (Web of Debt, Dec 19, 2012):

The “fiscal cliff” has all the earmarks of a false flag operation, full of sound and fury, intended to extort concessions from opponents. Neil Irwin of the Washington Post calls it “a self-induced austerity crisis.” David Weidner in the Wall Street Journal calls it simply theater, designed to pressure politicians into a budget deal:

The cliff is really just a trumped-up annual budget discussion. . . . The most likely outcome is a combination of tax increases, spending cuts and kicking the can down the road.

Yet the media coverage has been “panic-inducing, falling somewhere between that given to an approaching hurricane and an alien invasion.” In the summer of 2011, this sort of media hype succeeded in causing the Dow Jones Industrial Average to plunge nearly 2000 points. But this time the market is generally ignoring the cliff, either confident a deal will be reached or not caring.

The Fiscal Cliff Is A Diversion: The Derivatives Tsunami And The Dollar Bubble

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

– The Fiscal Cliff Is A Diversion: The Derivatives Tsunami and the Dollar Bubble (Paul Craig Roberts, Dec 17, 2012):

The “fiscal cliff” is another hoax designed to shift the attention of policymakers, the media, and the attentive public, if any, from huge problems to small ones.

The fiscal cliff is automatic spending cuts and tax increases in order to reduce the deficit by an insignificant amount over ten years if Congress takes no action itself to cut spending and to raise taxes. In other words, the “fiscal cliff” is going to happen either way.

The problem from the standpoint of conventional economics with the fiscal cliff is that it amounts to a double-barrel dose of austerity delivered to a faltering and recessionary economy. Ever since John Maynard Keynes, most economists have understood that austerity is not the answer to recession or depression.

Regardless, the fiscal cliff is about small numbers compared to the Derivatives Tsunami or to bond market and dollar market bubbles.

Read moreThe Fiscal Cliff Is A Diversion: The Derivatives Tsunami And The Dollar Bubble

House Republicans Propose $2.2 Trillion Fiscal-Cliff Plan

FYI.

– House Republicans Propose $2.2 Trillion Fiscal-Cliff Plan (Bloomberg, Nov 3, 2012):

House Republicans, rejecting President Barack Obama’s demand for higher tax rates, countered with a $2.2 trillion deficit-cutting plan that would trim Medicare and Social Security and cap tax deductions for top earners.The proposal, in a letter today to Obama from House Speaker John Boehner and other Republican leaders, seeks $800 billion in tax revenue in the next decade and would slow the growth in Social Security cost-of-living payments. It would reduce entitlement program costs by at least $900 billion, including raising the Medicare eligibility age, and cut $300 billion in discretionary spending.

Read moreHouse Republicans Propose $2.2 Trillion Fiscal-Cliff Plan

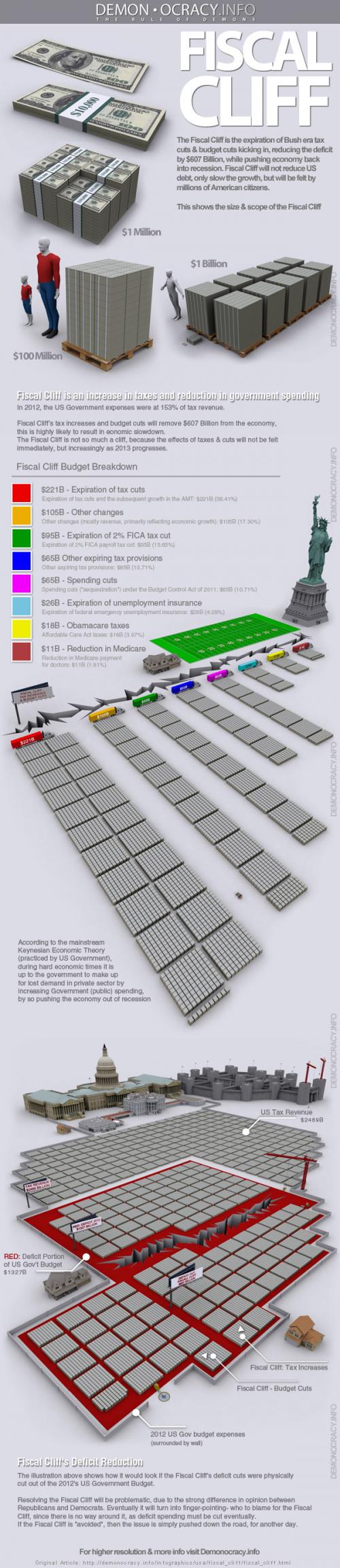

US: The Ultimate Fiscal Cliff Cheat Sheet Infographic

– The Ultimate Fiscal Cliff Cheat Sheet Infographic (ZeroHedge, Nov 30, 2012):

The Fiscal Cliff is the name given for the 2013 increase of Federal Government taxes and budget cuts. The Bush-era tax cuts expire and the 2013 “Budget Control Act” kicks in, among other budget cuts & new taxes. The Fiscal Cliff is set to reduce the 2013 US Government budget deficit by roughly half; will remove $607 Billion from economy (GDP), resulting in 4% drop, pushing it back into recession; it can NOT be avoided. It must happen to fix the budget deficit; any delay must be paid for later; it will NOT reduce the US debt, only slow down the growth. The Fiscal Cliff’s (new taxes and budget cuts) size and impact are visualized below in physical $100 bills.

Morgan Stanley’s Doom Scenario: Major Recession In 2013 (CNBC)

Preparing you for the ‘Greatest Depression’.

– Morgan Stanley’s Doom Scenario: Major Recession in 2013 (CNBC, Nov 20, 2012):

The global economy is likely to be stuck in the “twilight zone” of sluggish growth in 2013, Morgan Stanley has warned, but if policymakers fail to act, it could get a lot worse.

The bank’s economics team forecasts a full-blown recession next year, under a pessimistic scenario, with global gross domestic product (GDP) likely to plunge 2 percent.“More than ever, the economic outlook hinges upon the actions taken or not taken by governments and central banks,” Morgan Stanley said in a report.

Under the bank’s more gloomy scenario, the U.S. would go over the “fiscal cliff” leading to a contraction in U.S. GDP for the first three quarters of 2013. In Europe, the bank’s pessimistic scenario assumes a failure of the European Central Bank (ECB) in cutting rates and a delay of its bond-buying program.

Read moreMorgan Stanley’s Doom Scenario: Major Recession In 2013 (CNBC)

Will The Wealthy Race To Dump Stocks And Other Financial Assets Before The Fiscal Cliff Kicks In?

From the article (Famous investor Marc Faber):

In fact, Faber is absolutely convinced that a full-blown stock market crash is coming no matter what happens with the fiscal cliff…

“I think the whole global financial system will have to be reset and it won’t be reset by central bankers but by imploding markets — either the currency [markets, debt market or stock markets,” he said. “It will happen — it will happen one day and then we’ll be lucky if we still have 50 percent of the asset values that we have today.”

Don’t miss:

– MUST-SEE: The Eight Scariest Charts For Equity Bulls

– A 21% Chance Of A 50% Plunge In The S&P 500?

– Stock Market Fragility Fast Approaching ‘Flash Crash’ Levels

– Will The Wealthy Race To Dump Stocks And Other Financial Assets Before The Fiscal Cliff Kicks In? (Economic Collapse Nov 13, 2012):

The election results made it abundantly clear that taxes are going to be going up, and right now a lot of wealthy people all over America are trying to figure out how to best position themselves for the hit that is coming. There are a whole host of tax cuts that are set to expire on December 31st, and many analysts are now speculating that we could see a race to dump stocks and other financial assets before 2013 in order to get better tax treatment on those sales. Of course it is still possible that Congress may reach a bargain which would avoid these tax increases, but with each passing day that appears to be increasingly unlikely – especially regarding the tax increases on the wealthy. Whatever you may believe about this politically, the truth is that we should all be able to agree that these looming tax increases provide an incentive for wealthy people to sell off financial assets now rather than later. After all, there are very few people out there that would actually prefer to pay higher taxes on purpose. If the race to dump financial assets becomes a landslide, could this push stocks down significantly late in the year? Already there are all sorts of technical signs that indicate that stocks are ready for a “correction” at the very least. For example, the S&P 500 has already closed below its 200 day moving average for several days in a row. Could the “sell off” that has already begun become a race for the exits?

Rep. Ron Paul’s Farewell To Congress (Video)

A MUST-SEE!!!

“My goals in 1976 were the same as they are today: Promote peace and prosperity by a strict adherence to the principles of individual liberty.”

…”economic ignorance is common place, as the failed policies of Keynesianism are continually promoted”…

… “psychopathic totalitarians endorse government initiatives to change our world” …

Forward to 2:08:40:

Obama To Demand $1.6 Trillion In Tax Hikes Over Ten Years, Double Previously Expected

We told you so:

“Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers.”

– Ron Paul“When a country embarks on deficit financing and inflationism you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul“Believe me, the next step is a currency crisis because there will be a rejection of the dollar, the rejection of the dollar is a big, big event, and then your personal liberties are going to be severely threatened.”

– Ron Paul

(And NO, I do not think that elite puppet Romney would have been a better choice than elite puppet Obama.)

– Obama To Demand $1.6 Trillion In Tax Hikes Over Ten Years, Double Previously Expected (ZeroHedge, Nov 13, 2012):

If the Fiscal Cliff negotiations are supposed to result in a bipartisan compromise, it is safe that the initial shots fired so far are about as extreme as can possibly be. As per our previous assessment of the status quo, with the GOP firmly against any tax hike, many were expecting the first olive branch to come from the generous victor – Barack Obama. Yet on the contrary, the WSJ reports, Obama’s gambit will be to ask for double what the preliminary negotiations from the “debt deficit” summer of 2011 indicated would be the Democrats demand for tax revenue increase. To wit: “President Barack Obama will begin budget negotiations with congressional leaders Friday by calling for $1.6 trillion in additional tax revenue over the next decade, far more than Republicans are likely to accept and double the $800 billion discussed in talks with GOP leaders during the summer of 2011. Mr. Obama, in a meeting Tuesday with union leaders and other liberal activists, also pledged to hang tough in seeking tax increases on wealthy Americans.” Granted, there was a tiny conciliation loophole still open, after he made no specific commitment to leave unscathed domestic programs such as Medicare, yet this is one program that the GOP will likely not find much solace in cutting. In other words, all the preliminary talk of one party being open to this or that, was, naturally, just that, with a whole lot of theatrics, politics and teleprompting thrown into the mix. The one hope is that the initial demands are so ludicrous on both sides, that some leeway may be seen as a victory by a given party’s constituents. Yet that is unlikely: as we have noted on many occasions in the past, any compromise will result in swift condemnation in a congress that has never been as more polarized in history.

From the WSJ:

Kevin Smith, a spokesman for House Speaker John Boehner (R., Ohio), dismissed the president’s opening position for the negotiations. He said Mr. Boehner’s proposal to revamp the tax code and entitlement programs is “consistent with the president’s call for a ‘balanced’ approach.”

Read moreObama To Demand $1.6 Trillion In Tax Hikes Over Ten Years, Double Previously Expected

PIMCO’s Bill Gross: US Fiscal Cliff Deeper Than Advertised. Its A Grand Canyon.

– Deep Sunday Morning Thoughts From Bill Gross (ZeroHedge, Nov 11, 2012):

Just because Jack Handey never got to manage $1+ trillion in debt…

Read morePIMCO’s Bill Gross: US Fiscal Cliff Deeper Than Advertised. Its A Grand Canyon.

The Fiscal Cliff

– THe FiSCaL CLiFF… (ZeroHedge, Nov 9, 2012):