We told you so:

“Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers.”

– Ron Paul“When a country embarks on deficit financing and inflationism you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul“Believe me, the next step is a currency crisis because there will be a rejection of the dollar, the rejection of the dollar is a big, big event, and then your personal liberties are going to be severely threatened.”

– Ron Paul

(And NO, I do not think that elite puppet Romney would have been a better choice than elite puppet Obama.)

– Obama To Demand $1.6 Trillion In Tax Hikes Over Ten Years, Double Previously Expected (ZeroHedge, Nov 13, 2012):

If the Fiscal Cliff negotiations are supposed to result in a bipartisan compromise, it is safe that the initial shots fired so far are about as extreme as can possibly be. As per our previous assessment of the status quo, with the GOP firmly against any tax hike, many were expecting the first olive branch to come from the generous victor – Barack Obama. Yet on the contrary, the WSJ reports, Obama’s gambit will be to ask for double what the preliminary negotiations from the “debt deficit” summer of 2011 indicated would be the Democrats demand for tax revenue increase. To wit: “President Barack Obama will begin budget negotiations with congressional leaders Friday by calling for $1.6 trillion in additional tax revenue over the next decade, far more than Republicans are likely to accept and double the $800 billion discussed in talks with GOP leaders during the summer of 2011. Mr. Obama, in a meeting Tuesday with union leaders and other liberal activists, also pledged to hang tough in seeking tax increases on wealthy Americans.” Granted, there was a tiny conciliation loophole still open, after he made no specific commitment to leave unscathed domestic programs such as Medicare, yet this is one program that the GOP will likely not find much solace in cutting. In other words, all the preliminary talk of one party being open to this or that, was, naturally, just that, with a whole lot of theatrics, politics and teleprompting thrown into the mix. The one hope is that the initial demands are so ludicrous on both sides, that some leeway may be seen as a victory by a given party’s constituents. Yet that is unlikely: as we have noted on many occasions in the past, any compromise will result in swift condemnation in a congress that has never been as more polarized in history.

From the WSJ:

Kevin Smith, a spokesman for House Speaker John Boehner (R., Ohio), dismissed the president’s opening position for the negotiations. He said Mr. Boehner’s proposal to revamp the tax code and entitlement programs is “consistent with the president’s call for a ‘balanced’ approach.”

Mr. Boehner hasn’t specified a revenue target that would be his opening bid. He has said he would be willing to accept new tax revenues—not higher tax rates—if Democrats accept structural changes to entitlement programs, the ultimate source of the U.S.’s long-term budget woes.

The president’s opening gambit, based on his 2013 budget proposal, signals Mr. Obama’s intent to press his advantage on the heels of his re-election last week. However, before gathering at the White House with lawmakers on Friday, he will meet with chief executives of a dozen companies Wednesday. Many executives have aired concerns about the economic consequences of the looming “fiscal cliff”—and the risk of another standoff.

…

Speaking to reporters about Mr. Obama’s plans for Friday’s talks, White House spokesman Jay Carney said, “the president has put forward a very specific plan that will be what he brings to the table when he sits down with congressional leaders.”

“We know what a truly balanced approach to our fiscal challenges looks like,” said Mr. Carney, using Democrats’ language to mean spending cuts combined with tax increases.

Republicans already have appeared willing to cut a deal that results in Americans paying more taxes if it averts the scheduled spending cuts and tax increases due to take effect at year-end.

“New revenue must be tied to genuine entitlement changes,” Senate Minority Leader Mitch McConnell (R., Ky.) said Tuesday. “Republicans are offering bipartisan solutions and now it’s the president’s turn. He needs to bring his party to the table.”

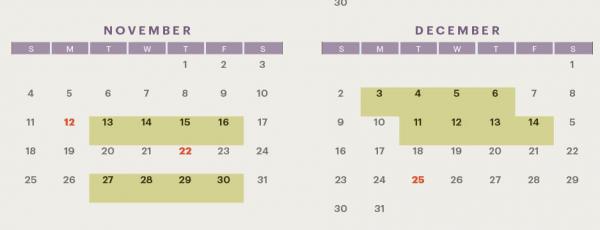

More here, but we can summarize it as follows: the lame duck congress will posture, prance and pout. And it is a certainty that in the 15 (see calendar below) remaining days it is expected to be session it will get nothing done. Which means, that once again, it will be up to the market, just like last August, just like October of 2008, to implode and to shock Congress into awakening and coming up with a compromise of sorts. Only this time, now that Bernanke has shown he will “get to work” at a moment’s notice, the impetus to do anything as a result of even a market plunge will be far less. After all why lose face, and put your career in jeopardy when there is the Fed which, supposedly, can offset a market crash, courtesy of the shining example set by Chuck Schumer.

It is thus quite possible that this December, for the first time in history, we may get to a point where not even a 20% market drop will be sufficient to get a Congress, now habituated with the Fed bailing it, and by it we mean the market, out, to cross bitter party lines. The problem then becomes one of what we saw happen at 3:30 pm today, when the Fed’s Chairman-in-waiting, Janet Yellen hinted at an even longer ZIRP, and… nothing.

To summarize: think the economy is doomed if the Congress doesn’t get its act together? You ain’t seen nothing yet.