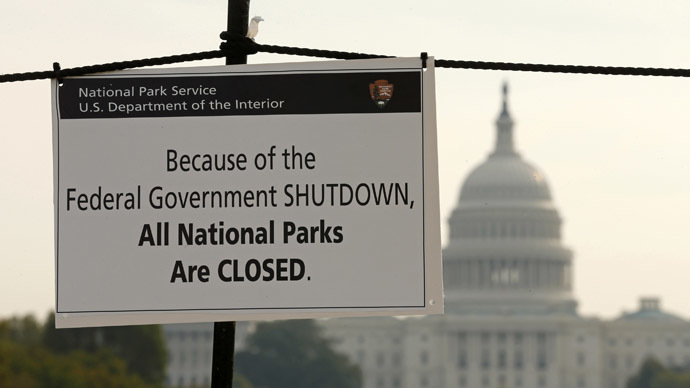

The U.S. Capitol looms in the background of a sign on the National Mall reminding visitors of the closures to all national parks due to the federal government shutdown in Washington October 3, 2013. (Reuters/Kevin Lamarque)

Michel Chossudovsky is an award-winning author, professor of economics, founder and director of the Centre for Research on Globalization, Montreal and editor of the globalresearch.ca website.

– Shutdown of US govt & ‘debt default’: Dress rehearsal for privatization of federal state system? (RT, Oct 15, 2013):

By Michel Chossudovsky

The ‘shutdown’ of the US government and the financial climax associated with a deadline date, leading to a possible ‘debt default’ by the federal government, is a money-making undertaking for Wall Street.

Several overlapping political and economic agendas are unfolding. Is the shutdown – implying the furloughing of tens of thousands of public employees – a dress rehearsal for the eventual privatization of important components of the federal state system?

A staged default, bankruptcy and privatization is occurring in Detroit (with the active support of the Obama administration), whereby large corporations become the owners of municipal assets and infrastructure.

The important question: could a process of ‘state bankruptcy’, which is currently afflicting local level governments across the land, realistically occur in the case of the central government of the United States of America?

This is not a hypothetical question. A large number of developing countries under the brunt of IMF ‘economic medicine’ were ordered by their external creditors to dismantle the state apparatus, fire millions of public sector workers as well as privatize state assets. The IMF’s Structural Adjustment Program (SAP) has also been applied in several European countries.