Listen AMERICA! Listen WORLD! Listen!!!

Stop listening to elite puppets like Obama, Bernanke and Geithner or you are doomed!!!

1 of 2:

2 of 2:

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

Listen AMERICA! Listen WORLD! Listen!!!

Stop listening to elite puppets like Obama, Bernanke and Geithner or you are doomed!!!

1 of 2:

2 of 2:

Added: 12. December 2009

Barack Obama ran for president as a man of the people, standing up to Wall Street as the global economy melted down in that fateful fall of 2008. He pushed a tax plan to soak the rich, ripped NAFTA for hurting the middle class and tore into John McCain for supporting a bankruptcy bill that sided with wealthy bankers “at the expense of hardworking Americans.” Obama may not have run to the left of Samuel Gompers or Cesar Chavez, but it’s not like you saw him on the campaign trail flanked by bankers from Citigroup and Goldman Sachs. What inspired supporters who pushed him to his historic win was the sense that a genuine outsider was finally breaking into an exclusive club, that walls were being torn down, that things were, for lack of a better or more specific term, changing.

Then he got elected.

What’s taken place in the year since Obama won the presidency has turned out to be one of the most dramatic political about-faces in our history. Elected in the midst of a crushing economic crisis brought on by a decade of orgiastic deregulation and unchecked greed, Obama had a clear mandate to rein in Wall Street and remake the entire structure of the American economy. What he did instead was ship even his most marginally progressive campaign advisers off to various bureaucratic Siberias, while packing the key economic positions in his White House with the very people who caused the crisis in the first place. This new team of bubble-fattened ex-bankers and laissez-faire intellectuals then proceeded to sell us all out, instituting a massive, trickle-up bailout and systematically gutting regulatory reform from the inside.

How could Obama let this happen? Is he just a rookie in the political big leagues, hoodwinked by Beltway old-timers? Or is the vacillating, ineffectual servant of banking interests we’ve been seeing on TV this fall who Obama really is?

Whatever the president’s real motives are, the extensive series of loophole-rich financial “reforms” that the Democrats are currently pushing may ultimately do more harm than good. In fact, some parts of the new reforms border on insanity, threatening to vastly amplify Wall Street’s political power by institutionalizing the taxpayer’s role as a welfare provider for the financial-services industry. At one point in the debate, Obama’s top economic advisers demanded the power to award future bailouts without even going to Congress for approval — and without providing taxpayers a single dime in equity on the deals.

How did we get here? It started just moments after the election — and almost nobody noticed.

‘Just look at the timeline of the Citigroup deal,” says one leading Democratic consultant. “Just look at it. It’s fucking amazing. Amazing! And nobody said a thing about it.”

Barack Obama was still just the president-elect when it happened, but the revolting and inexcusable $306 billion bailout that Citigroup received was the first major act of his presidency. In order to grasp the full horror of what took place, however, one needs to go back a few weeks before the actual bailout — to November 5th, 2008, the day after Obama’s election.

If you understand what is going on and do nothing about it, then you deserve to lose everything!

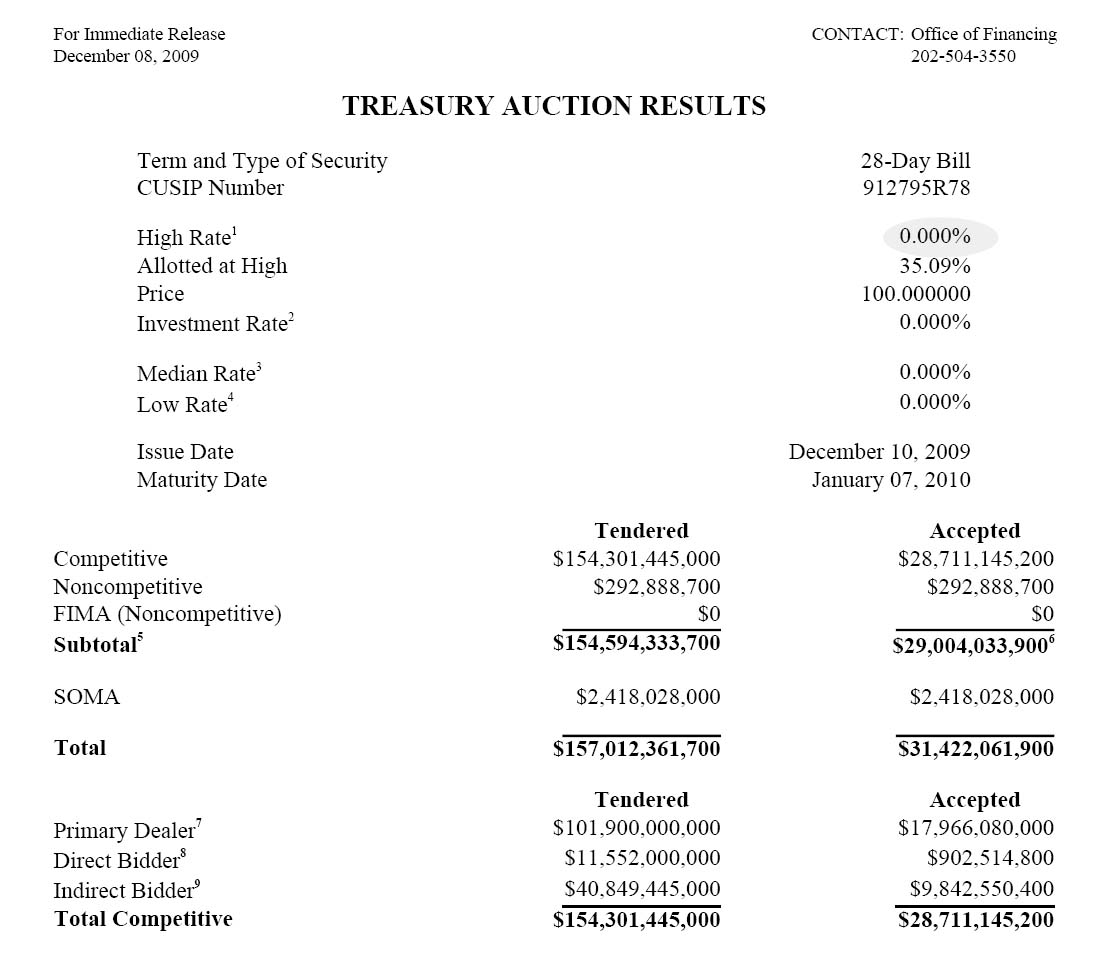

(Click on image to enlarge.)

Welcome to ACME bond auctions. This is the world of looney tunes where Tim and Ben, the rescue rangers, run the printing press and the toilet paper issuance facility.

Also, do primary dealers feel like 0.000% is an attractive rate all of a sudden? $102 billion tendered. Hmm, who’d a thunk it.

Submitted by Tyler Durden on 12/08/2009 15:14 -0500

Source: ZeroHedge

Exactly right Mr. Burgess!

The problem is that the US is held hostage by the same criminals that caused/created the crisis.

Date: 19th Nov 09

More on Timmy:

– Prof. William Black: Timothy Geithner ‘Burned Billions,’ Shafted Taxpayers on CIT Loan

– Treasury Secretary Geithner’s Closest Aides Reaped Millions Working for Banks, Hedge Funds

– The Federal Reserve buys Fannie Mae bonds; Timothy Geithner is a liar

– Geithner: Auditing the Federal Reserve is a ‘line that we don’t want to cross’

– New York Fed’s Secret Choice to Pay for AIG Swaps Squandered Billions of Taxpayer Money

Every bailout only increased the problems the US will have to face in the future. The bailout money just went to Wall Street and did nothing for the people.

Another one of the nation’s largest lenders has filed for bankruptcy. On the brink for months, CIT filed for Chapter 11 protection on Sunday.

The prepackaged plan allows CIT to restructure its debt while trying to keep badly needed loans flowing to thousands of mid-sized and small businesses. The plan keeps CIT’s operations alive and makes it possible for the company to exit bankruptcy by year’s end.

But here’s the bad news: While senior debt holders will only lose 30% of their investment, we, the U.S. taxpayer, will lose the entire $2.3 billion we lent the company this summer.

William Black, professor at the University of Missouri-Kansas City School of Law is dumbfounded. “We put ourselves on the hook in a completely inept way where we lose first. We lose entirely as the taxpayers.”

Black, a former top federal banking regulator, blames Treasury Secretary Timothy Geithner for negotiating such a bad deal on behalf of the American public.

His argument goes as follows:

The government was in no way obligated to lend the struggling CIT money and, in fact, initially refused to provide it bailout funds. More importantly, being the lender of last resort, the government should have guaranteed we’d be the first to get paid if CIT eventually filed Chapter 11. By failing to do so, “it’s like he [Geithner] burned billions of dollars again in government money, our money, gratuitously,” says Black.

Read moreProf. William Black: Timothy Geithner ‘Burned Billions,’ Shafted Taxpayers on CIT Loan

Even TARP was limited. This is more than criminal!

‘Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren,” Obama said in a 2006 floor speech that preceded a Senate vote to extend the debt limit. “America has a debt problem and a failure of leadership.”

– Barack Obama

Exactly right.

But more than that the US government and the Fed are bankrupting America and destroying the US dollar.

In case you haven’t seen this yet:

– Fall Of The Republic – The Presidency Of Barack H. Obama (The Full Movie HQ)

– The Obama Deception

The Obama administration is a lot worse than even the Bush administration.

Change!

By Rep. Brad Sherman (D-Calif.)

In my questioning of Treasury Secretary Timothy Geithner before the Financial Services Committee on Wednesday, I focused on the new bailout authority included in the 618-page legislative proposal submitted by the Treasury Department.

In my opinion, Geithner’s proposal is “TARP on steroids.” Section 1204 of the proposal allows the executive branch to use taxpayer money to make loans to, or invest in, the largest financial institutions to avoid a systemic risk to the economy.

Geithner’s proposal reminds me of the Troubled Asset Relief Program (TARP), the $700 billion Wall Street bailout adopted last year, but the TARP was limited to two years, and to a maximum of $700 billion.

Section 1204 is unlimited in dollar amount and is a permanent grant of power to the executive branch. TARP contained some limits on executive compensation and an array of special oversight authorities. Section 1204 contains absolutely no limits on executive compensation and no special oversight.

When I asked Geithner whether he would accept a $1 trillion limit on the new bailout authority (if the executive branch wanted to spend more, it would have to come back to Congress), he rejected a $1 trillion limit, insisting that the executive branch be able to respond without coming back to Congress.

“When the people find they can vote themselves money, that will herald the end of the republic.”

– Benjamin Franklin

Added: 22. October 2009

Fall Of The Republic documents how an offshore corporate cartel is bankrupting the US economy by design. Leaders are now declaring that world government has arrived and that the dollar will be replaced by a new global currency.

President Obama has brazenly violated Article 1 Section 9 of the US Constitution by seating himself at the head of United Nations’ Security Council, thus becoming the first US president to chair the world body.

A scientific dictatorship is in its final stages of completion, and laws protecting basic human rights are being abolished worldwide; an iron curtain of high-tech tyranny is now descending over the planet.

A worldwide regime controlled by an unelected corporate elite is implementing a planetary carbon tax system that will dominate all human activity and establish a system of neo-feudal slavery.

Read moreFall Of The Republic – The Presidency Of Barack H. Obama (The Full Movie HQ)

The Obama administration is pure Wall Street, Federal Reserve, CFR and Trilateral Commission. There is no change. The banksters have free reign in America.

Related information:

– The US Government: Bought and Paid For

– Treasury Secretary Geithner’s Closest Aides Reaped Millions Working for Banks, Hedge Funds

– Goldman Sachs Banksters Set to Pay Record £14 Billion in Bonuses

– Government Watchdog: Treasury and Federal Reserve Knew Bailed-Out Banks Were Not Healthy, Lying to Americans

– Goldman Sachs to be paid $1bn if CIT fails, while US taxpayers would lose $2.3bn

– US: Utah approved a $27.3 million incentive package to keep Goldman Sachs, bringing the total amount to $47.3 million

– Congresswoman Marcy Kaptur: There Has Been a Financial Coup D’Etat

Mike Shedlock:

“I am outraged that the Obama Administration promised change and did not deliver. “Yes We Can” was a lie. The reality is “It’s Business As Usual, Only Worse, With Higher Deficits”.”

“I am outraged there is not enough outrage over this.”

“Where the hell is the outrage?”

The number of articles and opinions on Goldman Sachs earnings, bonuses, and influence peddling over the past several days is quite stunning.

Many have pointed out the problems; few have expressed outrage over what is happening in general, not just at Goldman Sachs. Let’s take a look.

My take is at the end.

Letting The Dice Roll

Rolfe Winkler at Contingent Capital is writing Letting Goldman Roll The Dice.

Is Goldman really such an indispensable financial intermediary? One look at the firm’s revenue breakdown shows that it’s more casino than anything else, and some of the markets it makes still put the economy in danger.

Goldman, in other words, generates most of its revenue trading its own money and earning vigorish on customer transactions. It’s a hybrid hedge fund and bookie, with an investment bank and asset management business thrown in for good measure.

With that in mind, one is left to wonder whether Goldman was really worth saving last year. What have taxpayers received for the $50 billion worth of cash and guarantees, for giving Goldman access to the Federal Reserve as its lender of last resort?

Saving Goldman was largely about saving the derivatives market, which is so big and unstable that the death of one counterparty could mean the death of all. With big commercial banks like JPMorgan Chase in deep, saving the derivatives business was as much about protecting depositors and maintaining the integrity of the payment system as it was derivatives themselves.

Read moreThe Goldman Sachs Bankster Casino – Where The Hell Is The Outrage?

Treasury Secretary Timothy Geithner was head of the Federal Reserve Bank of New York and is a member of the Council on Foreign Relations and the Trilateral Commission.

– Jim Rogers: Obama administration run by people who caused the latest financial problems

…who intentionally caused the latest financial problems.

Do you still trust the government?:

– The Federal Reserve buys Fannie Mae bonds; Timothy Geithner is a liar

– The US Government: Bought and Paid For

– Congresswoman Marcy Kaptur: There Has Been a Financial Coup D’Etat

– Former Assistant Secretary of the Treasury Paul Craig Roberts On The U.S. Leadership:

“They Are Criminals” – The Potential Here Is Far Worse Than The Great Depression

Change you can believe in!

And now…

Oct. 14 (Bloomberg) — Some of Treasury Secretary Timothy Geithner’s closest aides, none of whom faced Senate confirmation, earned millions of dollars a year working for Goldman Sachs Group Inc., Citigroup Inc. and other Wall Street firms, according to financial disclosure forms.

The advisers include Gene Sperling, who last year took in $887,727 from Goldman Sachs and $158,000 for speeches mostly to financial companies, including the firm run by accused Ponzi scheme mastermind R. Allen Stanford. Another top aide, Lee Sachs, reported more than $3 million in salary and partnership income from Mariner Investment Group, a New York hedge fund.

As part of Geithner’s kitchen cabinet, Sperling and Sachs wield influence behind the scenes at the Treasury Department, where they help oversee the $700 billion banking rescue and craft executive pay rules and the revamp of financial regulations. Yet they haven’t faced the public scrutiny given to Senate-confirmed appointees, nor are they compelled to testify in Congress to defend or explain the Treasury’s policies.

“These people are incredibly smart, they’re incredibly talented and they bring knowledge,” said Bill Brown, a visiting professor at Duke University School of Law and former managing director at Morgan Stanley. “The risk is they will further exacerbate the problem of our regulators identifying with Wall Street.”

While it isn’t unusual for Treasury officials to come from the financial industry, President Barack Obama has been critical of Wall Street, blaming its high-risk, high-pay culture for helping cause the financial-market meltdown.

‘Reckless Behavior’

Speaking to financial executives last month, Obama said: “We will not go back to the days of reckless behavior and unchecked excess that was at the heart of this crisis, where too many were motivated only by the appetite for quick kills and bloated bonuses.”

At the same time, the president has promised to change Washington by keeping lobbyists for special interests at a distance and by making decisions in the open. (See: The US Government: Bought and Paid For)

Sperling and Sachs are each paid $162,900 at the Treasury. Along with four others, they hold the title of counselor to Geithner. Sachs, 46, withdrew earlier this year from consideration to be the Treasury’s top domestic finance official, a job that would have required Senate confirmation.

Geithner’s predecessor, Henry Paulson, brought on a coterie of non-confirmed advisers from Goldman Sachs at the end of his term. Paulson, who had been the firm’s chief executive officer, defended the arrangement as necessary to quickly bring in top talent when the financial system was on the verge of collapse.

Read moreTreasury Secretary Geithner’s Closest Aides Reaped Millions Working for Banks, Hedge Funds

I find the term mantra very appropriate here.

Chanting mantras, with their true meaning lost ages ago, like in religion, has little if no effect at all.

The Fed and the Treasury have created a religion and Timothy Geithner and Ben Bernanke are seen as the high priests.

And behind close doors the Fed and the Treasury rape and abuse the US dollar, which has been entrusted to them, as violent and often as possible.

And people still believe those criminals.

– The Federal Reserve buys Fannie Mae bonds; Timothy Geithner is a liar

– US budget deficit tripled to a record $1.4 trillion in 2009

– Gerald Celente on the demise of the US dollar: ‘The US is failing on it’s most basic level’

For 14 years US Treasury secretaries have taken up the mantra as though it were an essential part of the office. So, sure enough, Tim Geithner, like his recent predecessors, believes “in a strong dollar”.

But if one thing has been devalued over that time, it is not so much the currency itself but the impact of the phrase.

After a week that saw the dollar reach a 14-month low against a basket of currencies and a fervour of Republican fretting about the value of the currency, the accusation is doing the rounds that maybe Mr Geithner does not “believe” hard enough.

There are reasons for entertaining this doubt. His commitment to a rebalancing of global trade could be accomplished by higher domestic demand in surplus countries such as China and Germany but it is not hurt by a weaker greenback.

Read moreFinancial Times: US mantra of strong dollar loses its value

The Fed is creating more money out of thin air.

The Fed and the US government are lying to the people (all of the time):

“You are saying that buying 300 billion dollars of debt by the Fed is not monetizing?”

Timothy Geithner: “Absolutely not.” (!!!)

(Start watching at 9 minutes)

Next thing Timmy will tell us is that taxes are to be seen as income for every US citizen.

Change you can believe in!

Oct. 9 (Bloomberg) — The Federal Reserve bought $170 million of two-year notes sold yesterday by Fannie Mae, the quickest purchase after issuance of benchmark bonds from the company or similar institutions since the central bank began acquiring so-called agency debt.

The purchase was part of $2.6 billion of buying today, the New York Fed said on its Web site. The central bank listed the notes among ones it would accept bids for yesterday, about 90 minutes after Washington-based Fannie Mae announced the results of its $5 billion sale in a statement.

The Fed last month said it would begin buying “on-the- run” agency debt, or the most recently issued notes in different maturities. It has purchased $136.3 billion of Fannie Mae, Freddie Mac or Federal Home Loan Bank bonds since December, according to data complied by Bloomberg.

Read moreThe Federal Reserve buys Fannie Mae bonds; Timothy Geithner is a liar

Hyperinflation Nation starring Peter Schiff, Ron Paul, Jim Rogers, Marc Faber, Tom Woods, Gerald Celente, and others.

Prepare now before the US dollar is worthless.

Part 1 :

“Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren,” Obama said in a 2006 floor speech that preceded a Senate vote to extend the debt limit. “America has a debt problem and a failure of leadership.” – Barack Obama in 2006

The debt problem has increased dramatically under President Obama.

What does this say about Obama’s leadership?

Projected Deficit

Source: Washington Post

It will be President Obama that will lead the US into the greatest collapse in history.

Right now America has just another elite puppet as President.

The Senate must move legislation to raise the federal debt limit beyond $12.1 trillion by mid-October, a move viewed as necessary despite protests about the record levels of red ink.

The move will highlight the nation’s record debt, which has been central to Republican attacks against Democratic congressional leaders and President Barack Obama. The year’s deficit is expected to hit a record $1.6 trillion.

Democrats in control of Congress, including then-Sen. Obama (Ill.), blasted President George W. Bush for failing to contain spending when he oversaw increased deficits and raised the debt ceiling.

“Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren,” Obama said in a 2006 floor speech that preceded a Senate vote to extend the debt limit. “America has a debt problem and a failure of leadership.”

Obama later joined his Democratic colleagues in voting en bloc against raising the debt increase.

Now Obama is asking Congress to raise the debt ceiling, something lawmakers are almost certain to do despite misgivings about the federal debt. The ceiling already has been hiked three times in the past two years, and the House took action earlier this year to raise the ceiling to $13 trillion.

Congress has little choice. Failing to raise the cap could lead the nation to default in mid-October, when the debt is expected to exceed its limit, Treasury Secretary Timothy Geithner has said. In August, Geithner asked Senate Majority Leader Harry Reid (D-Nev.) to increase the debt limit as soon as possible.

Related information:

– Judge: Federal Reserve Must Release Reports on Emergency Bank Loans

– Federal Reserve Refuses to Disclose Recipients of $2 Trillion

In an interview released today by Digg and the Wall Street Journal, Treasury Secretary Timothy Geithner was pressured about the growing popular movement to Audit the Fed spearheaded by Texas Congressman Ron Paul.

A visibly uncomfortable Geithner attempts to dismiss the question by stating “I’m sure people understand that you want to keep politics out of monetary policy.”

When Geithner is again pressed on the issue, he makes the stunning assertion that conducting an audit of the Federal Reserve-something never before done in its 96 year history-is a “line that we don’t want to cross,” proclaiming that such a move would be “problematic for the country.” Watch the interview in the player below:

Geithner’s response that auditing the Fed would give politicians dangerous control over American monetary policy is mistaken at best and a deliberate lie at worst.

Allowing the public to know what happened to their $24 trillion in bailout money does not give undue control of monetary policy to the people’s elected representatives.

Instead, such an audit would finally allow the public to see how their money has been spent in the midst of the largest spending binge in the history of the world’s economy, hardly an unreasonable demand given the well-documented revolving door between the Treasury and Goldman Sachs, the main recipient of bailout funds.

Ultimately, the Treasury Secretary is left spewing the absurdity that “I think even the sponsor of that bill recognizes how important it is to us to have the Fed independent of politics,” which can only be said to be true insofar as Ron Paul-the sponsor of House Resolution (HR) 1207– wants to abolish the Federal Reserve system altogether.

That the Wall Street Journal would even pressure the Treasury Secretary on serious issues like the Audit the Fed movement may be surprising, given that the Wall Street Journal is a mouthpiece of the financial oligarchy and that editor Paul Gigot, like Geithner himself, is a Bilderberg attendee.

Needless to say, this was not a typical inside-the-beltway interview. Instead, questions were submitted and voted on by the Digg community, with the top 10 questions being posed to Mr. Geithner.

Read moreGeithner: Auditing the Federal Reserve is a ‘line that we don’t want to cross’

William K. Black, the former litigation director of the Federal Home Loan Bank Board who investigated the Savings and Loan disaster of the 1980s, discusses the latest scandal in which a single bank, IndyMac, lost more money than was lost during the entire Savings and Loan crisis.

He will examine the political failure behind this economic disaster, in which not only massive fraud has taken place, but a vast transfer of wealth from the poor and middle class continues as the federal government bails out the seemingly reckless, if not the criminal.

Black teaches economics and law at the University of Missouri, Kansas City and is the author of The Best Way to Rob a Bank Is to Own One.

(Run Time: 1 hour, 38 min.)

Posted August 11, 2009

Source: Information Clearing House

Must-read.

See also RBS chief credit strategist issues red alert on global stock markets

Bernanke has pulled out all the stops.

Credit is not flowing. In fact, credit is contracting. That means things aren’t getting better; they’re getting worse. When credit contracts in a consumer-driven economy, bad things happen. Business investment drops, unemployment soars, earnings plunge, and GDP shrinks. The Fed has spent more than a trillion dollars trying to get consumers to start borrowing again, but without success. The country’s credit engines are grinding to a halt.

Bernanke has increased excess reserves in the banking system by $800 billion, but lending is still slow. The banks are hoarding capital in order to deal with the losses from toxic assets, non performing loans, and a $3.5 trillion commercial real estate bubble that’s following housing into the toilet. That’s why the rate of bank failures is accelerating. 2010 will be even worse; the list is growing. It’s a bloodbath.

The standards for conventional loans have gotten tougher while the pool of qualified credit-worthy borrowers has shrunk. That means less credit flowing into the system. The shadow banking system has been hobbled by the freeze in securitization and only provides a trifling portion of the credit needed to grow the economy. Bernanke’s initiatives haven’t made a bit of difference. Credit continues to shrivel.

The S&P 500 is up 50 percent from its March lows. The financials, retail, materials and industrials are leading the pack. It’s a “Green Shoots” Bear market rally fueled by the Fed’s Quantitative Easing (QE) which is forcing liquidity into the financial system and lifting equities. The same thing happened during the Great Depression. Stocks surged after 1929. Then the prevailing trend took hold and dragged the Dow down 89 percent from its earlier highs. The S&P’s March lows will be tested before the recession is over. Systemwide deleveraging is ongoing. That won’t change.

No one is fooled by the fireworks on Wall Street. Consumer confidence continues to plummet. Everyone knows things are bad. Everyone knows the media is lying. Credit is contracting; the economy’s life’s blood has slowed to a trickle. The economy is headed for a hard landing.

Bernanke has pulled out all the stops. He’s lowered interest rates to zero, backstopped the entire financial system with $13 trillion, propped up insolvent financial institutions and monetized $1 trillion in mortgage-backed securities and US sovereign debt. Nothing has worked. Wages are falling, banks are cutting lines of credit, retirement savings have been slashed in half, and home equity losses continue to mount. Living standards can no longer be bandaged together with VISA or Diners Club cards. Household spending has to fit within one’s salary. That’s why retail, travel, home improvement, luxury items and hotels are all down double-digits. The easy money has dried up.

According to Bloomberg:

“Borrowing by U.S. consumers dropped in June for the fifth straight month as the unemployment rate rose, getting loans remained difficult and households put off major purchases. Consumer credit fell $10.3 billion, or 4.92 percent at an annual rate, to $2.5 trillion, according to a Federal Reserve report released today in Washington. Credit dropped by $5.38 billion in May, more than previously estimated. The series of declines is the longest since 1991.

A jobless rate near the highest in 26 years, stagnant wages and falling home values mean consumer spending… will take time to recover even as the recession eases. Incomes fell the most in four years in June as one-time transfer payments from the Obama administration’s stimulus plan dried up, and unemployment is forecast to exceed 10 percent next year before retreating.” (Bloomberg)

What a mess. The Fed has assumed near-dictatorial powers to fight a monster of its own making, and achieved nothing. The real economy is still dead in the water. Bernanke is not getting any traction from his zero-percent interest rates. His monetization program (QE) is just scaring off foreign creditors. On Friday, Marketwatch reported:

“The Federal Reserve will probably allow its $300 billion Treasury-buying program to end over the next six weeks as signs of a housing recovery prompt the central bank to unwind one its most aggressive and unusual interventions into financial markets, big bond dealers say.”

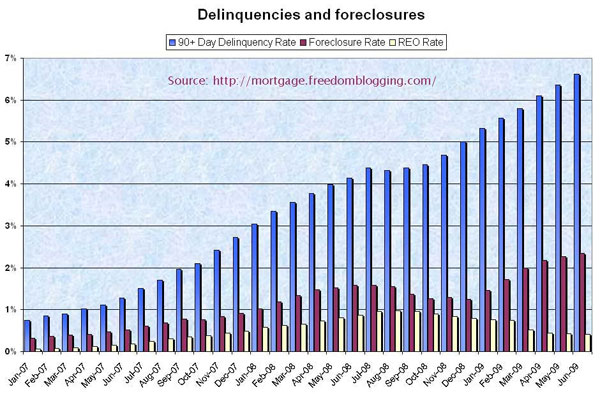

Right. Does anyone believe the housing market is recovering? If so, please check out this chart and keep in mind that, in the first 6 months of 2009, there have already been 1.9 million foreclosures.

The Fed is abandoning the printing presses (presumably) because China told Geithner to stop printing money or they’d sell their US Treasuries. It’s a wake-up call to Bernanke that the power is shifting from Washington to Beijing.

That puts Bernanke in a pickle. If he stops printing; interest rates will skyrocket, stocks will crash and housing prices will tumble. But if he continues QE, China will dump their Treasuries and the greenback will vanish in a poof of smoke. Either way, the malaise in the credit markets will persist and personal consumption will continue to sputter.

Read moreUS Economy: This is No Recession. It’s a Planned Demolition

There are no ‘real’ signs that the economy is improving.

– About half of US mortgages seen underwater by 2011 (Reuters)

NEW YORK (Reuters) – The percentage of U.S. homeowners who owe more than their house is worth will nearly double to 48 percent in 2011 from 26 percent at the end of March, portending another blow to the housing market, Deutsche Bank said on Wednesday.

– US Bank Failures Rise to 72 With Collapses in Florida, Oregon (Bloomberg):

Aug. 8 (Bloomberg) — U.S. bank failures rose to 72 this year with the collapse of two lenders in Florida and one in Oregon amid the worst economic slump since the Great Depression.

Washington — U.S. Treasury Secretary Timothy Geithner asked Congress to increase the $12.1 trillion debt limit on Friday, saying it is “critically important” that they act in the next two months.

Mr. Geithner, in a letter to U.S. lawmakers, said that the Treasury projects that the current debt limit could be reached as early mid-October. Increasing the limit is important to instilling confidence in global investors, Mr. Geithner said.

The Treasury didn’t request a specific increase in the letter.

“It is critically important that Congress act before the limit is reached so that citizens and investors here and around the world can remain confident that the United States will always meet its obligations,” Mr. Geithner said in a letter to lawmakers.

Related article: Geithner tries to assure Chinese investors, draws laughter from the audience

Mr. Geithner said the that it is “clearly a moment in our history” that requires support from both Democrats and Republicans for the increase.

“Congress has never failed to raise the debt limit when necessary,” Mr. Geithner said.

The non-partisan Congressional Budget Office said Thursday the federal government’s budget deficit reached $1.3 trillion through the first ten months of fiscal 2009, on track to reach a record high of $1.8 trillion for the 12-month period.

A must see!

Max Keiser:

“They are literally stealing a hundred million dollars a day. Goldman Sachs is stealing every day on the floor of the exchange. They should be in the Hague, they should be taken on financial terrorism charges. They should all be thrown in jail”

“U.S. Treasury Secretary Timothy Geithner said in a letter to Senator Judd Gregg last month that $70.1 billion in repayments from 32 banks that received government funds indicate financial firms are healing.”

“The banks have paid back funds from the $700 billion TARP program, enacted last year. Participating financial firms also have paid $5.2 billion in dividends to the U.S. government, Geithner said in the letter, dated June 30 and released July 7.”

Surprise! Must-read:

– Banks buying back TARP warrants at a discount, panel says (Market Watch):

WASHINGTON (MarketWatch) — A panel that oversees the $700 billion bank bailout package said Friday that financial institutions buying out warrants they gave the government in exchange for capital injections are now buying back those stakes at well below their fair value. The Congressional Oversight Panel, which is charged with overseeing the Troubled Asset Relief Program, or TARP, said in a report that a group of 11 small banks that have repurchased government warrants in exchange for taxpayer-funded assistance, have bought-out the stakes at 66% of their face value.

… and the taxpayer pays for it all. Change!

July 13 (Bloomberg) — The U.S. budget deficit topped $1 trillion for the first nine months of the fiscal year and broke a monthly record for June as the recession subtracted from revenue and the government spent to rejuvenate the economy.

The shortfall for the fiscal year that began Oct. 1 totaled $1.1 trillion, the first time that the gap for the period surpassed $1 trillion, Treasury figures showed today in Washington. The excess of spending over revenue for June was $94.3 billion, the first deficit for that month since 1991, according to data compiled by Bloomberg.

Individual and corporate tax receipts are sliding even as the worst recession in five decades shows signs of easing (?) because the jobless rate continues to rise — reaching a 26-year high in June — and companies have yet to see a sustained increase in demand. The shortfall is also widening as the government ramps up spending from the $787 billion stimulus program President Barack Obama signed into law in February.

Rep. Mark Kirk (R-IL) told Greta Van Sustern that China is investing away from the dollar. Kirk said that China has invested in an oil field this year and bought enough gold to fill up Fort Knox twice!

Added: June 09, 2009

Ron Paul on MSNBC talking about Obama’s New Regulatory Reforms

Marc Faber: “There is no deflation at the present time.”

Related article:

Marc Faber: U.S. will go into Hyperinflation, Approaching Zimbabwe Levels (Bloomberg)

1 of 3:

Added: 11. Juni 2009

Read moreMarc Faber: Bernanke Is An Economic Criminal And In My Opinion He Is A Madman (06/06/09)