Added: 13. Mai 2010

Great Depression

Mike Krieger: Goodbye Disneyland! – The Neo-Feudalistic, Gulag Casino Economy Has Already Begun

Mike Krieger, formerly a macro analyst at Bernstein, and currently running his own fund, KAM LP, summarizies the pretend reality we are all caught in now, knowing full well America is set on a crash course with reality at some point, yet sticking our collective heads in the sand, as the collapse will be some time in the “indefinite” future. In the meantime, banks will continue to boost US GDP by peddling “financial innovation” and restructuring advice to countries like Greece… and nothing else.

Goodbye Disneyland, by Mike Krieger

In the end the Party would announce that two and two made five, and you would have to believe it. It was inevitable that they should make that claim sooner or later: the logic of their position demanded it. Not merely the validity of experience, but the very existence of external reality was tacitly denied by their philosophy. The heresy of heresies was common sense. And what was terrifying was not that they would kill you for thinking otherwise, but that they might be right. For, after all how do we know that two and two make four? Or that the force of gravity works? Or that the past is unchangeable? If both the past and the external world exist only in the mind, and if the mind itself is controllable – what then?

– Winston Smith in George Orwell’s 1984

A government big enough to give you everything you want is a government big enough to take from you everything you have.

– Thomas Jefferson

We Must Move to a Free Market and Shun the Welfare-Warfare State or all will be Lost

Unfortunately for all of us, the primary economic policy of the U.S. government as well as many others around the world is an extend and pretend strategy that is economic suicide primarily in that it keeps the irresponsible in their assets and it makes the responsible shudder and shun productive investments. Whether it be a homeowner that is subsidized to stay in a home that he cannot afford or a bank that doesn’t want to come clean on the extent of its bad assets, the result is the same. Complete economic inertia. Now of course there has been a rebound in demand, but my argument has been and continues to be that this is the most unproductive rebound in aggregate demand that perhaps the world has ever seen. Whether it be in the U.S. or China, the demand is taking away spare capacity in many areas indeed but we must question the methods. This is where the whole idea of inflation comes into play. The whole reason why printing a million dollars and giving it to everyone doesn’t work is because this “liquidity” is not created through a productive process. It is purely an injection of new dollars into the economy. The basic rule of supply/demand kicks in. In the average person’s pocket, this money is unlikely to be “invested” in productive capital endeavors, rather the vast majority of it will simply be spent to consume the resources of that which can be supplied by the already existing capital stock. So in many ways it isn’t that the creation of the money itself that is the biggest problem, it is the distribution channel of that money. Only a small percentage of the population that receives the million dollars has the ability, drive and discipline to invest the money into something that will create economic value for the society at large rather than just blow it on a flat screen television. This is the entire premise of why a free market economy works when it is allowed to work (which I would argue is not possible under the current Federal Reserve system). The Fed is a socialist organization that SETS the most important price in the economy, the price of money. Even worse, when they set that price at say 0% as is basically the case today that 0% or anything close to it is not offered to all the small businessmen or potential entrepreneurs out there. It might not even be so bad if the low interest rates weren’t simply being used to gamble or play a carry trade with treasuries. Of course, the banks or anyone else for that matter playing a spread by borrowing at near zero to buy long-term treasuries is doing irreparable harm to this nation. They are complicit in the gross misallocation of capital to the government, capital that can then be doled out at will to favored interests. So all we have today is essentially a creation of money and credit out of thin air that is allocated to two major constituents. First, it has primarily been used to maintain the people of wealth, power and political connections (on both sides of the isle) before the crash entrenched in their socioeconomic roles. Second, is to pay off political favors. Those who supported the President in his campaign have been paid back handsomely and are today much more powerful and secure than before whether we are talking unions or the oligopoly banks. If we wish to have any hope of a sustainable recovery preventing the inevitable social unrest to come from truly getting dangerous we must restore the free market and end the union of big business and government, which historically has presented an extremely dangerous situation. For those that are in big business and think they have made a great move by joining forces with the state I suggest you go back and read your history. You never will possess the ultimate power, you will be seduced into thinking you do and then when the time is right government can eliminate you and your fortune with the stroke of a pen. Power is granted to you by this authority when you engage in this unholy union and it can be taken away on whim and your wealth confiscated. Selling out freedom and your fellow citizens for some extra money or government contracts will come back to haunt you. Your legacy to the United States will be a neo-feudalistic, gulag casino economy that has already begun. Below is a link to an excellent interview with Bill Moyers on PBS about our financial oligarchy (I believe many industries here are becoming oligarchies but the financial one is the most powerful) and the need to stop its cancerous growth.

http://www.pbs.org/moyers/journal/04162010/watch.html

There Will be Surplus…In 2050!

Gerald Celente: This time they will close the Banks & Wall Street (03/27/10)

‘Fascism is coming to America’

Added: 28th Mar 10

More from Gerald Celente:

– Gerald Celente: ‘The Crash is Coming in 2010.’

– The No.1 Trend Forecaster Gerald Celente: Financial Mafia Controlling US and Wall Street

– Survivor, America: ‘It’s Only Going to Get Worse,’ Gerald Celente Says

– The No.1 Trend Forecaster Gerald Celente: The Terror And The Crash of 2010

If Nostradamus were alive today, he’d have a hard time keeping up with Gerald Celente.

– New York Post

When CNN wants to know about the Top Trends, we ask Gerald Celente.

– CNN Headline News

There’s not a better trend forecaster than Gerald Celente. The man knows what he’s talking about.

– CNBC

Those who take their predictions seriously … consider the Trends Research Institute.

– The Wall Street Journal

A network of 25 experts whose range of specialties would rival many university faculties.

– The Economist

US Government Preparing For Civil Unrest In America

Legislation to Establish Internment Camps on US Military Bases

FEMA Camps Courtesy of Google Earth (Click on image to enlarge.)

The Economic and Social Crisis

The financial meltdown has unleashed a latent and emergent social crisis across the United States.

What is at stake is the fraudulent confiscation of lifelong savings and pension funds, the appropriation of tax revenues to finance the trillion dollar “bank bailouts”, which ultimately serve to line the pockets of the richest people in America.

This economic crisis is in large part the result of financial manipulation and outright fraud to the detriment of entire populations, leading to a renewed wave of corporate bankruptcies, mass unemployment and poverty.

The criminalization of the global financial system, characterized by a “Shadow Banking” network has resulted in the centralization of bank power and an unprecedented concentration of private wealth.

Obama’s “economic stimulus” package and budget proposals contribute to a further process of concentration and centralization of bank power, the cumulative effects of which will eventually resul in large scale corporate, bankruptcies, a new wave of foreclosures not to mention fiscal collapse and the downfall of State social programs. (For further details see Michel Chossudovsky, America’s Fiscal Collapse, Global Research, March 2, 2009).

The cumulative decline of real economic activity backlashes on employment and wages, which in turn leads to a collapse in purchaisng power. The proposed “solution” under the Obama administration contributes to exacerbating rather than alleviating social inequalities and the process of wealth concentration.

The Protest Movement

When people across America, whose lives have been shattered and destroyed, come to realize the true face of the global “free market” system, the legitimacy of Wall Street, the Federal Reserve and the US administration will be challenged.

A latent protest movement directed against the seat of economic and political power is unfolding.

How this process will occur is hard to predict. All sectors of American society are potentially affected: wage earners, small, medium and even large businesses, farmers, professionals, federal, State and municipal employees, students, teachers, health workers, and unemployed. Protests will initially emerge from these various sectors. There is, however, at this stage, no organized national resistance movement directed against the administration’s economic and financial agenda.

Obama’s populist rhetoric conceals the true nature of macro-economic policy. Acting on behalf of Wall Street, the administration’s economic package, which includes close to a trillion dollar “aid” package for the financial services industry, coupled with massive austerity measures, contributes to precipitating America into a bottomless crisis.

“Orwellian Solution” to the Great Depression: Curbing Civil Unrest

At this particular juncture, there is no economic recovery program in sight. The Washington-Wall Street consensus prevails. There are no policies, no alternatives formulated from within the political and economic system. .

What is the way out? How will the US government face an impending social catastrophe?

The solution is to curb social unrest. The chosen avenue, inherited from the outgoing Bush administration is the reinforcement of the Homeland Security apparatus and the militarization of civilian State institutions.

The outgoing administration has laid the groundwork. Various pieces of “anti-terrorist” legislation (including the Patriot Acts) and presidential directives have been put in place since 2001, largely using the pretext of the “Global War on Terrorism.”

Homeland Security’s Internment Camps

Directly related to the issue of curbing social unrest, cohesive system of detention camps is also envisaged, under the jurisdiction of the Department of Homeland Security and the Pentagon.

A bill entitled the National Emergency Centers Establishment Act (HR 645) was introduced in the US Congress in January. It calls for the establishment of six national emergency centers in major regions in the US to be located on existing military installations. http://www.govtrack.us/congress/billtext.xpd?bill=h111-645

The stated purpose of the “national emergency centers” is to provide “temporary housing, medical, and humanitarian assistance to individuals and families dislocated due to an emergency or major disaster.” In actuality, what we are dealing with are FEMA internment camps. HR 645 states that the camps can be used to “meet other appropriate needs, as determined by the Secretary of Homeland Security.”

There has been virtually no press coverage of HR 645.

These “civilian facilities” on US military bases are to be established in cooperation with the US Military. Modeled on Guantanamo, what we are dealing with is the militarization of FEMA internment facilities.

Once a person is arrested and interned in a FEMA camp located on a military base, that person would in all likelihood, under a national emergency, fall under the de facto jurisdiction of the Military: civilian justice and law enforcement including habeas corpus would no longer apply.

HR 645 bears a direct relationship to the economic crisis and the likelihood of mass protests across America. It constitutes a further move to militarize civilian law enforcement, repealing the Posse Comitatus Act.

In the words of Rep. Ron Paul:

“…the fusion centers, militarized police, surveillance cameras and a domestic military command is not enough… Even though we know that detention facilities are already in place, they now want to legalize the construction of FEMA camps on military installations using the ever popular excuse that the facilities are for the purposes of a national emergency. With the phony debt-based economy getting worse and worse by the day, the possibility of civil unrest is becoming a greater threat to the establishment. One need only look at Iceland, Greece and other nations for what might happen in the United States next.” (Daily Paul, September 2008, emphasis added)

The proposed internment camps should be seen in relation to the broader process of militarization of civilian institutions. The construction of internment camps predates the introduction of HR 645 (Establishment of Emergency Centers) in January 2009. There are, according to various (unconfirmed) reports, some 800 FEMA prison camps in different regions of the U.S. Moreover, since the 1980s, the US military has developed “tactics, techniques and procedures” to suppress civilian dissent, to be used in the eventuality of mass protests (United States Army Field Manual 19-15 under Operation Garden Plot, entitled “Civil Disturbances” was issued in 1985)

Read moreUS Government Preparing For Civil Unrest In America

How to invest for a global-debt-bomb explosion; Prepare for an apocalyptic anarchy (Market Watch)

Must-read!

Prepare for an apocalyptic anarchy ending Wall Street’s toxic capitalism

ARROYO GRANDE, Calif. (MarketWatch) — Wake up investors. Are you prepared for the economic anarchy coming after a global-debt time bomb explodes? Are you thinking outside the box? Investing differently? Act now — tomorrow will be too late.

Start by looking past the endless cable skirmishes between Rush, Glenn, Bill and Shawn versus Harry, Nancy, Ben and Barack. Look way past the insurgency bonding Sarah and her diehard Tea Party revolutionaries with Ron Paul’s Neo-Reaganite ideologues, Fat-Cat Bankers and the Party of No, all planning a massive frontal assault on the 2010 elections, hell-bent on destroying the presidency. All that’s the sideshow.

The Big One is coming soon, bigger than the 2000 dot-com crash and the 2008 subprime credit meltdown combined. A huge market blowout. And as Bloomberg-BusinessWeek predicts: “The results won’t be pretty for investors or elected officials.”

After the global-debt bomb explodes don’t expect a typical bear correction followed by a new bull. Wall Street’s toxic pseudo-capitalism is imploding. Be prepared for a massive meltdown. Yes, already the third major bubble-bust of the 21st century, triggered once again by Wall Street’s out-of-control Fat Cat Bankers. And it’s dead ahead.

Can your family survive in the anarchy after the debt bomb explodes?

America’s already descending into economic anarchy. We’re all trapped in a historic economic supercycle, a turning point that must bleed through a no-man’s land of lawless self-destructive anarchy before a neo-capitalistic world can re-emerge. Investors tell me they “feel” it at a deep level, “know” it’s happening. They keep asking: “What’s the best investment strategy to prepare now?”

This is no joke, folks. Are you prepared? Or preparing? Will your family survive in a post-apocalyptic world, when anarchy is rampant in America? Look at Washington, Wall Street and Corporate America today. You know it’s already begun.

You are witnessing a fundamental breakdown of the American dream, a systemic breakdown of our democracy and our capitalism, a breakdown driven by the blind insatiable greed of Wall Street: Dysfunctional government, insane markets, economy on the brink. Multiply that many times over and see a world in total disarray. Ignore it now, tomorrow will be too late.

Survivor, America: ‘It’s Only Going to Get Worse,’ Gerald Celente Says

“It’s only going to get worse,” is the sobering forecast of Gerald Celente, director of the Trends Research Institute.

As discussed in a prior segment, Celente believes the “bailout bubble” is going to burst and the U.S. economy will slip back into recession, if not worse, in 2010.

Like all forecasters, Celente isn’t always right but he has predicted a number of major events, as detailed here.

So if Celente is right about 2010, what will that mean for the average American? Celente says we’re going back to basics, making do with less and adopting the following mantra: “Waste not, want not. Use it up wear it out. Make it due, due without.”

On his Website, Celente offers the following predictions, further discussed in the accompanying video:

Read moreSurvivor, America: ‘It’s Only Going to Get Worse,’ Gerald Celente Says

US slides deeper into depression as Wall Street revels

December was the worst month for US unemployment since the Great Recession began.

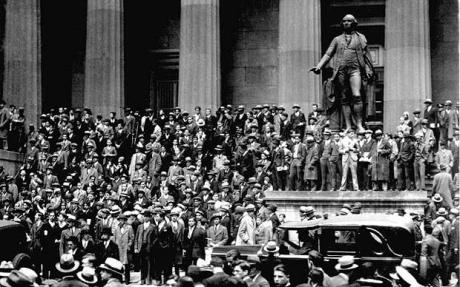

History repeating itself? President Obama has been accused by some economists of making the same mistakes policymakers in the US made in the Great Depression, which followed the Wall Street crash of 1929, pictured Photo: AP

The labour force contracted by 661,000. This did not show up in the headline jobless rate because so many Americans dropped out of the system. The broad U6 category of unemployment rose to 17.3pc. That is the one that matters.

Wall Street rallied. Bulls hope that weak jobs data will postpone monetary tightening: a silver lining in every catastrophe, or perhaps a further exhibit of market infantilism.

The home foreclosure guillotine usually drops a year or so after people lose their job, and exhaust their savings. The local sheriff will escort them out of the door, often with some sympathy — just like the police in 1932, mostly Irish Catholics who tithed 1pc of their pay for soup kitchens.

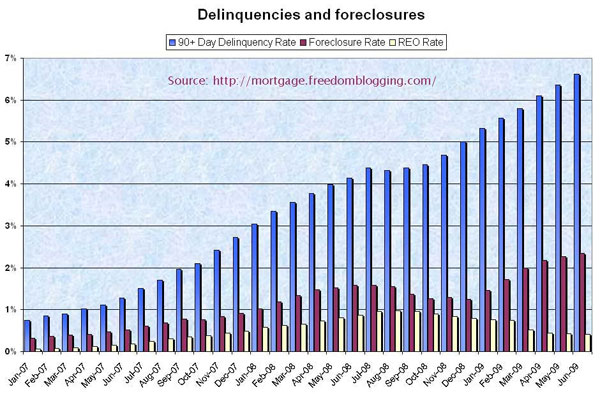

Realtytrac says defaults and repossessions have been running at over 300,000 a month since February. One million American families lost their homes in the fourth quarter. Moody’s Economy.com expects another 2.4m homes to go this year. Taken together, this looks awfully like Steinbeck’s Grapes of Wrath.

Judges are finding ways to block evictions. One magistrate in Minnesota halted a case calling the creditor “harsh, repugnant, shocking and repulsive”. We are not far from a de facto moratorium in some areas.

This is how it ended between 1932 and 1934, when half the US states declared moratoria or “Farm Holidays”. Such flexibility innoculated America’s democracy against the appeal of Red Unions and Coughlin Fascists. The home siezures are occurring despite frantic efforts by the Obama administration to delay the process.

Read moreUS slides deeper into depression as Wall Street revels

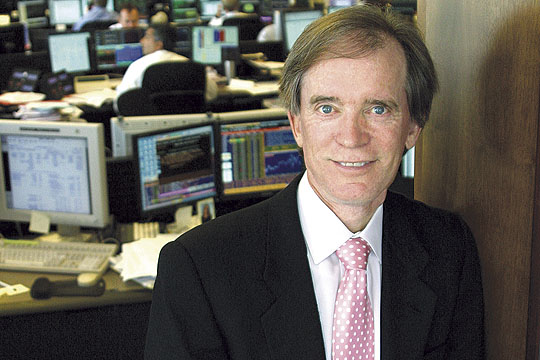

PIMCO’S Bill Gross: ‘Let’s Get Fisical’ (… or why the US will not make it.)

On Thursday I had posted Bloomberg’s summary on the monthly investment outlook by PIMCO’s Bill Gross:

But that summary missed a lot of important points.

Here is just one excerpt as a starter:

“Here’s the problem that the U.S. Fed’s “exit” poses in simple English: Our fiscal 2009 deficit totaled nearly 12% of GDP and required over $1.5 trillion of new debt to finance it. The Chinese bought a little ($100 billion) of that, other sovereign wealth funds bought some more, but as shown in Chart 2, foreign investors as a group bought only 20% of the total – perhaps $300 billion or so. The balance over the past 12 months was substantially purchased by the Federal Reserve. …”

If that doesn’t bother you, then I do not know what will. The Federal Reserve is creating money out of thin air like there is no tomorrow and the bad news is that that is exactly what the elite that controls the US government and the Federal Reserve has planned for America:

In the next two years (or just a little more than that) we will see hyperinflation in the US, people in America will become desperately poor and the Greatest Depression will turn the US into a Third World country.

(In 2009 Bill Gross was named the world’s 32nd most powerful man by Forbes.)

Now here is the full article by Bill Gross, ‘The King of Bonds’ (Must-Read!):

Let’s Get Fisical

Quixotic journeys often make for great literature, but by definition are rarely productive. I am, after all, referring to windmills here – not their 21st century creation, but their 17th century chasing. Futility, not productivity, was the ultimate fate of Cervantes’ man from La Mancha. So it is with hesitation, although quixotic obsession, that I plunge headlong into a discussion of American politics, healthcare legislation, resultant budget deficits and – finally – their potential effect on financial markets. There will be windmills aplenty in the next few pages and not much good can come of these opinions or my tilting in their direction. Still, I mount my steed, lance in hand, and ride forward.

Question: What has become of the American nation? Conceived with the vision of liberty and justice for all, we have descended in the clutches of corporate and other special interests to a second world state defined by K Street instead of Independence Square. Our government doesn’t work anymore, or perhaps more accurately, when it does, it works for special interests and not the American people. Washington consistently stoops to legislate 10,000-page perversions of healthcare, regulatory reform, defense, and budgetary mandates overflowing with earmarks that serve a monied minority as opposed to an all-too-silent majority. You don’t have to be Don Quixote to believe that legislators – and Presidents – often do not work for the benefit of their constituents: A recent NBC News/Wall Street Journal poll reported that over 65% of Americans trust their government to do the right thing “only some of the time” and a stunning 19% said “never.” What most politicians apparently are working for is to perpetuate their power – first via district gerrymandering, and then second by around-the-clock campaigning financed by special interest groups. If, by chance, they’re ever voted out of office, they have a home just down the street – at K Street – with six-figure incomes as a starting wage.

What amazes me most of all is that politicians can be bought so cheaply. Public records show that combined labor, insurance, big pharma and related corporate interests spent just under $500 million last year on healthcare lobbying (not much of which went to politicians) for what is likely to be a $50-100 billion annual return. The fact is that American citizens have never been as divorced from their representatives – and if that description fits the Democratic Congress now in control – then it applies to Republicans as well – past and present. So you watch Fox, or is it MSNBC? O’Reilly or Olbermann? It doesn’t matter. You’re just being conned into rooting for a team that basically runs the same plays called by lookalike coaches on different sidelines. A “ballot box” pox on all their houses – Senators, Representatives and Presidents alike. There has been no change, there will be no change, until we the American people decide to publicly finance all national and local elections and ban the writing of even a $1 check for our favorite candidates. Undemocratic? Hardly. Get on the internet, use Facebook, YouTube, or Twitter to campaign for your choice. That’s the new democracy. When special interests, even singular citizens write a check, it represents a perversion of democracy not the exercise of the First Amendment. Any chance that any of this will happen? Not one ghost of a chance. Forward Don Quixote, the windmills are in sight.

Distressed as I am about the state of American democracy, a rational money manager cannot afford to get mad or “just get even” when it comes to investing clients’ money. Still, like pilots politely advertise at the end of most flights, “We know you have a choice of airlines and we thank you for flying ‘United’.” Global investment managers likewise have a choice of sovereign credits and risk assets where stable inflation and fiscal conservatism are available. If 2008 was the year of financial crisis and 2009 the year of healing via monetary and fiscal stimulus packages, then 2010 appears likely to be the year of “exit strategies,” during which investors should consider economic fundamentals and asset markets that will soon be priced in a world less dominated by the government sector. If, in 2009, PIMCO recommended shaking hands with the government, we now ponder “which” government, and caution that the days of carefree check writing leading to debt issuance without limit or interest rate consequences may be numbered for all countries.

Read morePIMCO’S Bill Gross: ‘Let’s Get Fisical’ (… or why the US will not make it.)

We’re Screwed! Hyperinflation like in the Weimar Republic; Great Depression worse than in the 1930s

The US is already beyond hope!

See also:

– John Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

This is the Greatest Depression.

ShadowStats.com founder John Williams explains the risk of hyperinflation. Worst-case scenario? Rioting in the streets and devolution to a bartering system.

Courtesy of John WilliamsEconomist/statistician John Williams shifts through the government’s rose-tinted data

Do you believe everything the government tells you? Economist and statistician John Williams sure doesn’t. Williams, who has consulted for individuals and Fortune 500 companies, now uncovers the truth behind the U.S. government’s economic numbers on his Web site at ShadowStats.com. Williams says, over the last several decades, the feds have been infusing their data with optimistic biases to make the economy seem far rosier than it really is. His site reruns the numbers using the original methodology. What he found was not good.

Maymin: So we are technically bankrupt?

Williams: Yes, and when countries are in that state, what they usually do is rev up the printing presses and print the money they need to meet their obligations. And that creates inflation, hyperinflation, and makes the currency worthless.

Obama says America will go bankrupt if Congress doesn’t pass the health care bill.

Well, it’s going to go bankrupt if they do pass the health care bill, too, but at least he’s thinking about it. He talks about it publicly, which is one thing prior administrations refused to do. Give him credit for that. But what he’s setting up with this health care system will just accelerate the process.

Where are we right now?

In terms of the GDP, we are about halfway to depression level. If you look at retail sales, industrial production, we are already well into depressionary. If you look at things such as the housing industry, the new orders for durable goods we are in Great Depression territory. If we have hyperinflation, which I see coming not too far down the road, that would be so disruptive to our system that it would result in the cessation of many levels of normal economic commerce, and that would throw us into a great depression, and one worse than was seen in the 1930s.

What kind of hyperinflation are we talking about?

I am talking something like you saw with the Weimar Republic of the 1930s. There the currency became worthless enough that people used it actually as toilet paper or wallpaper. You could go to a fine restaurant and have an expensive dinner and order an expensive bottle of wine. The next morning that empty bottle of wine is worth more as scrap glass than it had been the night before filled with expensive wine.

We just saw an extreme example in Zimbabwe. … Probably the most extreme hyperinflation that anyone has ever seen. At the same time, you still had a functioning, albeit troubled, Zimbabwe economy. How could that be? They had a workable backup system of a black market in U.S. dollars. We don’t have a backup system of anything. Our system, with its heavy dependence on electronic currency, in a hyperinflation would not do well. It would probably cease to function very quickly. You could have disruptions in supply chains to food stores. The economy would devolve into something like a barter system until they came up with a replacement global currency.

What can we do to avoid hyperinflation? What if we just shut down the Fed or something like that?

We can’t. The actions have already been taken to put us in it. It’s beyond control. The government does put out financial statements usually in December using generally accepted accounting principles, where unfunded liabilities like Medicare and Social Security are included in the same way as corporations account for their employee pension liabilities. And in 2008, for example, the one-year deficit was $5.1 trillion dollars. And that’s instead of the $450 billion, plus or minus, that was officially reported.

Wow.

These numbers are beyond containment. Even the 2008 numbers, you can take 100 percent of people’s income and corporate profit and you’d still be in deficit. There’s no way you can raise enough money in taxes.

What about spending?

If you eliminated all federal expenditures except for Medicare and Social Security, you’d still be in deficit. You have to slash Social Security and Medicare. But I don’t see any political will to rein in the costs the way they have to be reined in. There’s just no way it can be contained. The total federal debt and net present value of the unfunded liabilities right now totals about $75 trillion. That’s five times the level of GDP.

John Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

“The US Has No Way of Avoiding a Financial Armageddon,” Says John Williams.

John Williams, who runs the popular counter government data manipulation site Shadowstats, has thrown down the gauntlet to deflationists, and in an extensive report concludes that the probability of a hyperinflationary episode in America over the next year has reached critical levels. While the debate between deflationists and (hyper)inflationists has been a long and painful one, numerous events set off in motion by the Bernanke Fed (as a direct legacy of the Greenspan multi-decade period of cheap and boundless credit) may have well cast America as the unwilling protagonist in the sequel of the failed monetary policy economic experiment better known as Zimbabwe.

Williams does not mince his words:

The U.S. economic and systemic solvency crises of the last two years are just precursors to a Great Collapse: a hyperinflationary great depression. Such will reflect a complete collapse in the purchasing power of the U.S. dollar, a collapse in the normal stream of U.S. commercial and economic activity, a collapse in the U.S. financial system as we know it, and a likely realignment of the U.S. political environment. The current U.S. financial markets, financial system and economy remain highly unstable and vulnerable to unexpected shocks. The Federal Reserve is dedicated to preventing deflation, to debasing the U.S. dollar. The results of those efforts are being seen in tentative selling pressures against the U.S. currency and in the rallying price of gold.

And even as Bernanke continues existing in a factless vacuum where he sees no asset bubbles, Williams takes aim at the one party almost exclusively responsible for the economic carnage that will soon transpire:

The crises have been generated out of and are centered on the United States financial system, triggered by the collapse of debt excesses actively encouraged by the Greenspan Federal Reserve. Recognizing that the U.S. economy was sagging under the weight of structural changes created by government trade, regulatory and social policies — policies that limited real consumer income growth — Mr. Greenspan played along with the political and banking systems. He made policy decisions to steal economic activity from the future, fueling economic growth of the last decade largely through debt expansion.

The Greenspan Fed pushed for ever-greater systemic leverage, including the happy acceptance of new financial products, which included instruments of mis-packaged lending risks, designed for consumption by global entities that openly did not understand the nature of the risks being taken. Complicit in this broad malfeasance was the U.S. government, including both major political parties in successive Administrations and Congresses.

As with consumers, the federal government could not make ends meet while appeasing that portion of the electorate that could be kept docile by ever-expanding government programs and increasing government spending. The solution was ever-expanding federal debt and deficits.Purportedly, it was Arthur Burns, Fed Chairman under Richard Nixon, who first offered the advice that helped to guide Alan Greenspan and a number of Administrations. The gist of the wisdom imparted was that if you ran into problems, you could ignore the budget deficit and the dollar. Ignoring them did not matter, because doing so would not cost you any votes.

Back in 2005, I raised the issue of a then-inevitable U.S. hyperinflation with an advisor to both the Bush Administration and Fed Chairman Greenspan. I was told simply that “It’s too far into the future to worry about.”Indeed, pushing the big problems into the future appears to have been the working strategy for both the Fed and recent Administrations. Yet, the U.S. dollar and the budget deficit do matter, and the future is at hand. The day of ultimate financial reckoning has arrived, and it is playing out.

Looking at the events over the past year demonstrates that Williams is not just being a drama queen.

Effective financial impairments and at least partial nationalizations or orchestrated bailouts/takeovers resulted for institutions such as Bear Stearns, Citigroup, Washington Mutual, AIG, General Motors, Chrysler, Fannie Mae and Freddie Mac, along with a number of further troubled financial institutions. The Fed moved to provide whatever systemic liquidity would be needed, while the federal government moved to finance corporate bailouts and to introduce significant stimulus spending.

Curiously, though, the Fed and the Treasury let Lehman Brothers fail outright, which triggered a foreseeable run on the system and markedly intensified the systemic solvency crisis in September 2008. Whether someone was trying to play political games, with the public and Congress increasingly raising questions of moral hazard issues, or whether the U.S. financial wizards missed what would happen or simply moved to bring the crisis to a head, remains to be seen.

More on the impending timing of the complete economic collapse of the US financial system:

Read moreJohn Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

Ron Paul: Be Prepared for the Worst

– Quotes from the Great Depression

The large-scale government intervention in the economy is going to end badly.

Any number of pundits claim that we have now passed the worst of the recession. Green shoots of recovery are supposedly popping up all around the country, and the economy is expected to resume growing soon at an annual rate of 3% to 4%. Many of these are the same people who insisted that the economy would continue growing last year, even while it was clear that we were already in the beginning stages of a recession.

A false recovery is under way. I am reminded of the outlook in 1930, when the experts were certain that the worst of the Depression was over and that recovery was just around the corner. The economy and stock market seemed to be recovering, and there was optimism that the recession, like many of those before it, would be over in a year or less. Instead, the interventionist policies of Hoover and Roosevelt caused the Depression to worsen, and the Dow Jones industrial average did not recover to 1929 levels until 1954. I fear that our stimulus and bailout programs have already done too much to prevent the economy from recovering in a natural manner and will result in yet another asset bubble.

Anytime the central bank intervenes to pump trillions of dollars into the financial system, a bubble is created that must eventually deflate. We have seen the results of Alan Greenspan’s excessively low interest rates: the housing bubble, the explosion of subprime loans and the subsequent collapse of the bubble, which took down numerous financial institutions. Rather than allow the market to correct itself and clear away the worst excesses of the boom period, the Federal Reserve and the U.S. Treasury colluded to put taxpayers on the hook for trillions of dollars. Those banks and financial institutions that took on the largest risks and performed worst were rewarded with billions in taxpayer dollars, allowing them to survive and compete with their better-managed peers.

US bank chargeoff rate exceeds Great Depression: Moody’s

And this is the Greatest Depression.

NEW YORK (Reuters) – The rate of loan charge-offs by major U.S. banks has exceeded those seen in the early years of the Great Depression as the credit crisis continues to take a toll, Moody’s Investors Service said on Monday.

Bank charge-offs — loans written off as uncollectable — have reached $116 billion year to date, or 2.9 percent of outstanding loans on an annualized basis, Moody’s said in a report. By comparison, bank charge-offs were about 2.25 percent in 1932, the third year of the Great Depression, Moody’s said.

Charge-offs climbed to $45 billion in the third quarter from $40 billion in the second quarter and $31 billion in the first, Moody’s said.

On an annualized basis, charge-offs were about 3.4 percent of outstanding loans in the third quarter, matching the Great Depression peak in 1934, Moody’s said.

Read moreUS bank chargeoff rate exceeds Great Depression: Moody’s

Lindsey Williams on The Alex Jones Show: Economic Warfare Declared on the US

Alex continues his discussion with pastor Lindsey Williams about the plans of the elite to crash the economy.

Added: 23rd Oct 09

1 of 4:

Read moreLindsey Williams on The Alex Jones Show: Economic Warfare Declared on the US

Fall Of The Republic – The Presidency Of Barack H. Obama (The Full Movie HQ)

“When the people find they can vote themselves money, that will herald the end of the republic.”

– Benjamin Franklin

Added: 22. October 2009

Fall Of The Republic documents how an offshore corporate cartel is bankrupting the US economy by design. Leaders are now declaring that world government has arrived and that the dollar will be replaced by a new global currency.

President Obama has brazenly violated Article 1 Section 9 of the US Constitution by seating himself at the head of United Nations’ Security Council, thus becoming the first US president to chair the world body.

A scientific dictatorship is in its final stages of completion, and laws protecting basic human rights are being abolished worldwide; an iron curtain of high-tech tyranny is now descending over the planet.

A worldwide regime controlled by an unelected corporate elite is implementing a planetary carbon tax system that will dominate all human activity and establish a system of neo-feudal slavery.

Read moreFall Of The Republic – The Presidency Of Barack H. Obama (The Full Movie HQ)

Gerald Celente: ‘Their is no recovery; It’s a coverup. We are already in the Greatest Depression.’

“We are already in the Greatest Depression.”

Date: 19th Oct 09

If Nostradamus were alive today, he’d have a hard time keeping up with Gerald Celente.

– New York Post

When CNN wants to know about the Top Trends, we ask Gerald Celente.

– CNN Headline News

There’s not a better trend forecaster than Gerald Celente. The man knows what he’s talking about. – CNBC

Those who take their predictions seriously … consider the Trends Research Institute.

– The Wall Street Journal

A network of 25 experts whose range of specialties would rival many university faculties.

– The Economist

Death of ‘Soul of Capitalism:’ 20 reasons America has lost its soul and collapse is inevitable

‘The “Great Depression 2” is dead ahead.’

ARROYO GRANDE, Calif. (MarketWatch) — Jack Bogle published “The Battle for the Soul of Capitalism” four years ago. The battle’s over. The sequel should be titled: “Capitalism Died a Lost Soul.” Worse, we’ve lost “America’s Soul.” And worldwide the consequences will be catastrophic.

That’s why a man like Hong Kong’s contrarian economist Marc Faber warns in his Doom, Boom & Gloom Report: “The future will be a total disaster, with a collapse of our capitalistic system as we know it today.”

No, not just another meltdown, another bear market recession like the one recently triggered by Wall Street’s “too-greedy-to-fail” banks. Faber is warning that the entire system of capitalism will collapse. Get it? The engine driving the great “American Economic Empire” for 233 years will collapse, a total disaster, a destiny we created.

OK, deny it. But I’ll bet you have a nagging feeling maybe he’s right, the end may be near. I have for a long time: I wrote a column back in 1997: “Battling for the Soul of Wall Street.” My interest in “The Soul” — what Jung called the “collective unconscious” — dates back to my Ph.D. dissertation: “Modern Man in Search of His Soul,” a title borrowed from Jung’s 1933 book, “Modern Man in Search of a Soul.” This battle has been on my mind since my days at Morgan Stanley 30 years ago, witnessing the decline.

Has capitalism lost its soul? Guys like Bogle and Faber sense it. Read more about the soul in physicist Gary Zukav’s “The Seat of the Soul,” Thomas Moore’s “Care of the Soul” and sacred texts.

But for Wall Street and American capitalism, use your gut. You know something’s very wrong: A year ago “too-greedy-to-fail” banks were insolvent, in a near-death experience. Now, magically they’re back to business as usual, arrogant, pocketing outrageous bonuses while Main Street sacrifices, and unemployment and foreclosures continue rising as tight credit, inflation, skyrocketing Federal debt killing taxpayers.

Yes, Wall Street has lost its moral compass. They created the mess, now, like vultures, they’re capitalizing on the carcass. They have lost all sense of fiduciary duty, ethical responsibility and public obligation.

Here are the Top 20 reasons American capitalism has lost its soul:

Paul Craig Roberts: The Economy is a Lie, too

Ben Bernanke IS RIGHT, ‘the recession is over.’

It is now the ‘Greatest Depression’.

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

Paul Craig Roberts

Americans cannot get any truth out of their government about anything, the economy included. Americans are being driven into the ground economically, with one million school children now homeless, while Federal Reserve chairman Ben Bernanke announces that the recession is over.

|

|

| At the urging of Larry Summers and Goldman Sachs’ CEO Henry Paulson, the Securities and Exchange Commission and the Bush administration went along with removing restrictions on debt leverage. | |

The spin that masquerades as news is becoming more delusional. Consumer spending is 70% of the US economy. It is the driving force, and it has been shut down. Except for the super rich, there has been no growth in consumer incomes in the 21st century. Statistician John Williams of shadowstats.com reports that real household income has never recovered its pre-2001 peak.

The US economy has been kept going by substituting growth in consumer debt for growth in consumer income. Federal Reserve chairman Alan Greenspan encouraged consumer debt with low interest rates. The low interest rates pushed up home prices, enabling Americans to refinance their homes and spend the equity. Credit cards were maxed out in expectations of rising real estate and equity values to pay the accumulated debt. The binge was halted when the real estate and equity bubbles burst.

As consumers no longer can expand their indebtedness and their incomes are not rising, there is no basis for a growing consumer economy. Indeed, statistics indicate that consumers are paying down debt in their efforts to survive financially. In an economy in which the consumer is the driving force, that is bad news.

The banks, now investment banks thanks to greed-driven deregulation that repealed the learned lessons of the past, were even more reckless than consumers and took speculative leverage to new heights. At the urging of Larry Summers and Goldman Sachs’ CEO Henry Paulson, the Securities and Exchange Commission and the Bush administration went along with removing restrictions on debt leverage.

When the bubble burst, the extraordinary leverage threatened the financial system with collapse. The US Treasury and the Federal Reserve stepped forward with no one knows how many trillions of dollars to “save the financial system,” which, of course, meant to save the greed-driven financial institutions that had caused the economic crisis that dispossessed ordinary Americans of half of their life savings.

The consumer has been chastened, but not the banks. Refreshed with the TARP $700 billion and the Federal Reserve’s expanded balance sheet, banks are again behaving like hedge funds. Leveraged speculation is producing another bubble with the current stock market rally, which is not a sign of economic recovery but is the final savaging of Americans’ wealth by a few investment banks and their Washington friends. Goldman Sachs, rolling in profits, announced six figure bonuses to employees.

The rest of America is suffering terribly.

The unemployment rate, as reported, is a fiction and has been since the Clinton administration. The unemployment rate does not include jobless Americans who have been unemployed for more than a year and have given up on finding work. The reported 10% unemployment rate is understated by the millions of Americans who are suffering long-term unemployment and are no longer counted as unemployed. As each month passes, unemployed Americans drop off the unemployment role due to nothing except the passing of time.

The inflation rate, especially “core inflation,” is another fiction. “Core inflation” does not include food and energy, two of Americans’ biggest budget items. The Consumer Price Index (CPI) assumes, ever since the Boskin Commission during the Clinton administration, that if prices of items go up consumers substitute cheaper items. This is certainly the case, but this way of measuring inflation means that the CPI is no longer comparable to past years, because the basket of goods in the index is variable.

The Boskin Commission’s CPI, by lowering the measured rate of inflation, raises the real GDP growth rate. The result of the statistical manipulation is an understated inflation rate, thus eroding the real value of Social Security income, and an overstated growth rate. Statistical manipulation cloaks a declining standard of living.

In bygone days of American prosperity, American incomes rose with productivity. It was the real growth in American incomes that propelled the US economy.

In today’s America, the only incomes that rise are in the financial sector that risks the country’s future on excessive leverage and in the corporate world that substitutes foreign for American labor. Under the compensation rules and emphasis on shareholder earnings that hold sway in the US today, corporate executives maximize earnings and their compensation by minimizing the employment of Americans.

Try to find some acknowledgement of this in the “mainstream media,” or among economists, who suck up to the offshoring corporations for grants.

The worst part of the decline is yet to come. Bank failures and home foreclosures are yet to peak. The commercial real estate bust is yet to hit. The dollar crisis is building.

When it hits, interest rates will rise dramatically as the US struggles to finance its massive budget and trade deficits while the rest of the world tries to escape a depreciating dollar.

Since the spring of this year, the value of the US dollar has collapsed against every currency except those pegged to it. The Swiss franc has risen 14% against the dollar. Every hard currency from the Canadian dollar to the Euro and UK pound has risen at least 13 % against the US dollar since April 2009. The Japanese yen is not far behind, and the Brazilian real has risen 25% against the almighty US dollar. Even the Russian ruble has risen 13% against the US dollar.

What sort of recovery is it when the safest investment is to bet against the US dollar?

CAUTION: US Monetary System Collapse

By Karl Denninger

Added: 15. September 2009

US: Hyperinflation Nation

Hyperinflation Nation starring Peter Schiff, Ron Paul, Jim Rogers, Marc Faber, Tom Woods, Gerald Celente, and others.

Prepare now before the US dollar is worthless.

Part 1 :

On the Edge with Max Keiser (08/28/09): Guest Mike “Mish” Shedlock

Related articles:

– Fed official: Real US unemployment rate at 16 percent

– Federal Reserve bailout revelations put on hold by judge

– RBS chief credit strategist issues red alert on global stock markets

– The US is in a ‘Death Spiral’ and ‘in the Tank Forever’, says Davidowitz

– Racketeering 101: Bailed Out Banksters Threaten Systemic Collapse If Fed Discloses Information

– Economy & Stock market: There is no recovery

– Bank CEO: 1000 Banks to Fail In Next Two Years

I still disagree with Mish Shedlock on the deflation vs. inflation issue.

I expect hyperinflation and the destruction of the US dollar.

“The entire US banking system is insolvent.” – Mike “Mish” Shedlock

1 of 3:

Read moreOn the Edge with Max Keiser (08/28/09): Guest Mike “Mish” Shedlock

US Economy: This is No Recession. It’s a Planned Demolition

Must-read.

See also RBS chief credit strategist issues red alert on global stock markets

Bernanke has pulled out all the stops.

Credit is not flowing. In fact, credit is contracting. That means things aren’t getting better; they’re getting worse. When credit contracts in a consumer-driven economy, bad things happen. Business investment drops, unemployment soars, earnings plunge, and GDP shrinks. The Fed has spent more than a trillion dollars trying to get consumers to start borrowing again, but without success. The country’s credit engines are grinding to a halt.

Bernanke has increased excess reserves in the banking system by $800 billion, but lending is still slow. The banks are hoarding capital in order to deal with the losses from toxic assets, non performing loans, and a $3.5 trillion commercial real estate bubble that’s following housing into the toilet. That’s why the rate of bank failures is accelerating. 2010 will be even worse; the list is growing. It’s a bloodbath.

The standards for conventional loans have gotten tougher while the pool of qualified credit-worthy borrowers has shrunk. That means less credit flowing into the system. The shadow banking system has been hobbled by the freeze in securitization and only provides a trifling portion of the credit needed to grow the economy. Bernanke’s initiatives haven’t made a bit of difference. Credit continues to shrivel.

The S&P 500 is up 50 percent from its March lows. The financials, retail, materials and industrials are leading the pack. It’s a “Green Shoots” Bear market rally fueled by the Fed’s Quantitative Easing (QE) which is forcing liquidity into the financial system and lifting equities. The same thing happened during the Great Depression. Stocks surged after 1929. Then the prevailing trend took hold and dragged the Dow down 89 percent from its earlier highs. The S&P’s March lows will be tested before the recession is over. Systemwide deleveraging is ongoing. That won’t change.

No one is fooled by the fireworks on Wall Street. Consumer confidence continues to plummet. Everyone knows things are bad. Everyone knows the media is lying. Credit is contracting; the economy’s life’s blood has slowed to a trickle. The economy is headed for a hard landing.

Bernanke has pulled out all the stops. He’s lowered interest rates to zero, backstopped the entire financial system with $13 trillion, propped up insolvent financial institutions and monetized $1 trillion in mortgage-backed securities and US sovereign debt. Nothing has worked. Wages are falling, banks are cutting lines of credit, retirement savings have been slashed in half, and home equity losses continue to mount. Living standards can no longer be bandaged together with VISA or Diners Club cards. Household spending has to fit within one’s salary. That’s why retail, travel, home improvement, luxury items and hotels are all down double-digits. The easy money has dried up.

According to Bloomberg:

“Borrowing by U.S. consumers dropped in June for the fifth straight month as the unemployment rate rose, getting loans remained difficult and households put off major purchases. Consumer credit fell $10.3 billion, or 4.92 percent at an annual rate, to $2.5 trillion, according to a Federal Reserve report released today in Washington. Credit dropped by $5.38 billion in May, more than previously estimated. The series of declines is the longest since 1991.

A jobless rate near the highest in 26 years, stagnant wages and falling home values mean consumer spending… will take time to recover even as the recession eases. Incomes fell the most in four years in June as one-time transfer payments from the Obama administration’s stimulus plan dried up, and unemployment is forecast to exceed 10 percent next year before retreating.” (Bloomberg)

What a mess. The Fed has assumed near-dictatorial powers to fight a monster of its own making, and achieved nothing. The real economy is still dead in the water. Bernanke is not getting any traction from his zero-percent interest rates. His monetization program (QE) is just scaring off foreign creditors. On Friday, Marketwatch reported:

“The Federal Reserve will probably allow its $300 billion Treasury-buying program to end over the next six weeks as signs of a housing recovery prompt the central bank to unwind one its most aggressive and unusual interventions into financial markets, big bond dealers say.”

Right. Does anyone believe the housing market is recovering? If so, please check out this chart and keep in mind that, in the first 6 months of 2009, there have already been 1.9 million foreclosures.

The Fed is abandoning the printing presses (presumably) because China told Geithner to stop printing money or they’d sell their US Treasuries. It’s a wake-up call to Bernanke that the power is shifting from Washington to Beijing.

That puts Bernanke in a pickle. If he stops printing; interest rates will skyrocket, stocks will crash and housing prices will tumble. But if he continues QE, China will dump their Treasuries and the greenback will vanish in a poof of smoke. Either way, the malaise in the credit markets will persist and personal consumption will continue to sputter.

Read moreUS Economy: This is No Recession. It’s a Planned Demolition

Bank of England: Recession will be the worst in modern history

– Ben Bernanke: This financial crisis may be worse than the Great Depression

Britain is facing the steepest recession in modern history, Mervyn King, the Bank of England Governor, declared as it laid bare the full extent of the damage wrought by the financial crisis.

The economy will take longer to recover from this recession than it did in previous economic slumps and it will take “several years” before banks are lending normally to households and businesses, Mr King said.

The downbeat message came as the Bank disclosed that it was likely to keep interest rates low for far longer than experts had predicted as Britain shakes off the effects of the downturn.

The Bank said that it expected the economy to contract by an annual rate of 5.5 per cent at its lowest point this year – an even deeper dive than experienced in the 1930s – let alone any of the other postwar recessions.

Read moreBank of England: Recession will be the worst in modern history

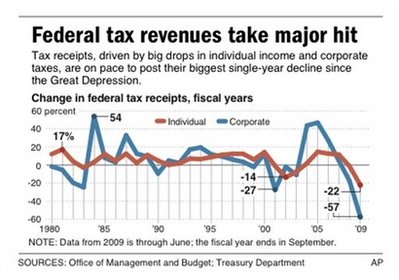

US federal tax revenue plummets most since 1932!

The Greatest Depression is already here.

– The Greatest Economic Collapse Is Coming:

“To give you an idea of how big a problem these deficits are, consider that the US government could tax its citizens 100% of their earnings and NOT have a balanced budget.” (!)

– Richard Fisher, president of the Dallas Federal Reserve Bank:

The“very big hole” in unfunded pension and health-care liabilities is over $99 trillion.

(Full article: Here)

– On the Edge with Max Keiser: The coming collapse of the US will be much worse than that of the USSR (07/31/09)

– Ben Bernanke: This financial crisis may be worse than the Great Depression

– Gerald Celente on Fox News: The Greatest Depression (05/31/09)

– Interview with Gerald Celente: 2009 – The Worst Economic Collapse Ever (02/10/09):

In 2009 we’re going to see the worst economic collapse ever, the ‘Greatest Depression’, says Gerald Celente, U.S. trend forecaster. He believes it’s going to be very violent in the U.S., including there being a tax revolt.

WASHINGTON – The recession is starving the government of tax revenue, just as the president and Congress are piling a major expansion of health care and other programs on the nation’s plate and struggling to find money to pay the tab.

The numbers could hardly be more stark: Tax receipts are on pace to drop 18 percent this year, the biggest single-year decline since the Great Depression, while the federal deficit balloons to a record $1.8 trillion.

Other figures in an Associated Press analysis underscore the recession’s impact: Individual income tax receipts are down 22 percent from a year ago. Corporate income taxes are down 57 percent. Social Security tax receipts could drop for only the second time since 1940, and Medicare taxes are on pace to drop for only the third time ever.

The last time the government’s revenues were this bleak, the year was 1932 in the midst of the Depression.

“Our tax system is already inadequate to support the promises our government has made,” said Eugene Steuerle, a former Treasury Department official in the Reagan administration who is now vice president of the Peter G. Peterson Foundation.

“This just adds to the problem.”

On the Edge with Max Keiser: The coming collapse of the US will be much worse than that of the USSR (07/31/09)

Max Keiser compares the collapse of the US and the USSR … and more.

1 of 3:

2 of 3:

Ben Bernanke: This financial crisis may be worse than the Great Depression

WASHINGTON (MarketWatch) — Federal Reserve Board Chairman Ben Bernanke discussed the economy with average Americans on Sunday, saying the current financial crisis could be even more virulent than the Great Depression.

“A lot of things happened, a lot came together, [and] created probably the worst financial crisis, certainly since the Great Depression and possibly even including the Great Depression,” Bernanke said at the start of a town-hall meeting in Kansas City.

Read moreBen Bernanke: This financial crisis may be worse than the Great Depression