At the start of this month, the gilts market appeared overwhelmed by the burgeoning demands of the UK government. Then the Bank of England sprang to the rescue, announcing that it would spend tens of billions of pounds acquiring government bonds. Gilts surged in response to this news. Economists applauded. Their reactions are mistaken. Quantitative easing, as it is called, poses a grave danger to Britain’s creditors. It is a perilous policy that threatens further disruption to the financial system at some future date.

On Thursday March 5, the Bank of England said it would acquire up to £75bn of gilts over the following three months. A further £75bn of Bank purchases have been earmarked. Relative to the size of the British economy, these are vast sums. The combined figure is roughly three times the stock of notes and coins in circulation and twice the country’s monetary base. It is also equal to almost a third of the stock of outstanding gilts. Put another way, the Bank is set to finance the largest peacetime deficit in British history.

Britain’s move into quantitative easing has mostly been greeted with cheers in the City. “For holders of gilts, this can only be good news,” commented the head of fixed income research at one broker. Another financial commentator estimated that buying gilts with newly printed money would save British taxpayers some £5bn in interest payments.

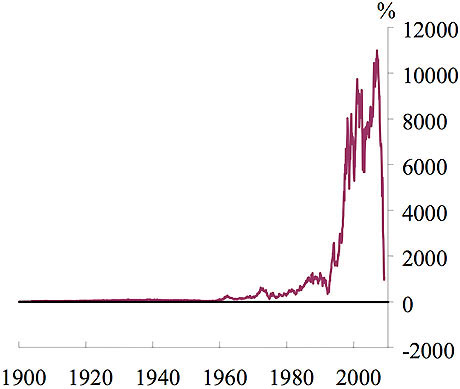

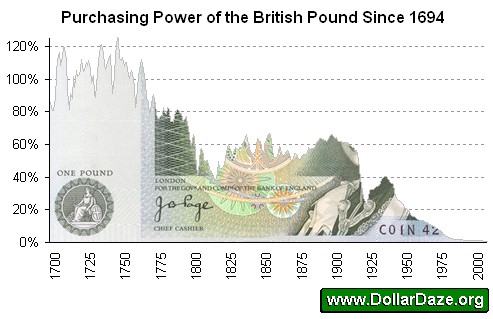

Yet long-term bondholders have nothing to celebrate. The aim of quantitative easing, after all, is to dispel deflation and achieve the Bank’s 2 per cent annual inflation target. There is no question that a determined central bank can get rid of deflation. It is simply a question of printing enough money. Economists have another term to describe the monetisation of government debt. The history of “seigniorage” goes back to the debasement of the coinage under the Roman emperors. Seigniorage is really a tax on holders of money and government debt which is paid via inflation. When carried to excess, it leads to hyperinflation.

The exponents of quantitative easing dismiss such fears. They claim that liquidity can easily be removed at some stage in the future. But what confidence should we place in the authorities to act in a timely fashion? After all, this crisis is largely the consequence of the Federal Reserve’s easy money policy at the beginning of the decade that fuelled the global housing bubble. If the economy remains stagnant, the Bank will probably be slow to remove the liquidity. In which case, there will be inflation.

An early experiment with quantitative easing occurred in Japan in 1932. At the time, the Bank of Japan financed a large fiscal expansion by printing money. In no time, Japan went from a severe deflation to near double-digit inflation. This monetary easing was never reversed and inflation escalated throughout the decade. After the second world war, the Fed likewise printed money to buy bonds. As a result, a mild deflation in 1949 was followed by inflation of about 10 per cent a couple of years later. Owners of Treasury bonds suffered heavy losses.

Read moreBeware Bank of England’s monetary con trick