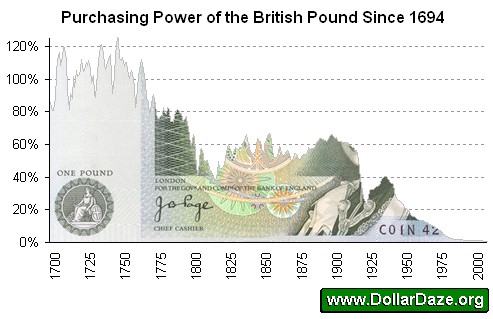

Quantitative easing = Creating money = Increasing the money supply = Inflation = Stealing

Inflation is a hidden tax:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

Source: The Financial Times

Mervyn King on Wednesday said the Bank of England could begin so-called “quantitative easing” as soon as next month, as he warned that the UK economy was in deep recession and that the risks to economic growth lay “heavily to the downside”.

Related article: ‘This is the worst recession for over 100 years’ (Independent)

He was speaking as the Bank unveiled its latest inflation report that suggested inflation will fall to 0.5 per cent and may remain well below the Bank’s 2 per cent target for much of 2010 and 2011.

In order to get more money flowing in the economy as interest rates approach zero, the governor of the Bank also said he was preparing to deploy quantitative easing – creating money to buy assets.

He said that interest rates would not have to fall to zero before starting quantitive easing, signalling that the Bank’s monetary policy committee could vote for such a move at its next monthly meeting. It also suggests that such unconventional measures could begin with gilt purchases.

Quantitative easing is aimed at increasing the money supply, getting banks to lend more, lowering interest rates and raising the level of inflation. (…and destroying the pound.)

The pound extended its losses on Wednesday after the release of the Bank’s latest warning on the UK economy.

Expectations that the Bank would embark on a policy of quantitative monetary easing undermined sterling.

The pound fell 1 per cent to $1.4385 against the dollar, lost 1.2 per cent to £0.8987 against the euro and fell 1.6 per cent to Y129.36 against the yen.

“Mr King is talking about turning on the printing press, which would effectively de-base the value of the pound,” said Paul Mackel at HSBC. “On the back of Mr King’s comments the path of least resistance is for sterling to weaken.”

The inflation report also reflected a dismal outlook for the economy. The Bank expects GDP would continue to decline until the final quarter of this year, hitting a low of minus 4 per cent in the second quarter compared with the year before.

This is much worse than the November forecast of the Bank’s inflation report, which foresaw a maximum of 1.9 per cent year on year drop in GDP.

The Bank forecasts that the decline in GDP this year will be amplified as companies run down stocks rather than make new orders as they fall short of working capital and their business prospects weaken. But it expects that companies will then ease their rate of destocking and begin to rebuild them, increasing output again.

At the lowest end of its forecast, the Bank said there was a chance that GDP could fall by as much as 6 per cent in the second quarter compared with the year before.

The Bank also spelled out its views on monetary policy as interest rates approach zero. It said that cuts in the Bank rate so far – from 4.75 per cent to 1 per cent since late 2008 – had fed through to consumers and businesses with longer term variable rate loans.

But it said that the transmission of lower interest rates to lending had been severely disrupted by the financial crisis, with interest rates for new lending to households tending to drop by much less than the fall in the bank rate.

“The net effect of these factors has blunted the impact of reductions in bank rate,” the report says.

In order to supplement normal interest rate policy, the Bank has been granted powers to use its asset purchase facility to buy up high-quality corporate debt to ease credit.

However, the Bank outlined its concerns about creating money, saying that there was a risk that banks would choose to hoard the funds rather than expand the supply of credit – as happened in Japan in the 1990s.

The Bank also said it was unclear how much using such purchases of assets improved liquidity or encouraged new issuance.

But it said it remained prepared to do whatever was needed to reach the inflation target.

“Whatever the uncertainties about the strength of the transmission mechanism, the private sector should be assured that the MPC will take the necessary to bring inflation back to target,” it said.

The Bank expects credit conditions over the forecast period to be tighter than had been expected in the November report, mainly because credit conditions for households had deteriorated. As a result of the extraordinary measures by the Bank and the government to stabilise financial markets – including the Bank’s £50bn asset purchase facility – lending to companies is expected to be better than assumed in its last report.

By Daniel Pimlott and Peter Garnham in London

11 Feb 2009 1:31pm