The Bank of England will be able to print extra money without having legally to declare it under new plans which will heighten fears that the Government will secretly pump extra cash into the economy.

The Bank of England will be able to print extra money

The Government is set to throw out the 165-year old law that obliges the Bank to publish a weekly account of its balance sheet – a move that will allow it theoretically to embark covertly on so-called quantitative easing. The Banking Bill, which is currently passing through Parliament, abolishes a key section of the law laid down by Robert Peel’s Government in 1844 which originally granted the Bank the sole right to print UK money.

The ostensible reason for the reform, which means the Bank will not have to print details of its own accounts and the amount of notes and coins flowing through the UK economy, is to allow the Bank more power to overhaul troubled financial institutions in the future, under its Special Resolution Authority.

However, some have warned that it means: “there is nothing to stop an unreported and unmonitored flooding of the money market by the undisciplined use of the printing presses.”

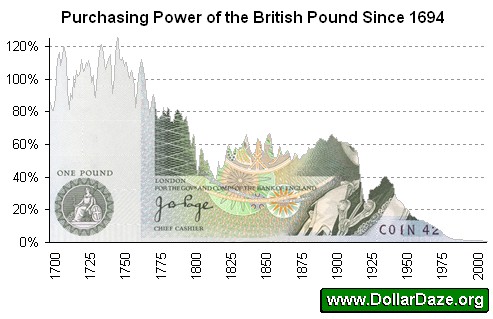

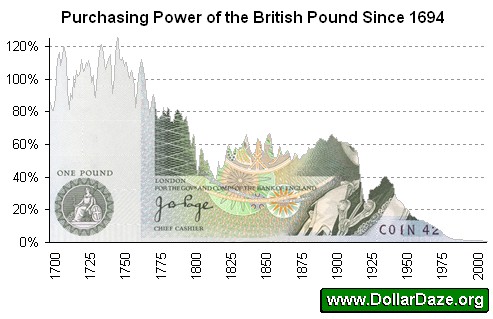

It comes after the Bank’s Monetary Policy Committee cut interest rates by half a percentage point, leaving them at the lowest level since the bank’s foundation in 1694.

With the Bank rate now at 1.5pc, most economists suspect the Government and Bank will soon be forced to start quantitative easing – directly increasing the quantity of money in the economy – in a drastic attempt to prevent a recession of unprecedented depth.

Quantitative easing means pure inflation.

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” – John Maynard Keynes

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.” – Alan Greenspan

Although the amount of easing is likely to be limited, news of this increased secrecy will spark comparisons with Weimar Germany and Zimbabwe, where uncontrolled use of the central banks’ printing presses ultimately caused hyperinflation.

Read moreReform plan raises fears of Bank secrecy