Nov. 15 (Bloomberg) — General Motors Corp., burning through cash as sales slump, would cost the government as much as $200 billion should the biggest U.S. automaker be forced to liquidate, a forecasting firm estimated.

A GM collapse would mean “more aid to specific states like Michigan, Ohio, and Indiana, and more money into unemployment and extended benefits,” Nariman Behravesh, chief economist at IHS Global Insight Inc. in Lexington, Massachusetts, said yesterday in an interview.

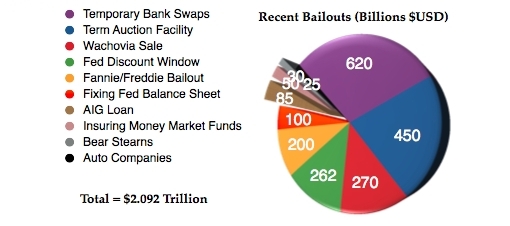

Behravesh’s projection of $100 billion to $200 billion in costs dwarfs the $25 billion industry bailout plan that will be debated in Congress next week to prop up Detroit-based GM, Ford Motor Co. and Chrysler LLC. The drain on taxpayers from a rescue or a GM failure is a central issue for U.S. lawmakers.

Included in the Global Insight estimate, which Behravesh supplied to Bloomberg News, are the anticipated costs for existing programs, such as unemployment insurance, and new measures that the economist said would be needed to revive economic growth after millions of auto-related job losses.

A GM shutdown would wipe out jobs among suppliers as well as at the automaker itself, pushing the U.S. unemployment rate next year to 9.5 percent, compared with current projections of as high as 8.5 percent, Behravesh said.

Read moreGM Collapse at $200 Billion Would Exceed Bailout Tab, Firm Says