There is an old adage on Wall Street that no one rings a bell at major market tops or bottoms. That may be true in normal times, but as many have noticed, we are now completely through the looking glass. In this parallel reality, Ben Bernanke has just rung the loudest bell ever heard in the foreign exchange and government debt markets. Investors who ignore the clanging do so at their own peril.

The bell’s reverberations will be felt by everyday Americans, whose lives are about to change in ways few can imagine. While nearly every facet of America’s economy has been devastated over the past six months, our national currency has thus far skipped through the carnage with nary a scratch. Ironically, the U.S. dollar has been the beneficiary of the global economic crises which the United States set in motion. As a result, our economy has thus far been spared the full force of the storm.

Related article: Terence Corcoran: Is this the end of America? (Financial Post)

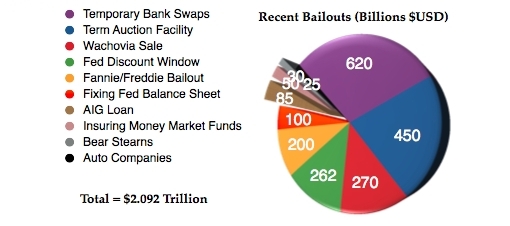

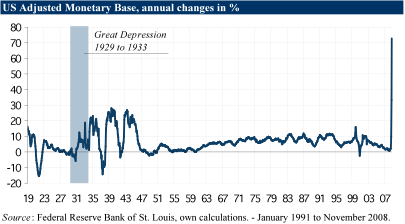

This week the Federal Reserve finally made clear what should have been obvious for some time – the only weapon that the Fed is willing to use to fight the economic downturn is a continuing torrent of pure, undiluted, inflation. The announcement should be seen as a game changer that redirects the fury of the financial storm directly onto our shores.

Both international speculators and ordinary Austrians want to get their hands on gold

Both international speculators and ordinary Austrians want to get their hands on gold