Dollar to fall to metals in upcoming rallies, rate hikes soon wont be able to fix economic problems, real inflation understated for years, USDX contracts plummet, why arent people fleeing from the stock market… Exchange Traded Funds are a disaster, losses from global write downs, Fed still invited to intervene in spite of failures

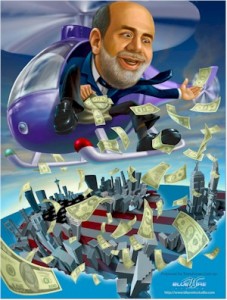

The dollar has once again collapsed. Get ready for the next dollar debacle and the coming rally in gold and silver which have just broken out. The elitists have lost all credibility. The would-be lords of the universe have told so many pathological lies that no one “in the know” believes anything emanating from the forked tongues of Buck-Busting, Bear-Bashing, Big-Ben Bernanke and Hanky Panky Paulson. If our Fed Head and Treasury Secretary had been characters in the Walt Disney movie entitled “Pinocchio,” their noses would have quickly grown to lengths that could have been wrapped around the earth’s equator several times. God would have had to reverse the earth’s rotation to extricate them.

Wall Street tells us the odds favor two quarter percent rate hikes to the Fed funds rate by the end of the year. We ask whether that would be before or after the economy collapses? If before, the Fed’s rate hikes will destroy what is left of our economy, and the dollar will collapse, thereby erasing any benefits from the rate hikes. If after, you will see rate cuts instead of rate hikes as the Fed attempts to save the fraudsters on Wall Street who are not even remotely close to recovering from the credit-crunch despite what the elitists might tell you to the contrary. We ask who the morons are that make up these odds, and what planet they come from. They give aliens a bad name. These index predictions are just another form of jaw-boning and disinformation.

As soon as the economy starts its final descent into Davy Jones’ Locker, which is likely to occur in the very near future, the Fed and the US Treasury will unceremoniously toss the so-called “strong dollar” policy into the nearest financial dumpster in order to save the economy and the fraudsters. Accompanying the “strong dollar” policy on its way to the dumpster will be the next round of derivative toxic waste that is on its way courtesy of the upcoming surge in fallout from tanking real estate markets in a process that will see the Fed blow what remains of its general collateral in exchange for such waste. Once the Fed’s general collateral is exhausted, we will be ushered into a new hyperinflationary era characterized by direct monetization of US treasuries to fund our deficits and to absorb more toxic waste as it continues to pour down on elitist financial institutions like Niagara Falls.

A few measly quarter percent cuts will do absolutely nothing to slow the acceleration of inflation, especially if the Fed keeps the M3 at current levels. Only a double-digit Fed funds rate and greatly reduced M3 could have any eventual and meaningful impact on the inflation that is built into the system for at minimum the next year and one half at levels in the area of 15% to 18%, and even then the impact will not be felt until the current baked-in inflation has run its course. Direct monetization of treasuries to replenish Fed collateral and to absorb our growing deficits will put inflation beyond the point of no return, as will the breaking of OPEC dollar pegs.

As you can see, there is no way that any of the proposed diminutive rate hikes will have a positive impact on the economy, on the dollar or on the balance sheets of the fraudsters. Therefore, there will not be any rate hikes. Any increase in the Fed funds rate would be accompanied by an economic catastrophe of epic proportions that would occur as a direct result of the raising of that rate. Any rate hike would take a year to a year and a half to have an impact on inflation. By the time the anticipated Fed rate hikes could have any kind of impact whatsoever, the economy will already be in a state of rampant hyperinflation, and would be well on its way to depression, far too late to save the dollar or the economy. Ergo, the new elitist motto will soon become: “Damn the inflation, full greed ahead!”

As the author of three books on mortgage finance and related derivative securities, and speaking as someone who first turned mortgages into rated securities in 1983, I’m going to let you in on an unfortunate little secret – the real subprime mortgage securitization crisis may not have even started yet. But, there is a good chance the real crisis will arrive soon.

As the author of three books on mortgage finance and related derivative securities, and speaking as someone who first turned mortgages into rated securities in 1983, I’m going to let you in on an unfortunate little secret – the real subprime mortgage securitization crisis may not have even started yet. But, there is a good chance the real crisis will arrive soon.