Must-read.

See also RBS chief credit strategist issues red alert on global stock markets

Bernanke has pulled out all the stops.

Credit is not flowing. In fact, credit is contracting. That means things aren’t getting better; they’re getting worse. When credit contracts in a consumer-driven economy, bad things happen. Business investment drops, unemployment soars, earnings plunge, and GDP shrinks. The Fed has spent more than a trillion dollars trying to get consumers to start borrowing again, but without success. The country’s credit engines are grinding to a halt.

Bernanke has increased excess reserves in the banking system by $800 billion, but lending is still slow. The banks are hoarding capital in order to deal with the losses from toxic assets, non performing loans, and a $3.5 trillion commercial real estate bubble that’s following housing into the toilet. That’s why the rate of bank failures is accelerating. 2010 will be even worse; the list is growing. It’s a bloodbath.

The standards for conventional loans have gotten tougher while the pool of qualified credit-worthy borrowers has shrunk. That means less credit flowing into the system. The shadow banking system has been hobbled by the freeze in securitization and only provides a trifling portion of the credit needed to grow the economy. Bernanke’s initiatives haven’t made a bit of difference. Credit continues to shrivel.

The S&P 500 is up 50 percent from its March lows. The financials, retail, materials and industrials are leading the pack. It’s a “Green Shoots” Bear market rally fueled by the Fed’s Quantitative Easing (QE) which is forcing liquidity into the financial system and lifting equities. The same thing happened during the Great Depression. Stocks surged after 1929. Then the prevailing trend took hold and dragged the Dow down 89 percent from its earlier highs. The S&P’s March lows will be tested before the recession is over. Systemwide deleveraging is ongoing. That won’t change.

No one is fooled by the fireworks on Wall Street. Consumer confidence continues to plummet. Everyone knows things are bad. Everyone knows the media is lying. Credit is contracting; the economy’s life’s blood has slowed to a trickle. The economy is headed for a hard landing.

Bernanke has pulled out all the stops. He’s lowered interest rates to zero, backstopped the entire financial system with $13 trillion, propped up insolvent financial institutions and monetized $1 trillion in mortgage-backed securities and US sovereign debt. Nothing has worked. Wages are falling, banks are cutting lines of credit, retirement savings have been slashed in half, and home equity losses continue to mount. Living standards can no longer be bandaged together with VISA or Diners Club cards. Household spending has to fit within one’s salary. That’s why retail, travel, home improvement, luxury items and hotels are all down double-digits. The easy money has dried up.

According to Bloomberg:

“Borrowing by U.S. consumers dropped in June for the fifth straight month as the unemployment rate rose, getting loans remained difficult and households put off major purchases. Consumer credit fell $10.3 billion, or 4.92 percent at an annual rate, to $2.5 trillion, according to a Federal Reserve report released today in Washington. Credit dropped by $5.38 billion in May, more than previously estimated. The series of declines is the longest since 1991.

A jobless rate near the highest in 26 years, stagnant wages and falling home values mean consumer spending… will take time to recover even as the recession eases. Incomes fell the most in four years in June as one-time transfer payments from the Obama administration’s stimulus plan dried up, and unemployment is forecast to exceed 10 percent next year before retreating.” (Bloomberg)

What a mess. The Fed has assumed near-dictatorial powers to fight a monster of its own making, and achieved nothing. The real economy is still dead in the water. Bernanke is not getting any traction from his zero-percent interest rates. His monetization program (QE) is just scaring off foreign creditors. On Friday, Marketwatch reported:

“The Federal Reserve will probably allow its $300 billion Treasury-buying program to end over the next six weeks as signs of a housing recovery prompt the central bank to unwind one its most aggressive and unusual interventions into financial markets, big bond dealers say.”

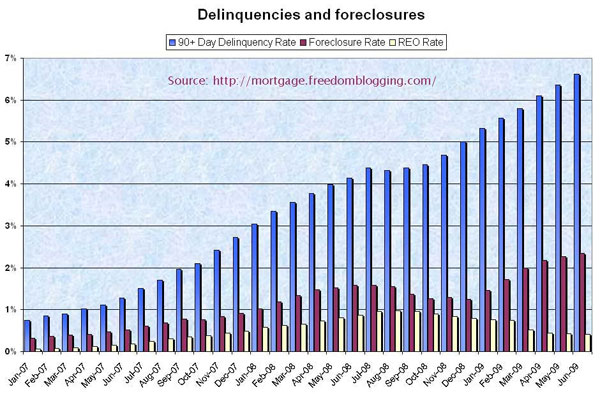

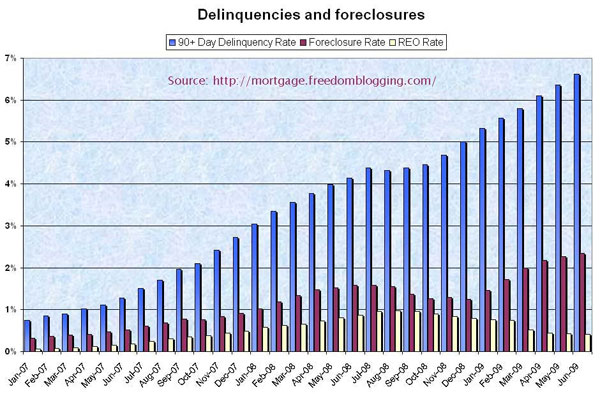

Right. Does anyone believe the housing market is recovering? If so, please check out this chart and keep in mind that, in the first 6 months of 2009, there have already been 1.9 million foreclosures.

The Fed is abandoning the printing presses (presumably) because China told Geithner to stop printing money or they’d sell their US Treasuries. It’s a wake-up call to Bernanke that the power is shifting from Washington to Beijing.

That puts Bernanke in a pickle. If he stops printing; interest rates will skyrocket, stocks will crash and housing prices will tumble. But if he continues QE, China will dump their Treasuries and the greenback will vanish in a poof of smoke. Either way, the malaise in the credit markets will persist and personal consumption will continue to sputter.

Read moreUS Economy: This is No Recession. It’s a Planned Demolition