Baltic Exchange Dry Index (BDI)

20 day exponential average in red.

200 day exponential average in green.

I expect the next leg down in the markets any time soon.

After all those banks have invested their bailout/taxpayer money in the stock market it is about time that investors are coming back to their senses and take a look at the fundamentals, realizing that the Fed and the US government have just created another even bigger bubble. Now we have even several bubbles that are about to burst.

The biggest Ponzi scheme in the world is run by the Federal Reserve and not by China.

The Baltic Dry Index is an excellent indicator, because it can’t be (that easily) manipulated.

China is also in trouble, partly because it has also applied the dead wrong US bailout/stimulus policies, but when the world realizes that the US has entered into the Greatest Depression, China – or better China’s elite – will greatly benefit from that.

The people will of course suffer.

China has effectively ‘written off’ its investment in US Treasuries. China is not stupid.

Be prepared.

(Note: This is not an investment advice.)

China’s loan growth plunged in July while exports fell 23pc from a year ago after grinding lower for nine months as consumers in the West tighten their belts further.

Can the world rely on China’s growth miracle to power recovery?

The data raise fresh doubts about the strength of global trade and whether the world can rely on China’s growth miracle to power recovery.

Separately, the Baltic Dry Index – measuring freight rates for bulk goods – has tipped over, dropping 25pc since late July. The shipping figures buttress reports that China has stopped building up stocks of metals and other commodities after a spate of frantic buying over the early summer.

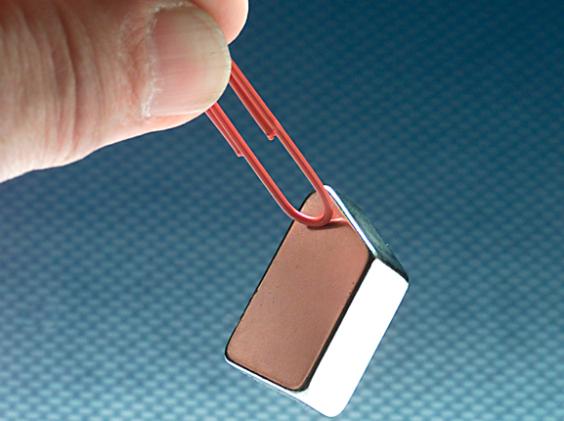

(China does not have stopped building up stocks of metals and other commodities. It is also buying mining companies or at least stakes in them.

– Coal Miner in Australia Agrees to Chinese Bid (New York Times)

– China Hunger for Australia’s Minerals Undeterred by Hu Dispute (Bloomberg)

That trend will continue, because it is China’s best way to diversify itself further away from the soon to be worthless US dollar. 🙂 )

China’s central bank said loan growth fell to $52bn (£31bn) from $248bn a month earlier, although it is too early to tell whether Beijing has begun to rein in credit after the explosion of bank loans in the first half of the year.

The loan figures are being watched closely by analysts and traders in the City. Excess liquidity in China has been a key driver of global markets since the rally began in March.

Beijing is walking a tightrope by trying to offset the collapse in exports – almost 40pc of GDP – with an investment blitz in roads, railways, and industry through state-owned companies.

The real economy cannot absorb the money, so it is leaking into asset speculation. The central bank estimates that 20pc of fresh credit has ended up in equity markets. The Shanghai index is up 80pc this year, though profits have fallen by almost a third. The pattern echoes the final phase of Japan’s Nikkei bubble in 1989.

“China is a big fat tail risk for world markets,” said Hans Redeker, currency chief at BNP Paribas. “Shanghai equities have reached the same extreme as in late 2007. The country will have to cut credit growth, and when this happens, Shanghai equities and commodities will suffer. That is what could bring this global rally to a halt.”

China Construction Bank, the number two lender, is cutting loans by 70pc over the second half of the year. “We noticed that some loans didn’t go into the real economy. Housing prices are rising too fast,” said the bank’s president, Zhang Jianguo.

Andy Xie, a leading consultant, said China’s boom was a “giant Ponzi scheme” that was likely to “bring very bad consequences” for the country.

“The stock market is in a final frenzy again. The most ignorant retail investors are being sucked in by rising momentum,” he said. Equities are overvalued by 50pc to 100pc.

Read moreChina: Credit tightening threatens ‘giant Ponzi scheme’