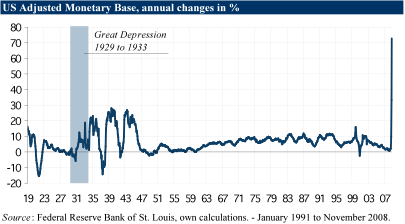

A few weeks ago when the Fed announced a strategy designed to bring down long-term interest and home mortgage rates through unlimited Treasury bond purchases, government debt staged a spectacular rally. To the unschooled market observer, the spike may be difficult to understand. After all, why would the value of Treasury bonds rise while their underlying credit quality is deteriorating faster than Bernie Madoff’s social schedule? The move is actually a perfect illustration of the tried and true Wall Street strategy of “buy the rumor and sell the fact”.

If it is well known that Fed will be a big purchaser of Treasuries, those buying now will be positioned to unload their holdings when the buying spree begins. If the Fed pays higher prices in the future, traders can earn riskless speculative profits. If the traders lever up their positions, as many are likely doing, even small profits can turn unto huge windfalls.

The downside of course, is that all of the demand for Treasuries is artificial. Treasuries are now in the hands of speculators looking to sell, not investors looking to hold. These players are analogous to the mid-decade condo-flippers who flocked to new developments for quick profits. They did not intend to occupy their properties, but rather flip them to future buyers. Once these properties came back on the market, condo prices collapsed, as developers were forced to compete for new sales with their former customers.

This is precisely what will happen with Treasuries. Just as the U.S. government issues mountains of new debt to finance the multi-trillion annual deficits planned by the Obama Administration, speculative holders of existing debt will be offering their bonds for sale as well. In order to prevent a complete collapse in the bond prices the Fed will be forced to significantly increase its buying.

However, since the only way the Fed can buy bonds is by printing money, the more bonds they buy the more inflation they will create. As inflation diminishes the investment value of low-yielding Treasuries, such a scenario will kick off a downward spiral. But the more active the Fed becomes in their quest to prop up bond prices, the bigger the incentive to hit the Fed’s bid. The result will be that all Treasuries sold will be purchased by the Fed. But with the resulting frenzy in the Treasury market, and with inflation kicking into high gear, we can expect that demand for other debt classes that the Fed is not backstopping, such as corporate, municipal and agency debt, to fall through the floor, pushing up interest rates across the board.

In order to “save” the economy from these high rates the Fed will then have to expand its purchases to include all forms of debt. If that happens, run-away inflation will quickly turn into hyper-inflation, and our currency will be worthless and our economy left in ruins.

Read morePeter Schiff: The Fed’s Bubble Trouble