MUST-LISTEN!!!

FULL INTERVIEW: MP3: Leuren Moret & Chistopher Busby (The Real Deal):

NB: The mp3 link has been corrected with the February 2012 interview.

Part 1:

– Fallujah, Fukushima, & the Global Radiation Catastrophe, Part 1 (Veterans Today, Feb. 13, 2012)

Part 2:

– Fallujah, Fukushima, & the Global Radiation Catastrophe, Part 2 (Veterans Today, Feb. 23, 2012):

The 20th century proved to be a century of great advancement towards the centuries old goals of the ruling elite – global slavery and total control of the world’s resources.

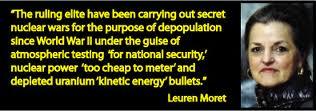

Through the Bilderberg Group, Council on Foreign Relations (CFR), Vatican, CIA and MI6, and the European Union (EU), and profiteering from the global drug economy – the ruling elite have developed their agenda to depopulate and remove independence from all countries and permit the aristocracies tyrannical rule from behind the military might of the United Nations (UN). Covert and overt nuclear wars are causing a catastrophic decline in the global population, funded by profiteering war mongering bankers, and politicians who authorized the use of genocidal nuclear weapons while investing in pharmaceutical companies to treat the epidemic of global illnesses caused by their nuclear weapons.

The recent skiing accident by Dutch Prince Friso, led to the exposure of the deep criminal activities of the Dutch and other aristocracies: “Grim Tidings From the Netherlands: Prince Bernhard’s Grandchildren Continue Bilderberg Legacy”. For centuries, through the Dutch East India Company, the deep involvement of the Dutch crown in the global drug trade has now been exposed as the source of the Dutch monarchies tremendous wealth. As second son, Prince Friso was involved in many aspects of the development of technologies for total control of the human race from space (HAARP), was employed by Goldman Sachs (the Rothschild bankers), Wolfenson of the World Bank, and presently a uranium enrichment company. Despite being a homosexual, he married the former girlfriend of one of the top ten drug dealers (a Dutchman) in the world – with ties to Queen Beatrix (his mother) through her lawyer. The aristocracy likes to keep their enterprises “in the family””The Real Deal” Radio Show (February 3, 2012)

“The Real Deal” Radio Show (February 3, 2012)

Host: Jim Fetzer: James Fetzer Ph.D.

Guests:

Dr. Busby: Christopher Busby, Ph.D.

Leuren Moret: Leuren Moret, B.S., M.A., PhD (ABD)

Editor’s Note: This transcription was prepared by William B. Fox, Publisher, America First Books, who also helped organize this interview. Let me add a special note of appreciation to Leuren Moret, who has done a brilliant job of providing the photos and graphs that accompany Part 1 and Part 2, which have substantially enhanced the presentation of the stunning information provided by her and Christopher Busby during this historic interview. They both deserve our highest praise and commendation.

Hour Two

Dr. Fetzer: This is Jim Fetzer, your host on “The Real Deal”, continuing my conversation with Leuren Moret, an independent geoscientist, who has done expert studies on Fukushima among her other research efforts, and Dr. Christopher Busby, visiting Biomedical Studies Professor at the University of Ulster, expert on the effects on what turns out to be enriched uranium in Iraq, and who has authored a new book in Japanese about the Fukushima disaster. Leuren, I know you have a number of things you would like to say.

Leuren Moret: Yes, in 2009 I was invited to my second War Crimes Conference in Malaysia by Tun Dr. Mahathir [former Prime Minister of Malaysia], and Chris was there in 2007. He did an absolutely wonderful, wonderful presentation. And my presentation in 2009 was titled “UN 2008 Report Evidence of Global Decline in Population and Fertility”. I put up two United Nations [UN] diagrams [Fig. 8, 10] from that report – their [UN] own report – that demonstrated that since 1986 all countries in the world, all regions in the world, have had declining populations and declining fertility.

Read moreInterview With Prof. Dr. Busby And Leuren Moret – Fallujah, Fukushima And The Global Radiation Catastrophe … Exposing Worldwide Depopulation And Genocide