Economy

George Carlin: The American Dream (Video)

Flashback.

Description:

“You have to be asleep to believe it.”

A short excerpt from the video “Life Is Worth Losing” (2005).

The Shorts Have Left The Building

– The Shorts Have Left The Building (ZeroHedge, Feb. 10, 2012):

Following the market’s “sudden” realization in December that the ECB had been quietly pumping $800 billion, or more than the entire QE2, into the market (sterilized? yeah right – when one lends out cash in exchange for worthless crap nobody else wants, and certainly not the Bundesbank, it is not sterilized), it became all too clear that the market’s response in 2012 would be a deja vu of 2011, if only for a while. Sure enough 2012 has been a tic-for-tic transposition of the market move in 2011. The only question is how far it would go, before, like back in 2011 again, it rolled over. To get a sense of one of the best indicators of an overextended rally, we go to the NYSE whose short interest update confirms that the rally, at least based on ongoing short squeeze dynamics (which as we said in mid-January has been the best strategy for a bizarro market) is now over. Sure enough, according to the latest data, short interest has collapsed from a multi-year high in September of 16 billion shorts, which coincided with the market lows, to essentially the lowest print seen in the past 4 years at 12.5 billion shares, a level which has not been breached once in the New Normal phase of market central planning. In other words, those who look at short interest and covering as a market inflection point, the time has come to take advantage of the short mauling, and bet on the market rolling over. That said, all it takes is for a central bank chairman somewhere to sneeze the wrong way, and this best laid plan will promptly collapse.

9/11: Take Our World Back! Government And Media Deceptions Exposed

For your information…

– Take Our World Back! (Take Our World Back)

Read more9/11: Take Our World Back! Government And Media Deceptions Exposed

9/11: Scientific Evidence For Reality Deniers

9/11: It Wasn’t Muslims!

Rabbi Confesses That Israel Conducted The 9/11 Attacks (Video)

Flashback:

– The US Military now KNOWS Mossad carried out 9/11 Attacks:

Dr. Alan Sabrosky, former director of studies at the US Army War College says that the military brass now know that Israel “and those traitors within our nation” committed the 911 attack.

……”I have had long conversations over the last two weeks with contacts at the Army War College and the headquarters, Marine Corps and I’ve made it absolutely clear in both cases that it is 100% certain that 9/11 was a Mossad operation.” Period.

……”There are some really, really unhappy people up there…….astonishment was the first thing…..they didn’t know, they truly didn’t know……and the next statement is rage…real rage”

……” The Zionists are playing this as an all-or-nothing exercise. If they lose this one, they’re done…..”

On Al-CIAda:

“The truth is, there is no Islamic army or terrorist group called Al Qaeda. And any informed intelligence officer knows this. But there is a propaganda campaign to make the public believe in the presence of an identified entity representing the ‘devil’ only in order to drive the TV watcher to accept a unified international leadership for a war against terrorism. The country behind this propaganda is the US.”

– Robin Cook, Former British Foreign Secretary

– Al Qaeda Doesn’t Exist or How The US Created Al Qaeda (Documentary)

– BBC: Al-Qaeda Does Not Exist

Just one month after his article in the Guardian Robin Cook DIED:

Flashback: Loose Change (Final Cut)

– 9/11 Commission Admits: We Never Got All Of The Facts

– Architects & Engineers: Solving The Mystery Of WTC 7

Read moreRabbi Confesses That Israel Conducted The 9/11 Attacks (Video)

S&P Downgrades 34 Of 37 Italian Banks!

– S&P Downgrades 34 Of 37 Italian Banks – Full Statement (ZeroHedge, Feb. 10, 2012):

S&P just downgraded 34 of the 37 Italian banks it covers. Below is the full statement. And so get get one second closer to midnight for Europe’s AIG equivalent: A&G. As for S&P, this is the funniest bit: “We classify the Italian government as “supportive” toward its banking sector. We recognize the government’s record of providing support to the banking system in times of stress.” Even rating agencies now have to rely on sovereign risk transfer as the only upside case to their reports. Oh, and who just went balls to the wall Italian stocks? Why the oldest (no pun intended) contrarian indicator in the book – none other than permawrong Notorious (Barton) B.I.G.G.S.

Mainly Negative Rating Actions Taken On 37 Italian Financial Institutions On Sovereign Downgrade And BICRA Change

LONDON (Standard & Poor’s) Feb. 10, 2012–Standard & Poor’s Ratings Services today said it has lowered its ratings on 34 Italy-based financial institutions. The downgrades follow the lowering of the unsolicited long- and short-term sovereign credit ratings on the Republic of Italy (BBB+/Negative/A-2; see “Italy’s Unsolicited Ratings Lowered To ‘BBB+/A-2’; Outlook Negative,” published Jan. 13, 2012, on RatingsDirect on the Global Credit Portal). They also reflect the revision of our Banking Industry Country Risk Assessment (BICRA) on Italy to group ‘4’ from group ‘3’, and of our economic risk and industry risk scores–both components of the BICRA–on Italy to ‘4’ from ‘3’ (see “BICRA On Italy Revised To Group ‘4’ From Group ‘3’ On Weakening Economic And Banking Industry Conditions,” published Feb. 10, 2012).

US: ‘Fewer Young Adults Hold Jobs Than Ever Before’ (CNN)

In Europe:

In the US:

– Collapse: 50% Of Americans Poor Or Near Poor (Video)

Flashback:

– Hiding The Greatest Depression: How The US Government Does It:

The real US unemployment rate is not 9.8% but between 25% and 30%.

I told you many times before that this is the GREATEST DEPRESSION (and the greatest financial collapse in world history is coming)!

Prepare for collapse!

– Fewer young adults hold jobs than ever before (CNN, Feb. 9, 2012):

NEW YORK — The share of young adults with jobs has hit its lowest level since the government started keeping records just after World War II.

By the end of 2011, only 54.3% of those between the ages of 18 and 24 were employed, according to a Pew Research Center report released Thursday. And the gap in employment between the young and all working-age adults is roughly 15 percentage points — the widest on record.

Read moreUS: ‘Fewer Young Adults Hold Jobs Than Ever Before’ (CNN)

Greek Police Union Threatens To Arrest EU/IMF Officials Due To ‘Austerity Demands’

Now even the police is finally waking up!(?)

Flashback:

– Max Keiser on Greece: ‘The IMF is a Financial Mafia’ (April 28, 2010):

The only solution for Greece is to arrest the Goldman Sachs bankers immediately and all those involved in the fabrication of Greek economic data in 2000, when you became a member of the eurozone. The next step is to nationalize all banks like Sweden did in 1993. The International Monetary Fund is that last thing you need. You will lose your sovereignty. It exercises terrorism. You will be raped in such a way, that it will be the worst pain you have ever felt.

– Greek Police Threaten IMF Arrests Due To “Austerity Demands” (ZeroHedge, Feb. 9, 2011)

As the headlines from Europe become more and more realistic (and ironically more and more Onion-worthy), Reuters notes one of the more interesting examples of just how the Greek people are feeling. The Federation of Greek Police have accused EU/IMF officials, in a formal letter, of “…blackmail, covertly abolishing or eroding democracy and national sovereignty”. While violence erupts among the largely unemployed youth, the supposedly ‘grown-up and responsible’ segment of the Greek society, which for now at least appears not to be on strike, is recognizing the wholesale destruction of their society (as 22% cuts in minimum wage for instance are thrust upon them). The Greek police, who have stood against the protesters and done their jobs facing threats and anger, are seemingly expressing solidarity with the antagonists as they call out ECB, European Commission, and IMF leaders for their destructive policies. At what point do the police throw down their riot shields and follow the Greek people into their ‘Bastille’?

Reuters: Greek Police Union Wants To Arrest EU/IMF Officials

Feb 10 (Reuters) – Greece’s largest police union has threatened to issue arrest warrants for officials from the country’s European Union and International Monetary Fund lenders for demanding deeply unpopular austerity measures.

In a letter obtained by Reuters on Friday, the Federation of Greek Police accused the officials of “…blackmail, covertly abolishing or eroding democracy and national sovereignty“ and said one target of its warrants would be the IMF’s top official for Greece, Poul Thomsen.

The threat is largely symbolic since legal experts say a judge must first authorize such warrants, but it shows the depth of anger against foreign lenders who have demanded drastic wage and pension cuts in exchange for funds to keep Greece afloat.

“Since you are continuing this destructive policy, we warn you that you cannot make us fight against our brothers. We refuse to stand against our parents, our brothers, our children or any citizen who protests and demands a change of policy,” said the union, which represents more than two-thirds of Greek policemen.

Read moreGreek Police Union Threatens To Arrest EU/IMF Officials Due To ‘Austerity Demands’

Greece Responds To Troika Deal With Immediate Two Day Strike, Threatens With ‘Social Uprising’

– Greece Responds To Troika Deal With Immediate Two Day Strike, Threatens With “Social Uprising” (ZeroHedge, Feb. 9, 2011)

Even as the ECB’s very own Mario Draghi is now peddling Greek deal rumors, which are essentially a reaffirmation that the country will “pledge” to return to GDP growth in 2013, we are already seeing real, not pledged, or promised, consequences of this deal, whether real or not (ignoring that Venizelos just said that it would actually take up to 15 days to finalize it, something which means the Greek exchange offer is DOA) namely that the crippling economic collapse discussed extensively on these pages is about to get far worse. AP reports: “Angry union leaders announced a 48-hour general strike for Friday and Saturday.” “We are moving to a social uprising,” said ADEDY Secretary Genera Iliopoulos.” Surely this is the fastest shortcut for Greece to meet or beat expectations of halting the 10% drop in its GDP and convert that number to positive. One can only hope that makers of bulletproof vests can compensate the economic collapse as every other part of the economy shuts down.

The unions, General confederation of Workers of Greece (GSEE) and Civil Servants Supreme Administrative Council (ADEDY), announced on Thursday that their members will go on a two-day strike from Friday in protest at the controversial decision.

“We will hold a general strike on Friday and Saturday along with the civil servants’ union,” said a spokeswoman with GSEE which represents the private sector.

ADEDY’s Secretary General Ilias Iliopoulos described the measures as “painful” which will “create misery for youths, unemployed and pensioners do not leave us much room.”

“We are moving to a social uprising,” said Iliopoulos.

A World In Debt (Infographic)

Excellent work! A must-see!

– Global Financial Crisis: A World In Debt (Demonocracy):

World governments have borrowed massive amounts of money to live beyond their means. Here are the world’s largest economies, and how much they borrowed.

Some quotes:

“There are two ways to conquer and enslave a nation. One is by the sword. The other is by debt. ”

– John Adams“I place the economy among the first and most important virtues, and public debt as the greatest of dangers.”

– Thomas Jefferson“The one aim of these financiers is world control by the creation of inextinguishable debts.”

– Henry Ford“There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.”

– Ludwig von Mises‘Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren,” Obama said in a 2006 floor speech that preceded a Senate vote to extend the debt limit. “America has a debt problem and a failure of leadership.’

– Barack Obama (ROFL!)“When a country embarks on deficit financing and inflationism you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard. ”

– Alan Greenspan“Capital must protect itself in every way… Debts must be collected and loans and mortgages foreclosed as soon as possible. When through a process of law the common people have lost their homes, they will be more tractable and more easily governed by the strong arm of the law applied by the central power of leading financiers. People without homes will not quarrel with their leaders. This is well known among our principle men now engaged in forming an imperialism of capitalism to govern the world. By dividing the people we can get them to expend their energies in fighting over questions of no importance to us except as teachers of the common herd.

– J. P. Morgan“The dollar represents a one dollar debt to the Federal Reserve System. The Federal Reserve Banks create money out of thin air to buy Government Bonds from the U.S. Treasury…and has created out of nothing a … debt which the American people are obliged to pay with interest.”

– Wright Patman

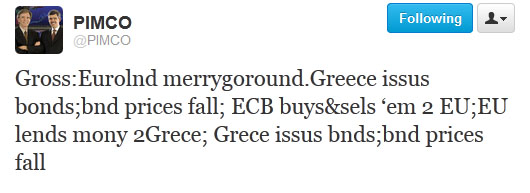

PIMCO’s Bill Gross Explains The European Ponzi

– Bill Gross Explains The European Ponzi (ZeroHedge, Feb. 8, 2012):

Not like it is news, but… Out of one pocket, into another, and in the mean time “things get better” as Gross explains below. That said, we hope Bill knows where Allianz of A&G fame (which just happens to be the closest comp to our own AIG) falls in the pecking order of the European house of cards.

President Obama Freezes All Iranian Assets In The US (Video)

YouTube Added: 06.02.2012

Description:

The United States has escalated tensions with Iran once again, this after President Obama called for a freeze of all Iranian assets held in the US. The executive order signed on Monday was in reaction to what the US is calling “deceptive practices” by Iran. Israel has also joined in by stepping up threats against Iran, and US Secretary Defense Leon Panetta has acknowledged Israel may attack Iran in the next 90 days. Vijay Prashad, director of International Studies at Trinity College, takes a deeper look on the escalated possibility of war.

Flashback:

– George Galloway: The Case Against War With Iran (Must-Listen!!!)

‘Iran Hasn’t Invaded Another Country In More Than 300 Years.’

More on Iran:

– Commander-In-Thief Obama Signs Executive Order Freezing Iran Assets In US (Video)

– Former Member Of The Russian Joint Chiefs Of Staff: Russia Is Ready to Defend Iran and Syria

– Iran, Gold and Oil – The Next Banksters War

Read morePresident Obama Freezes All Iranian Assets In The US (Video)

GlaxoSmithKline Clears Cash From Eurozone On A DAILY BASIS!!!

– GlaxoSmithKline clears cash from eurozone on a daily basis (Telegraph, Feb. 7, 2012):

GlaxoSmithKline is clearing cash out of eurozone countries on a daily basis to protect itself against a potential banking and liquidity crisis in the region.

Sir Andrew Witty, chief executive of Britain’s biggest drug maker, said that early last year the company had started emptying “tens of millions of pounds” in cash every day out of most eurozone countries into accounts in Britain.

“We don’t leave any cash in most European countries. We sweep any cash we raise during the day out of local banks into banks we think are robust and secure,” he added. “You do your best to actively manage the risk.”

Read moreGlaxoSmithKline Clears Cash From Eurozone On A DAILY BASIS!!!

Spiegel: ‘It’s Time To End The Greek Rescue Farce’

– Spiegel: “It’s Time To End The Greek Rescue Farce” (ZeroHedge, Feb. 7, 2012):

Back in July of 2011, when we first predicted the demise of the second Greek bailout package, even before the details were fully known in “The Fatal Flaw In Europe’s Second “Bazooka” Bailout: 82 Million Soon To Be Very Angry Germans, Or How Euro Bailout #2 Could Cost Up To 56% Of German GDP” we asked, “what happens tomorrow when every German (in a population of 82 very efficient million) wakes up to newspaper headlines screaming that their country is now on the hook to 32% of its GDP in order to keep insolvent Greece, with its 50-some year old retirement age, not to mention Ireland, Portugal, and soon Italy and Spain, as part of the Eurozone? What happens when these same 82 million realize that they are on the hook to sacrificing hundreds of years of welfare state entitlements (recall that Otto von Bismark was the original welfare state progentior) just so a few peripheral national can continue to lie about their deficits (the 6 month Greek deficit already is missing Its full year benchmark target by about 20%) and enjoy generous socialist benefits up to an including guaranteed pensions? What happens when an already mortally wounded in the polls Angela Merkel finds herself in the next general election and experiences an epic electoral loss? We will find out very, very shortly.” Alas, it has not been all that very “shortly”, as once again we underestimated people’s stupidity and willingness to pay the piper of a crumbling economic and monetary system. But our prediction is finally starting to come true. Spiegel has just released an article, which encapsulates what well over 50% of Germans think, who say that the time to let Greece loose, has come.

From Der Spiegel

It’s Time To End the Greek Rescue Farce

Whether it be an escrow account or a budget commissioner, the latest demands by Germany show just how absurd negotiations over Greece’s future have become. It is high time to bring an end to this tragicomedy.

IMF Begs Beijing To Prepare Stimulus

– IMF Urges Beijing to Prepare Stimulus (Wall Street Journal, Feb. 7, 2012):

China should be prepared to sharply stimulate its economy if Europe’s growth falls more than anticipated, the International Monetary Fund said, adding to expectations that Beijing could turn to spending if conditions significantly worsen.

In its China economic outlook report released on Monday, the IMF urged China to run a deficit of 2% of GDP rather than looking to reduce the country’s deficit as planned, given the uncertainty in the global economy.

If Europe’s problems turned out to be worse than expected, China should hit the fiscal gas pedal harder. In that case, “China should respond with a significant fiscal package” of about 3% of GDP, the IMF said, including reductions in consumption taxes and new subsidies for consumer-goods purchases and for corporate investments in pollution-control equipment.

‘Quality Assessment’ Of US Jobs Reveals The Ugliest Picture Yet

– A “Quality Assessment” Of US Jobs Reveals The Ugliest Picture Yet (ZeroHedge, Feb. 7, 2012):

Over the past week we have repeatedly exposed the BLS’ shennanigans to both keep the headline unemployment rate suppressed and to generate an upward bias in the market courtesy of a “bigger than expected beat” of expectations. Granted, various semantics experts continue to scratch their heads in attempting to explain a collapsing labor force when even Goldman’s Sven Jari Stehn just predicted that it will drop to 63.1% by the end of 2012 (and 62.5% by the end of 2015). Funny then that the US will have no unemployment left when the participation rate drops to 58.5%. And no, the “population soared argument based on revised data” doesn’t quite cut it when the bulk of said surge not only did not get a job, but was not even counted toward the labor force. Yet what the biggest flaw with all these arguments that vainly (and veinly) attempt to defend the US economy as if it is growing, is that they focus exclusively on the quantity of jobs, doctored or not, and completely ignore the quality. We have decided to step in and fill this void.

By now, most of our readers know that every incremental dollar of public debt leads to less than one dollar of GDP growth, courtesy of the debt/GDP ratio having surpassed 100% a month ago. Yet what most don’t know is that the marginal utility of public debt is not the only thing that may have peaked: as of January 31, 2012, the date of the most recent BLS jobs report, it appears that the “marginal utility” of job formation (if such a concept existed) also turned negative. And since it doesn’t exist, yet, allows us to explain.

Read more‘Quality Assessment’ Of US Jobs Reveals The Ugliest Picture Yet

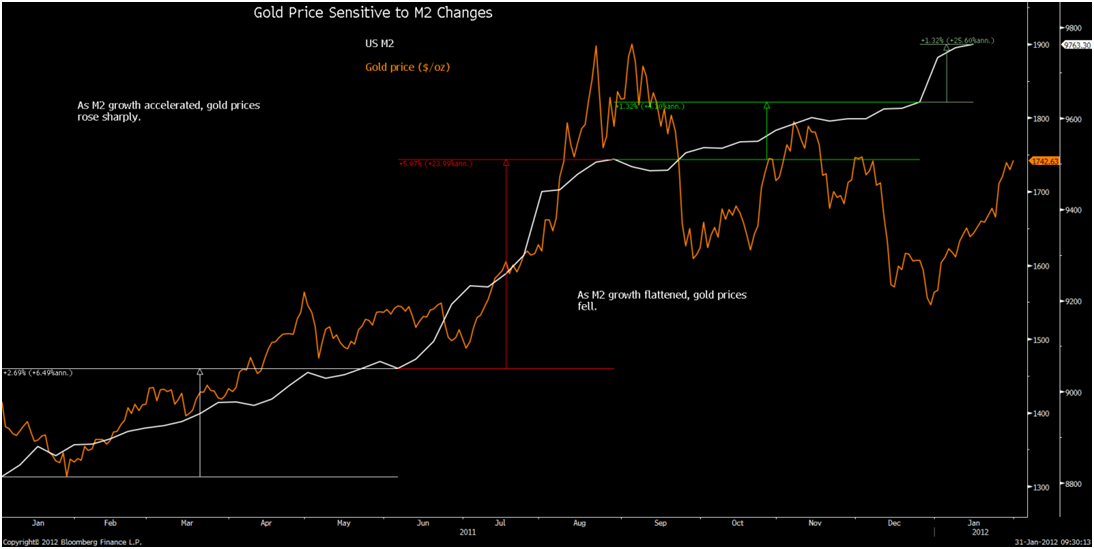

Federal Reserve’s Record Setting Money Supply Splurge Spurs Gold’s Rally

– Fed’s Record Setting Money Supply Splurge Spurs Gold’s Rally (ZeroHedge, Feb. 7, 2012):

Fed’s Record Setting Money Supply Splurge Spurs Gold’s Rally

The surge in the U.S. money supply in recent years has sent gold into a series of new record nominal highs.

Money supply surged again in 2011 sending gold to new record nominal highs.

Money supply has grown again, by more than 35% on an annualized basis, and this is contributing to gold’s consolidation and strong gains in January.

The Federal Reserve’s latest weekly money supply report from last Thursday shows seasonally adjusted M1 rose $13.2 billion to $2.233 trillion, while M2 rose $4.5 billion to $9.768 trillion.

Shipping Rates Go … Negative!

– Shipping Rates Go… Negative (ZeroHedge, Feb. 6, 2012):

Following the endless collapse in the Baltic Dry, it was only a matter of time before the shipping industry one-upped the Chairsatan, and was the first to introduce, dum dum dum, negative rates. That’s right: you are now paid to hire a ship. Via Bloomberg:

- GLENCORE HIRES SHIP AT MINUS $2,000 A DAY, GMI SAYS

- GMI TO CONTRIBUTE $2,000 A DAY TO GLENCORE’S FUEL COSTS

- GLOBAL MARITIME’S U.K. MD STEVE RODLEY CONFIRMS DEAL BY PHONE

Why is this happening? Perhaps because ships have to be kept seaworthy and in motion or else they become scrappage in as little time as 3 months. Think sharks. Needless to say, this will play havoc with shipping company (and affiliated entities’) liquidity, as the biggest default wave in the history of the industry is about to be unleashed and tens if not hundreds of billions of European secured loans are about to be “impaired.”

Fukushima’s Tobacco Farmers Secure Contract With Japan Tobacco For 2012 Crop

– Fukushima’s Leaf Tobacco Farmers Secured Contract with Japan Tobacco for 2012 Crop (EX-SKF, Feb. 5, 2012):

494 leaf tobacco farmers in Fukushima will grow leaf tobacco this year and sell it to Japan Tobacco (JT), a monopoly in Japan (50% of shares owned by the Ministry of Finance) and the 3rd largest tobacco and cigarettes manufacturer in the world, next to British American Tobacco.

Did you know that there is no national safety standard for radioactive materials in leaf tobacco?

From KFB Fukushima Broadcasting Co. (2/5/2012):

??????????????????????????????????????????????????????????????????????????

After the nuclear plant accident last year, the tobacco producers’ union in Fukushima Prefecture gave up planting the tobacco. In the next growing season [2012], 494 farms in central, southern and Aizu region of Fukushima Prefecture will resume planting on 474 hectares.

Read moreFukushima’s Tobacco Farmers Secure Contract With Japan Tobacco For 2012 Crop

Group Of 30 To 50 Angry Youngsters Attack House Of Greek President Karolos Papoulias, Hurl Rocks, Molotov Cocktails

See also:

– National Confederation of Greek Commerce (ESEE): Greece Warns It Will Soon Be In ‘Condition Of ABSOLUTE POVERTY’

“When people lose everything they lose lt.”

– Gerald Celente

– Angry Youths Attack House Of Greek President Papoulias; Hurl Rocks, Molotov Cocktails (ZeroHedge, Feb. 3, 2012):

Instead of defaulting a long time ago (when we first suggested it should) when it could have pulled an Iceland, taken a bitter pill, hyperinflated the drachma and in the process delevered overnight, if at a big social cost of losing its welfare safety net (which it is about to lose anyway courtesy of the PSI and OSI), and not be held captive to bigger geopolitical interests, and hostage to the banker superclass, Greece very likely could have been on the road to recovery now, granted with a totally different political regime. Instead, the political regime is the same, Greece is more in debt than ever before, the economy is in shambles, the banks have seen two straight years of bank runs, and most importantly the people now are poorer and more disenchanted than ever, and as the following story indicates, about to get far angrier than any Syntagma square riot cam (which is about to come back with a PayPerView vengeance) has shown to date. According to Kathimerini, late on Saturday evening, “A group of between 30 and 50 youngsters attacked the house of President Karolos Papoulias.”

“The result of the attack was some minor damage to the entrance of the house at Asklipiou Street in central Athens and to the car that Papoulias uses. The hooded youngsters, who arrived by motorbike and on foot just after 8 p.m, hurled a Molotov cocktail, rocks and paint at the house but stopped short of attacking the two guards at the President’s house.

EU Prepares For Potential Gas Crisis

See also:

– EU prepares for potential gas crisis (AP, Feb. 3, 2012):

BRUSSELS (AP) — The European Union is bracing for another potential energy crisis in the dead of winter as Russian gas supplies to some member states have suddenly dwindled by up to 30 percent.

The European Commission put its gas coordination committee on alert Friday, but insisted the situation had not yet reached an emergency level as nations have pledged to help each other if needed and storage facilities have been upgraded.

Commission spokeswoman Marlene Holzner said Russia was going through an extremely cold spell and needed more gas to keep its citizens warm.

She said that Russia’s gas contracts “allow for certain flexibility in case they also need the gas. And that is the situation that Russia is facing at the moment.” The severe winter in Russia has seen temperatures drop to minus 35 C (minus 30 F).