The Problem Is Still Falling House Prices

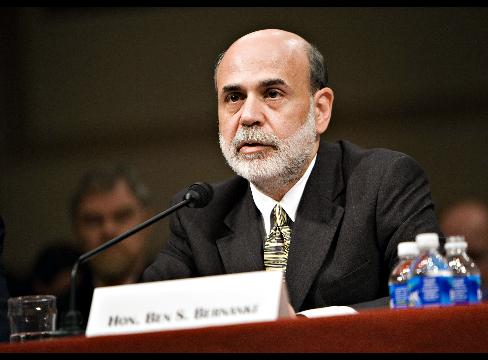

A successful plan to stabilize the U.S. economy and prevent a deep global recession must do more than buy back impaired debt from financial institutions. It must address the fundamental cause of the crisis: the downward spiral of house prices that devastates household wealth and destroys the capital of financial institutions that hold mortgages and mortgage-backed securities.

The recently enacted financial rescue plan does nothing to stop this spiral. Credit will not flow and liquidity will not return to the banking system until financial institutions have confidence in the solvency and liquidity of other banks.

Because of the 20% fall in the price of homes since the bursting of the house-price bubble, there are now some 10 million homes with mortgages that exceed the value of the house.

Read moreProf. Feldstein: The bailout bill doesn’t get at the root of the credit crunch