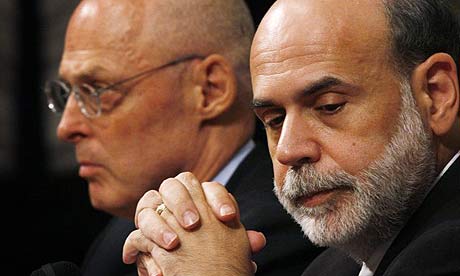

Federal Reserve chairman Ben Bernanke folds his hands while testifying with US Treasury secretary Henry Paulson before the Senate banking committee on Tuesday. Photograph: Charles Dharapak/AP

The proposed $700bn bailout of US financial markets faced harsh criticism in Congress today, with liberals and conservatives both sceptical that granting the Bush administration power to buy up risky mortgages would avert further economic crisis.

Yet despite the wariness from the Senate banking committee, where Henry Paulson and Ben Bernanke appeared today, the financial rescue seems poised to win approval by next week at the latest.

“This is not something I wanted to ask for,” the US treasury secretary said, assuring senators that “I feel your frustrations” and “I’m angry” at the prospect of Wall Street firms getting saved by the government.

But Paulson and Bernanke did ask for broad latitude to decide which toxic assets would win a purchase by the government. Senators of both parties did not attempt to hide their anger at the request, citing the Bush administration’s previous assurances of market stability.

“We have been given no credible assurances that this plan will work,” Richard Shelby, the senior Republican on the banking panel, said. “Congress does not have time to determine if there are better alternatives.”

The committee’s Democratic chairman, Chris Dodd, questioned Paulson’s request for immunity from any legal or government review of his actions during the bailout process.

“After reading this proposal, I can only conclude that it is not just our economy that is at risk,” Dodd told the treasury secretary, “but our constitution as well.”

Bernanke offered little detail on how the government would set the value of troubled mortgages before buying them. Yet America’s senior banker appeared conscious to avoid potential conflicts of interest, particularly given Paulson’s past chairmanship of Goldman Sachs.

“I’m a college professor,” Bernanke explained. “I never worked on Wall Street. I don’t have those interests, those connections.”

He then warned senators that “jobs will be lost, unemployment will rise, more houses will be foreclosed, GDP will contract” if the rescue plan is not approved.

The proposal is expected to become law within days, perhaps as soon as the weekend. What remains unclear is how many changes Congress can make to the bailout in the face of insistence on a “clean bill” by Paulson and the White House.

Dodd and Barney Frank, the Democratic chairman of the financial services committee in the House of Representatives, are working on rescue plans that could see separate votes or be merged in advance.

The congressional leaders are likely to agree on some key priorities:

• Limits on executive compensation at firms that get government aid. Paulson criticised this idea at first, predicting that it would limit incentive for banks to seek help, but now appears open to the concept. John McCain has backed compensation limits.

• A stake for taxpayers in any firms that the government assists. A Democratic senator, Jack Reed, has proposed issuing stock warrants that would allow the public to share the profits of rebounding companies. Republicans have urged that any profits from the rescue be used to pay down the bloated national debt.

• Direct attention to foreclosures. Democrats want US bankruptcy judges to be allowed to modify mortgages on primary homes, but conservatives view that proposal as a deal-breaker. A compromise could include more money for lenders to modify mortgage rates as well as a government guarantee for the renegotiated loans.

But before the $700bn bailout becomes law, Paulson and Bernanke must run the gantlet on Capitol Hill. They are likely to meet with more frustrated congressmen during a visit to Frank’s House financial panel tomorrow.

Elana Schor in Washington

Tuesday September 23 2008 19:41 BST

Source: The Guardian