Listen to Catherine Austin Fitts in this video from 2008:

– Former Assistant Secretary of Housing: The U.S. is the Global Leader in Illegal Money Laundering

A U.S. Customs and Border Protection agent inspects a vehicle heading into the U.S. at the San Ysidro border crossing in San Diego.(Bloomberg) |

Just before sunset on April 10, 2006, a DC-9 jet landed at the international airport in the port city of Ciudad del Carmen, 500 miles east of Mexico City. As soldiers on the ground approached the plane, the crew tried to shoo them away, saying there was a dangerous oil leak. So the troops grew suspicious and searched the jet.

They found 128 black suitcases, packed with 5.7 tons of cocaine, valued at $100 million. The stash was supposed to have been delivered from Caracas to drug traffickers in Toluca, near Mexico City, Mexican prosecutors later found. Law enforcement officials also discovered something else.

The smugglers had bought the DC-9 with laundered funds they transferred through two of the biggest banks in the U.S.: Wachovia Corp. and Bank of America Corp., Bloomberg Markets magazine reports in its August 2010 issue.

This was no isolated incident. Wachovia, it turns out, had made a habit of helping move money for Mexican drug smugglers. Wells Fargo & Co., which bought Wachovia in 2008, has admitted in court that its unit failed to monitor and report suspected money laundering by narcotics traffickers — including the cash used to buy four planes that shipped a total of 22 tons of cocaine.

The admission came in an agreement that Charlotte, North Carolina-based Wachovia struck with federal prosecutors in March, and it sheds light on the largely undocumented role of U.S. banks in contributing to the violent drug trade that has convulsed Mexico for the past four years.

‘Blatant Disregard’

Wachovia admitted it didn’t do enough to spot illicit funds in handling $378.4 billion for Mexican-currency-exchange houses from 2004 to 2007. That’s the largest violation of the Bank Secrecy Act, an anti-money-laundering law, in U.S. history — a sum equal to one-third of Mexico’s current gross domestic product.

“Wachovia’s blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations,” says Jeffrey Sloman, the federal prosecutor who handled the case.

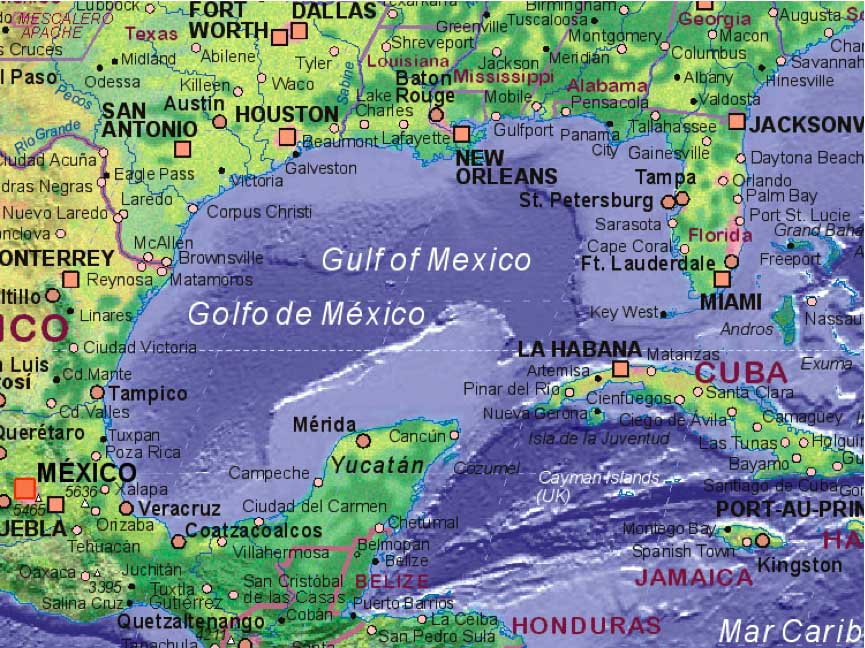

Since 2006, more than 22,000 people have been killed in drug-related battles that have raged mostly along the 2,000-mile (3,200-kilometer) border that Mexico shares with the U.S. In the Mexican city of Ciudad Juarez, just across the border from El Paso, Texas, 700 people had been murdered this year as of mid- June. Six Juarez police officers were slaughtered by automatic weapons fire in a midday ambush in April.

Rondolfo Torre, the leading candidate for governor in the Mexican border state of Tamaulipas, was gunned down yesterday, less than a week before elections in which violence related to drug trafficking was a central issue.

45,000 Troops

Mexican President Felipe Calderon vowed to crush the drug cartels when he took office in December 2006, and he’s since deployed 45,000 troops to fight the cartels. They’ve had little success.

Among the dead are police, soldiers, journalists and ordinary citizens. The U.S. has pledged Mexico $1.1 billion in the past two years to aid in the fight against narcotics cartels.

In May, President Barack Obama said he’d send 1,200 National Guard troops, adding to the 17,400 agents on the U.S. side of the border to help stem drug traffic and illegal immigration.

Behind the carnage in Mexico is an industry that supplies hundreds of tons of cocaine, heroin, marijuana and methamphetamines to Americans. The cartels have built a network of dealers in 231 U.S. cities from coast to coast, taking in about $39 billion in sales annually, according to the Justice Department.

‘You’re Missing the Point’

Twenty million people in the U.S. regularly use illegal drugs, spurring street crime and wrecking families. Narcotics cost the U.S. economy $215 billion a year — enough to cover health care for 30.9 million Americans — in overburdened courts, prisons and hospitals and lost productivity, the department says.

“It’s the banks laundering money for the cartels that finances the tragedy,” says Martin Woods, director of Wachovia’s anti-money-laundering unit in London from 2006 to 2009. Woods says he quit the bank in disgust after executives ignored his documentation that drug dealers were funneling money through Wachovia’s branch network.

“If you don’t see the correlation between the money laundering by banks and the 22,000 people killed in Mexico, you’re missing the point,” Woods says.

Cleansing Dirty Cash

Read moreBanksters Financing Mexico Gangs Admitted in Wells Fargo Deal