– How Many Shale Oil Plays Make Money At $37 Per Barrel? (Spoiler Alert: None) (The Burning Platform, March 18, 2015):

I’m tossing you a softball. Now think carefully. The choices are:

A. Zero

B. Zero

C. Zero

D. Zero

I know Americans are math challenged and need a calculator to subtract 10 from 20, but I think even a CNBC bimbo or Princeton economic professor could get this one right.

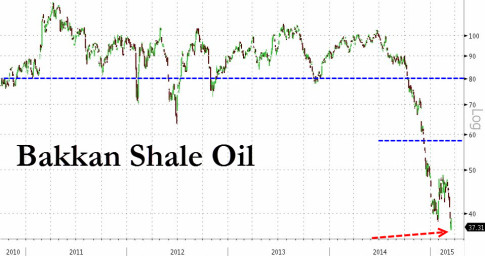

Last year there was much banter from the Wall Street shysters and Bakkan shale oil experts about the true breakeven price for shale oil not being $80 (which is the truth) but actually being as low as $58 a barrel. They were spreading this lie in order to keep idiot investors buying the stocks and bonds of these fly by night shale oil companies.

Read moreHow Many Shale Oil Plays Make Money At $37 Per Barrel? (Spoiler Alert: None)