– Italian Bad Debt Hits Record $197 Billion As Bank Lending Contracts For Unprecedented 33 Consecutive Months (ZeroHedge, March 16, 2015):

Repeat after us: the biggest threat facing Europe’s banking system is not a Grexit, is not the Austrian “bad bank” black swan (although it is pretty bad), it is the trillions in non-performing loans on the balance sheets of European banks, which Europe has no idea how to and which continue to multiply in the process threatening to impair depositors with bail-ins (see Cyprus). It is also why, after years of debate, the ECB finally agreed to flood European banks with what it hopes will be over €1 trillion in excess reserves a la the US (of course, if Zero Hedge, and now JPM, is correct, the ECB will break the bond market long before it achieves its goal) in order to mitigate the relentless cash demands of a constantly rising NPLs.

And unfortunately for the third largest issuer of sovereign bonds in the world, Italy – the country all eyes will focus on once Greece and/or Spain exit the Eurozone – when it comes to NPLs things are going from bad to worse because as Reuters reported earlier, citing ABI, gross bad loans at Italian lenders continued to rise, totaling 185.5 billion euros ($196.5 billion) in January from 183.7 billion euros a month earlier.

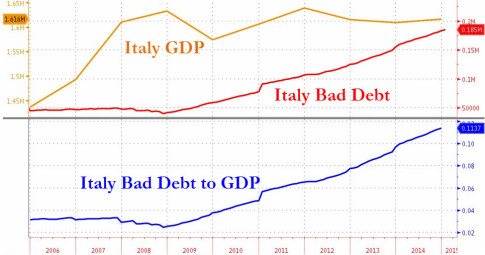

As the chart below shows, Italy now has over 10% of its GDP in the form of bad debt.

But there has to be a silver lining though, right? If the banks are issuing loans with reckless abandon, at least many more loans are entering the general population right, something which also happens to be the biggest hurdle for ECB’s clogged QE plumbing – the unwillingness of European banks to lend money.

Well, sorry, no silver lining, because as NPLs rose, total debt issuance contracted once more. Again Reuters:

Lending by Italian banks to families and businesses decreased 1.4 percent year-on-year in February, its 33rd consecutive monthly fall, even though the pace of decline is slowing, banking association ABI said. ABI said the February figure was the lowest rate of decline since July 2012.

Loans to households and non-financial companies had fallen 1.5 percent in January, a figure revised from a 1.8 percent drop announced a month ago.

Lending by Italian banks has been steadily falling since May 2012 as the euro zone’s third biggest economy grappled with its longest recession since World War II.

That’s ok, though, because all that needs to happen for banks to resume lending after nearly 3 years of consecutive declines in loan issuance, is for the ECB to start printing money. Because Draghi said so. Oh, and for Italy et al to change the definition of GDP once again so that economic growth under a Keynesian voodoo regime is no longer purely a function of how much credit is being created. Because across Europe, none is.

Who in their right mind will go on lending money to deadbeats?