– Options Market Signals 2007-Like Crash Risk, Goldman Warns (ZeroHedge, March 17, 2015):

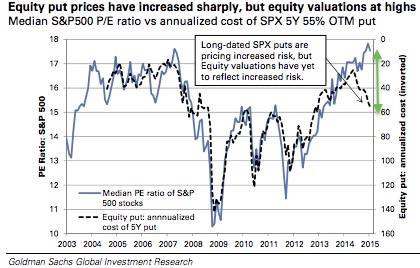

Although US equity prices have demonstrated a remarkable propensity to completely disregard apparently unimportant things like macro fundamentals, forward earnings estimates, and top-line growth projections, we’ve long argued that eventually, reality will come calling and the farther stretched valuations become in the meantime, the more painful the correction will be. As we noted on Sunday, the cracks are starting to form as DB became the first sell-side firm to predict that EPS will in fact not grow in 2015, prompting us to remark that “EPS growth in 2015 [is] now a wash (if not negative), which implies the only upside for the S&P 500 will once again come from substantial multiple expansion.” Against this backdrop of declining revenues, declining earnings, and pitiable economic projections (thanks a lot Atlanta Fed Nowcast), we bring you yet another sign that a “correction” may indeed be in the cards: an epic decoupling of put prices and S&P P/E ratios.

Here’s Goldman:

Long-dated crash put protection costs on the SPX have more than doubled over the past 9 months. We believe it is an important development to watch as it implies investors are increasingly concerned about downside risk even as US equities trade near all-time highs. Based on our conversations with investors over the past few months, it appears the increase in long-dated put prices has largely gone unnoticed among equity and credit investors. In fact, Investment Grade credit spreads have actually tightened slightly over the same period. The rise in long-dated equity put prices may signal an increasing fear that a substantial market correction is on the horizon, despite low short-term put prices which suggest low probably of a near-term drawdown vs history.

As you can see from the following, this is no trivial divergence — it’s actually quite the anomaly:

Furthermore, the usually tight correlation between the cost of OTM put protection and CDS spreads looks set to break down entirely as the CDS market doesn’t seem to be pricing in the same type of nervousness as the options market…

…

The stock market has little to do with the real world…..it is in its own world. It is rigged to the hilt, and if you are an insider, you can make a lot. If you bank your investments on the commodities market which are tanking………….there is no connection.

HFTs have caused this; when a few people control so many securities, it is bound to happen. If we had a credible market, HFTs would be illegal, buying and selling in less time than one blinks an eye would not be allowed. But, we don’t have a credible market, we have a rigged one.

Saying the stock market will suffer a correction is obvious………