Related info:

– Bilderberg 2013: Full List Of Attendees

– British Taxpayers To Pay ‘MILLIONS’ Towards Secretive BILDERBERG Meeting Security

Conspiracy theorists claim it is a shadow world government. Former leading members tell the Telegraph it was the most useful meeting they ever went to and it was crucial in forming the European Union. Today, the Bilderberg Group meets in Britain.

– Bilderberg Group? No conspiracy, just the most influential group in the world (Telegraph, June 6, 2013):

“The abuse is terrible,” said Peter Mandelson, leading the walking party through the throng of protesters and carrying the group’s uniform orange ski jacket under his arm.

Amid the din, Peer Steinbruck, the former German Finance Minister, pointedly refused to break off his conversation with Thomas Enders, the head of defence giant EADS. Behind him, Eric Schmidt, the Google chairman, picked up the pace along the narrow road and kept his eyes fixed on the Suvretta hotel ahead. Franco Bernabe, the vice chairman of Rothschild Europe, grinned through the chorus of booing and chanting in German down megaphones, before ducking under the police tape and into the safety of the hotel’s grounds.

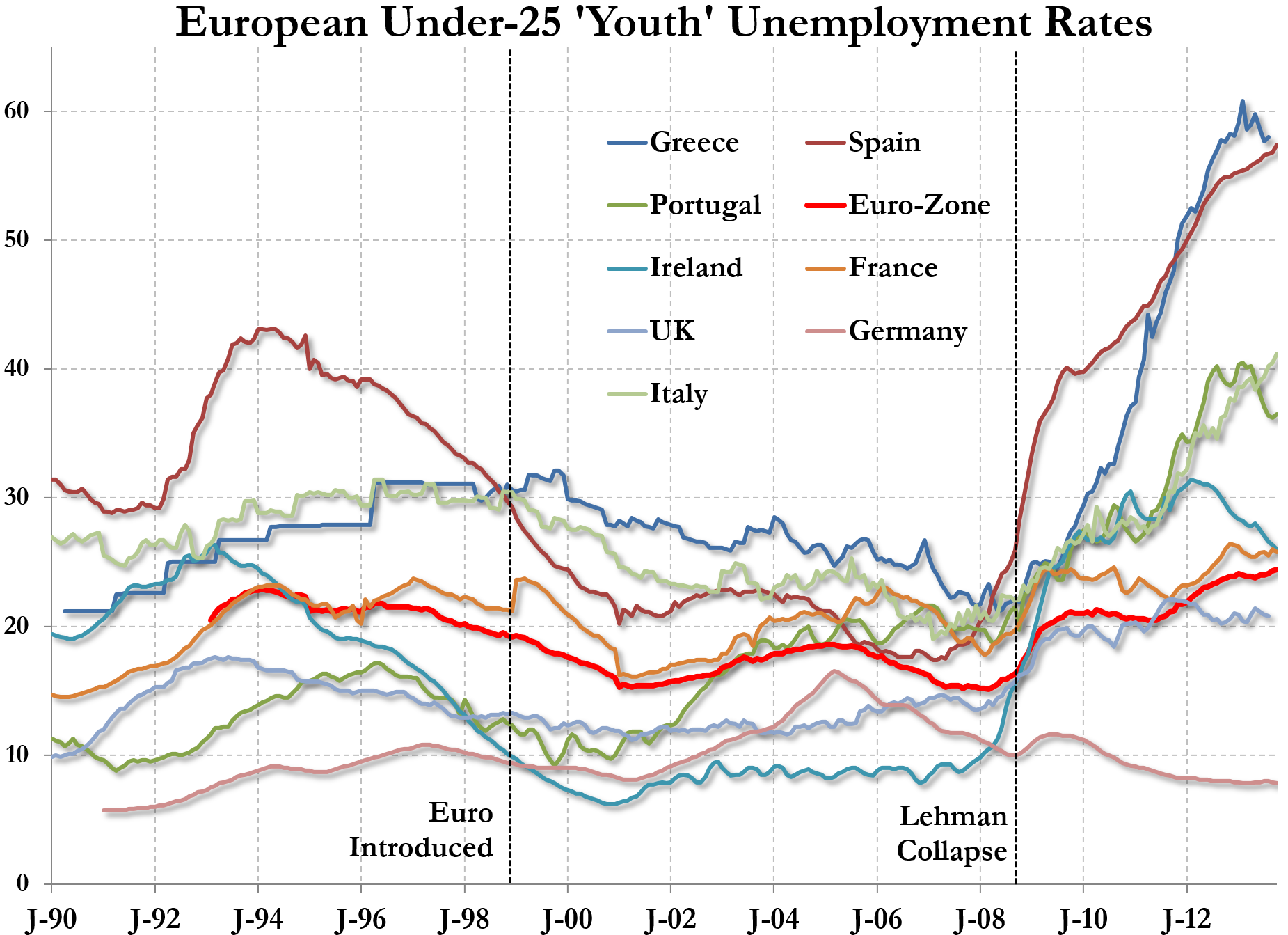

It was June 2011. Demonstrations were sweeping through the stricken eurozone, China and North Africa. And in tranquil St Moritz, high in the Swiss alps, half a dozen of the most powerful men in the West had taken a break from a weekend of intensive and strictly confidential debate to walk in the woods, when their paths crossed with the protesters who had come from around the world to keep an eye on them.

The gathering was entirely innocent, the walking party would insist. But what were they doing there?

No such encounters will take place in Watford this week, as the Bilderberg, the annual conference for 140 of the world’s most powerful, meet for four days at The Grove, a £300-a-night golf hotel close to the M25. The entire hotel has been booked out, and a high fence erected around the exclusion zone. Armed checkpoints have been set up on local roads, and locals must show their passports to enter their own driveways. The Home Office may foot the bill. A US news site dedicated to uncovering conspiracies had booked a room for last week but were told by phone not to turn up.

Read moreBilderberg 2013: Armed Checkpoints Set Up On Local Roads, Locals Must Show Passports To Enter Own Driveways